6381380/Image Editorial via Getty Images

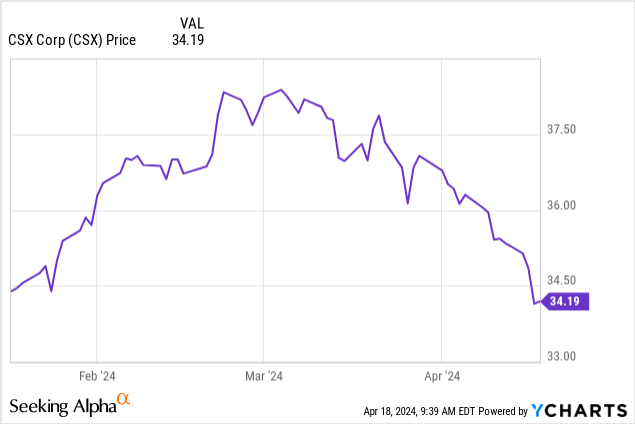

CSX Co., Ltd. (NASDAQ:CSX) The stock price has been doing well, trading within a fairly well-defined range. As the market reached all-time highs in the first quarter, CSX briefly topped that range.However, the stock has been revised and is expected to remain flat. Astute traders can earn income by leveraging both long and short positions here, as well as adopting a buy-write option approach.

However, in the short term, we see little reason to buy CSX Corporation stock for upside. Considering valuation and growth, we rate this a Hold. In this column, we take another look at this railway operator, which just reported strong financial results, although the outlook remains mixed.

Although this economy is strong, CSX still faces headwinds.The volume of railway data is Mixed weekly. Having said that, Q1 was strong. Let's discuss.

Revenue was flat compared to the same period last year

Results were largely in line with expectations, with first-quarter revenue essentially flat with last year. CSX Corporation has been growing slowly and steadily for years, but its revenue has shrunk in recent quarters. Revenues for the quarter totaled $3.68 billion, down 0.8% year over year and in line with fourth quarter revenues. This has been achieved despite increased intermodal traffic and improvements in the reliability and fluidity of the rail network. The volume of goods remained almost unchanged, but the volume of coal he increased by 2%. Now, we expected revenue to be down, but he exceeded expectations by $10 million.

The quarter was good for headline results, but revenue and segment earnings were mixed. Even though volumes increased, intermodal revenue increased by just 1%. Coal revenues were also flat. Product revenue, which accounts for about two-thirds of sales, was also flat.

Expenses are increasing despite relatively flat sales

CSX's revenue fell nearly 1%, but expenses rose. It's a difficult combination, and in this inflationary environment, costs are rising for everyone while compressing revenue potential. Expenditures increased 4% from the previous year to $2.32 billion. Expenses may have increased due to increased intermodal transportation volumes, but profit margins declined when pricing was taken into account. As you can see, despite efforts to improve efficiency over the past few years, the operating efficiency ratio has declined. Operating income was $1.35 billion, an 8% decrease compared to the same period in 2023, due to a 1% decrease in sales and lower efficiency. EPS decreased 4% to $0.46 from $0.48 in the prior-year period, which was $0.01 better than expected.

The company is actually doing well, but profit growth is declining. We don't want to pay up, especially when faced with economic headwinds. Currently, economic indicators continue to be difficult, but once they soften, railroad stocks will likely fall. Therefore, we consider this a hold. One positive is that the company bought back his $247 million stock in the first quarter, and at the same time he paid out a $235 million dividend. However, free cash flow before dividends fell significantly to $560 million from $816 million a year ago.

Outlook for 2024

In 2024, economic activity remains strong, but trends in rail data are mixed. Operating efficiency has taken a hit as revenues have gone from flat to declining and expenses are on the rise. Volumes have been mixed, but they are holding up. Although free cash flow is decreasing, dividends paid to shareholders are increasing.

Don't get me wrong. There's no liquidity risk here, but it's worth noting. Our outlook for 2024 remains unchanged after this quarter. For the year, total sales volume in 2024 is expected to grow in his low to mid single digits. Revenues will likely follow suit, growing in the low single digits. We will continue to focus on the expense line. Although we have been working to improve management efficiency, operating income is currently decreasing.

Having said that, economic indicators are still key. If it stays strong, CSX will continue to gain momentum. Finally, shareholders can expect continued capital returns through share buybacks and dividends. Given its performance, outlook, and volatile market here, we think CSX Corporation is best held. However, those looking to trade more can make considerable profits. If you are interested, please see our efforts below.