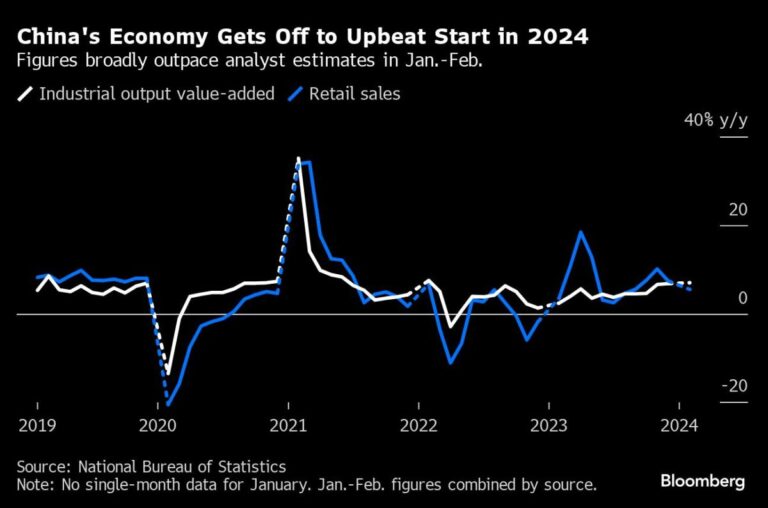

(Bloomberg) — China's economic growth was boosted by strong factory production and investment at the start of the year, while the consumption recovery continues to show slow progress.

Most Read Articles on Bloomberg

The Office for National Statistics said on Monday that industrial production rose 7% in January-February compared to the same period a year earlier, which was significantly higher than economists expected. Fixed asset investment growth accelerated to 4.2%, also higher than expected. Retail sales rose 5.5%, roughly in line with expectations.

“The economy is stabilizing with supply-side stimulus and some improvement in export demand,” said Michelle Lam, Greater China economist at Société Générale, citing strong investment and industry data. . “Consumer demand remains weak,” he said.

Robust industry and investment data add to evidence that the world's second-largest economy is gaining more traction after policymakers ramped up stimulus late last year. Export growth had previously exceeded expectations. Building and maintaining momentum will be key to meeting China's government's growth target of around 5% this year. This is the same as the 2023 growth target, but more difficult to achieve given less favorable comparative criteria.

The offshore Chinese yuan edged up by less than 0.1% after the data release and after the People's Bank of China increased support for the renminbi through the daily benchmark rate. The Australian dollar, which is said to be a proxy for China, rose 0.1%.

“Various policies took effect, and the economy continued to recover and improve in January and February. However, the external environment has become increasingly complex, harsh and uncertain, and the problem of insufficient domestic demand remains. “We also need to recognize that the foundations of economic recovery need to be further strengthened,” NBS said in a statement accompanying the announcement.

The urban unemployment rate was 5.3%, up from 5.1% at the end of December.

Investment in real estate development fell by 9% and remains a major drag on the economy. Uncertain revenue prospects continue to weigh on consumer and business confidence. Manufacturing overcapacity is growing, increasing tensions with trading partners and clouding export prospects.

Analysts said consumer prices rose for the first time in five months in February, but the recovery was likely to be short-lived, largely helped by spending during the Lunar New Year holiday.

The Chinese government has tightened fiscal policy and embarked on a program to sell very long-term special sovereign bonds in 2024 and in the coming years. Plans are also taking shape to upgrade industrial equipment and increase household spending on consumer goods, with the budget pledging to help fund programs likely worth hundreds of billions of yuan.

The People's Bank of China maintains an accommodative monetary policy stance, with Governor Ban Gongsheng saying he intends to inject additional liquidity to support growth as needed.

However, the boost from spending on government balance sheets will be offset by another campaign to contain local debt risks. The People's Bank of China's room for further rate cuts is also limited by the wide yield gap with the U.S. and the low profit margins of Chinese banks.

Last week, the central bank held interest rates on one-year insurance loans unchanged, draining cash from the banking system through the tool for the first time since November 2022.

The Office for National Statistics does not publish figures for January alone. In order to smooth out fluctuations due to the Lunar New Year holiday, we only publish statistics for the first two months of each year; however, the Lunar New Year holiday is likely to coincide with any month of the year as most factories and businesses are closed. There is.

(Updated with comments and details from NBS and The Economist)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP