Fourth Quarter | December 20, 2023

special questions

Data was collected from December 6-14. 141 oil and gas companies responded to the special questionnaire survey.

all companies

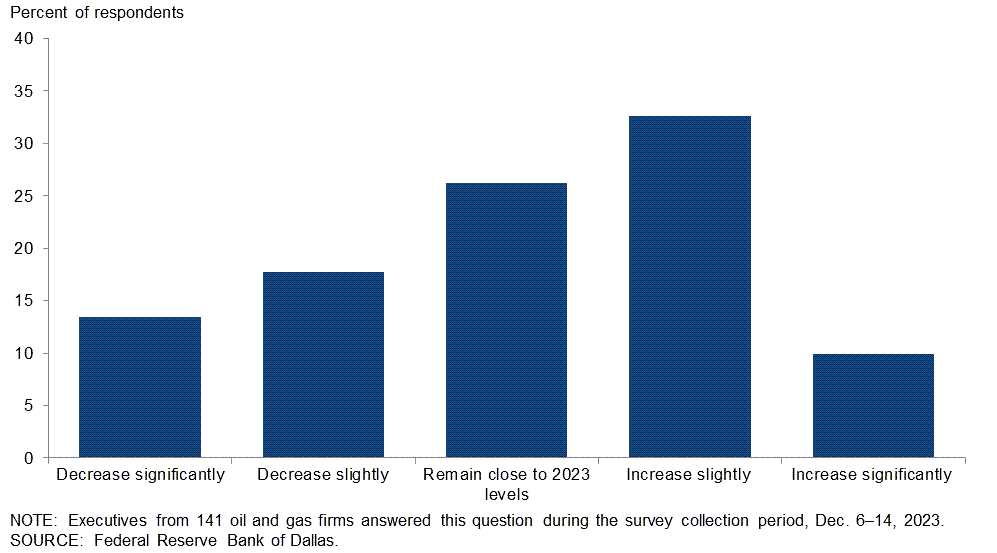

What do you expect your company's capital expenditures to be in 2024 compared to 2023?

Answers varied widely among executives. The most commonly chosen answer was “slightly increase,” selected by 33% of executives. The second most popular answer was “maintain near 2023 levels'' with 26%, followed by “slightly decrease'' with 18%. A further 13% chose a “significant decrease” and 10% chose a “significant increase.”

Answers varied depending on company size and type. A breakdown of the data for large and small exploration and production (E&P) companies and oil and gas support services can be found in the table below. E&P companies were classified as small if their production was less than 10,000 barrels per day (b/d) and large if their production was 10,000 barrels per day or more. The most common response chosen by executives of small E&P and service companies was 32% and 34%, respectively, while “slightly increase” was chosen most frequently by executives of large E&P companies. 35% of respondents said they would “maintain a level close to the 2023 level.” .

| response | Percentage of respondents (in each group) | |||

| all companies | Large-scale development | Small-scale development/development | service | |

| significantly increased | Ten | Five | 15 | Four |

| slightly increased | 33 | 30 | 32 | 34 |

| Maintain levels close to 2023 levels | 26 | 35 | twenty two | 30 |

| slightly decreased | 18 | 20 | 20 | 13 |

| significantly reduced | 13 | Ten | 11 | 19 |

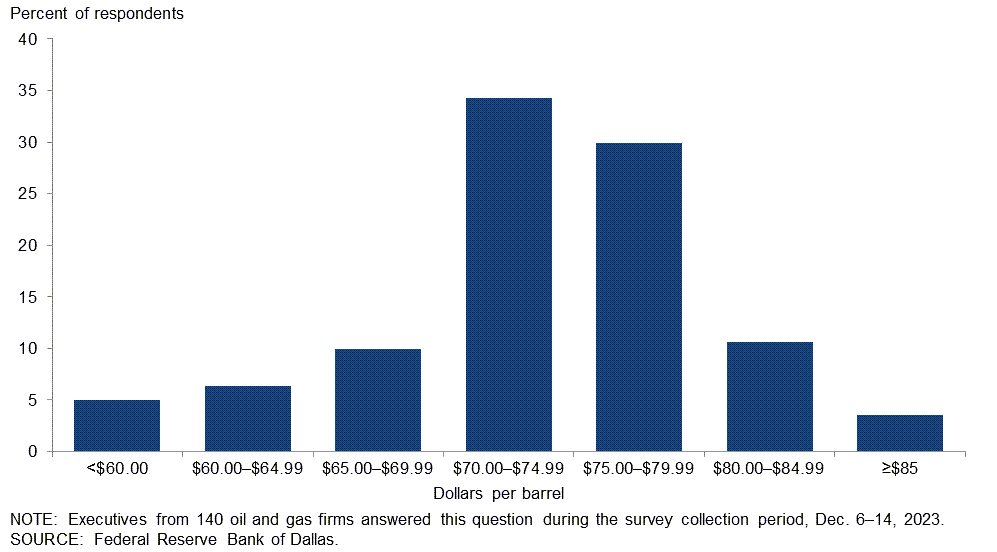

Is your company using West Texas Intermediate crude oil prices for your 2024 capital planning?

In this particular question, executives were asked to provide the WTI price they used for their 2024 capital spending plans. The average response was $71 per barrel, and the median and mode were $70 per barrel. The average price used is relatively close to the price used in the 2023 budget, $73, but is higher than previous years (2019, $54; 2020, $54; 2021; $44, 2022, $64).

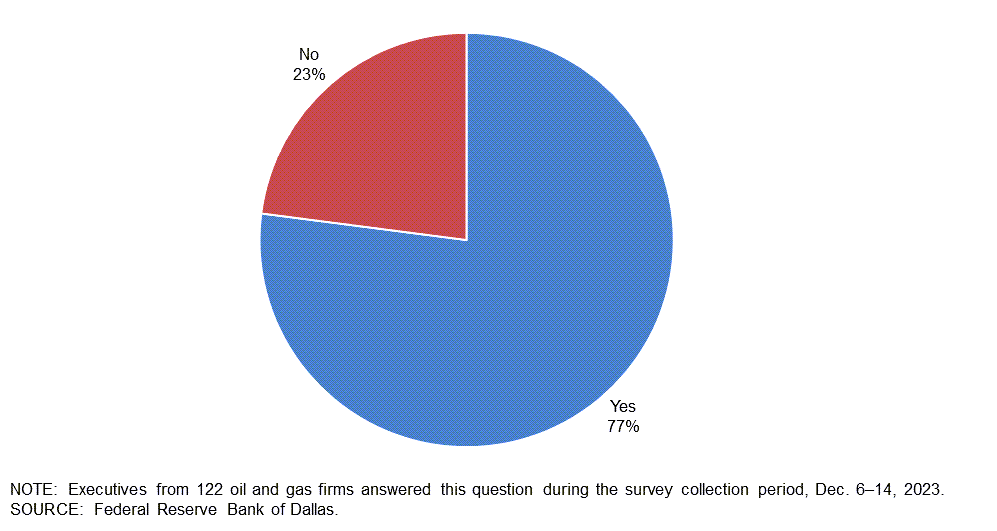

In October 2023, the acquisition of two E&P companies valued at over $50 billion was announced. Do you expect to see more deals of this size in the next two years?

Seventy-seven percent of executives surveyed said they expected more than $50 billion in additional acquisitions over the next two years. The remaining 23% do not envisage such a transaction.

Exploration and production (E&P) companies

Which of the following plans does your company have? (Please check all that apply.)

E&P companies were first asked to define their size based on fourth-quarter 2023 crude oil production. I then asked if they had any plans to: Reduce carbon emissions. Reduce methane emissions. Reduces flare. Water recycling/reuse. Invest in renewable energy. Respondents can select multiple answers for this particular question.

Although there are a large number of small E&P companies in the United States, large E&P companies account for the majority of production (more than 80%).For large companies, 53% of executives say their company plans to reduce their CO22 68% indicated plans to reduce methane emissions, 79% to reduce flaring, 42% to recycle/reuse water, and 11% to invest in renewable energy.

Among small and medium-sized businesses, 22% of executives say they plan to reduce CO2 emissions2 34% anticipate reducing methane emissions, 18% plan to reduce flaring, 27% plan to recycle/reuse water, and 4% plan to invest in renewable energy . Fifty-one percent of small businesses said they did not have a mitigation plan, compared to 11% of large development and development companies.

| response | Percentage of respondents (in each group) | ||

| Small and medium-sized enterprises | Large companies | all companies | |

| CO reduction plan2 emissions | 18 | 53 | 26 |

| Methane emissions reduction plan | 34 | 68 | 42 |

| Plan for flare reduction | 27 | 79 | 38 |

| Plan for water recycling/reuse | twenty two | 42 | 27 |

| Plan your renewable energy investments | Four | 11 | 6 |

| none of the above | 51 | 11 | 42 |

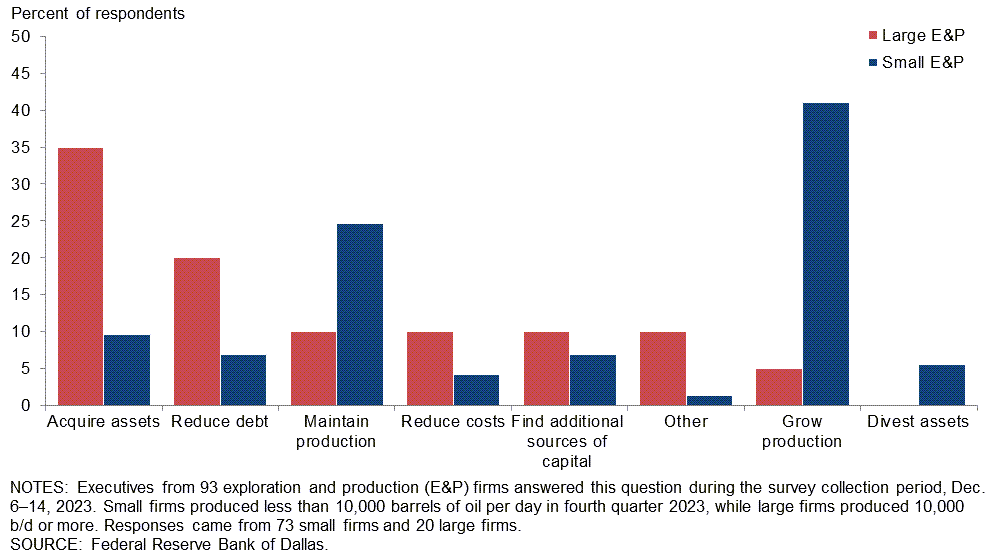

Which of the following is your company's main goal for 2024?

Executives from E&P companies were presented with eight potential goals for 2024 and asked to select their company's primary goal. The most frequently chosen answer among large companies was “acquire assets” (35% of respondents), followed by “reduce debt” (20% of respondents). At the same time, the most frequently chosen answer among small and medium-sized enterprises was “expand production.” (41% of respondents), followed by “maintaining production” (25% of respondents).

Special Questions Comments

Exploration and production (E&P) companies

- There are concerns that OPEC has not been able to secure binding production cuts from some member countries. Crude oil prices have been falling since OPEC announced additional voluntary production cuts. Oil prices also appear to be unaffected by hostilities between Israel and Hamas and the potential for further conflict, which should lead to higher prices. In general, price levels for all commodities are trending downward, reflecting the global economic slowdown where markets perceive demand for hydrocarbons to decline as supply exceeds demand. My fear is that, similar to what happened in 2014, Saudi Arabia will flood the market with crude to punish non-compliant OPEC countries and US producers.

- Merger and acquisition activity this year was $175 billion, more than the previous three years combined. Major companies are investing on the theory that the final stage of oil's forward curve is demonstrably false. Whatever Excel model they use to justify these prices doesn't fit into consolidation and reduction operations. U.S. onshore stocks will be extremely valuable in five years as shale creeps toward death and terminal decline. By the end of the decade, prices are likely to be closer to $150 instead of $50. Young people in the energy industry need to learn about offshore and international exploration early.

- Proposed federal rules and regulations discourage capital investment in the industry. Newly proposed Environmental Protection Agency rules and regulations are not based on historically documented factual information. The whole EPA green process is simply an attack on the industry because it is a common practice. Never mind facts or real science.

- Global developments will continue to put upward pressure on hydrocarbon commodity prices.

oil and gas support services company

- Further consolidation of E&P companies is a major challenge for service and equipment providers. I think that's a negative for the industry and communities in the Permian Basin.

- Industry consolidation is inevitable when purchasing reserves and production, which is cheaper than growing them organically. With a significant number of privately owned businesses looking to sell and value expectations balanced between buyers and sellers, we expect more public companies to acquire privately held businesses. Ru.

- Major oil companies are working hard to consolidate purchasing and procurement of key services to one or two vendors (drilling contractors), but this ends up costing them a lot of money .

- The acquisitions happening in the oil fields are not helpful.