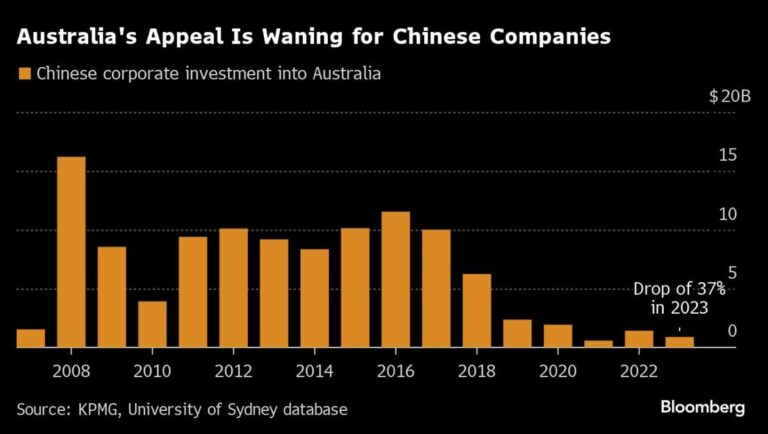

(Bloomberg) — Investment by Chinese private and state-owned enterprises in Australia fell to its second lowest level in 18 years in 2023, according to a report from KPMG and the University of Sydney.

Most Read Articles on Bloomberg

According to the analysis, direct investment fell 37% year-on-year to $892 million. In contrast, China's global outward investment surged in 2023, driven by projects in countries participating in President Xi Jinping's Belt and Road Initiative.

Australia's industries that have traditionally attracted Chinese companies, such as commercial real estate and mining, are in decline, according to the report, which was written by Doug Ferguson, head of Asia and international markets at KPMG. and China Business Practice Partner Helen Gee Dent.

The potential for China's Belt and Road investment to shift from infrastructure and resource withdrawal to processing could pose a “competitive challenge” for Australia, the researchers said in the report.

The report's data does not include portfolio investments that do not result in foreign management, ownership or legal control. The report also excludes investments from Hong Kong and Macau family offices and private entities not majority-owned by mainland Chinese companies.

Relations between China and Australia began to fray under former Australian leader Scott Morrison. Relations began to improve after the election of Prime Minister Antony Albanese's government in May 2022. Last month, China lifted punitive tariffs on Australian wine exports, signaling an end to its trade pressure campaign.

China has been plagued by a protracted real estate crisis and weak consumer sentiment, clouding the outlook for the world's second-largest economy.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP