| DFW Economy Dashboard (August 2023) | |||

|

Employment growth (annualized)

|

Unemployment rate |

average hourly wage |

Year-over-year growth rate of average hourly wage |

|

5.1% |

3.9% | $33.69 | 1.1% |

The Dallas-Fort Worth economy expanded in August. Employment growth remained strong and the unemployment rate remained low. Demand for apartments and permits for single-family homes increased in August, but permits for multifamily housing continued to decline, due in part to tighter credit conditions and higher financing costs. Housing affordability remained low in the second quarter due to high mortgage rates.

employment

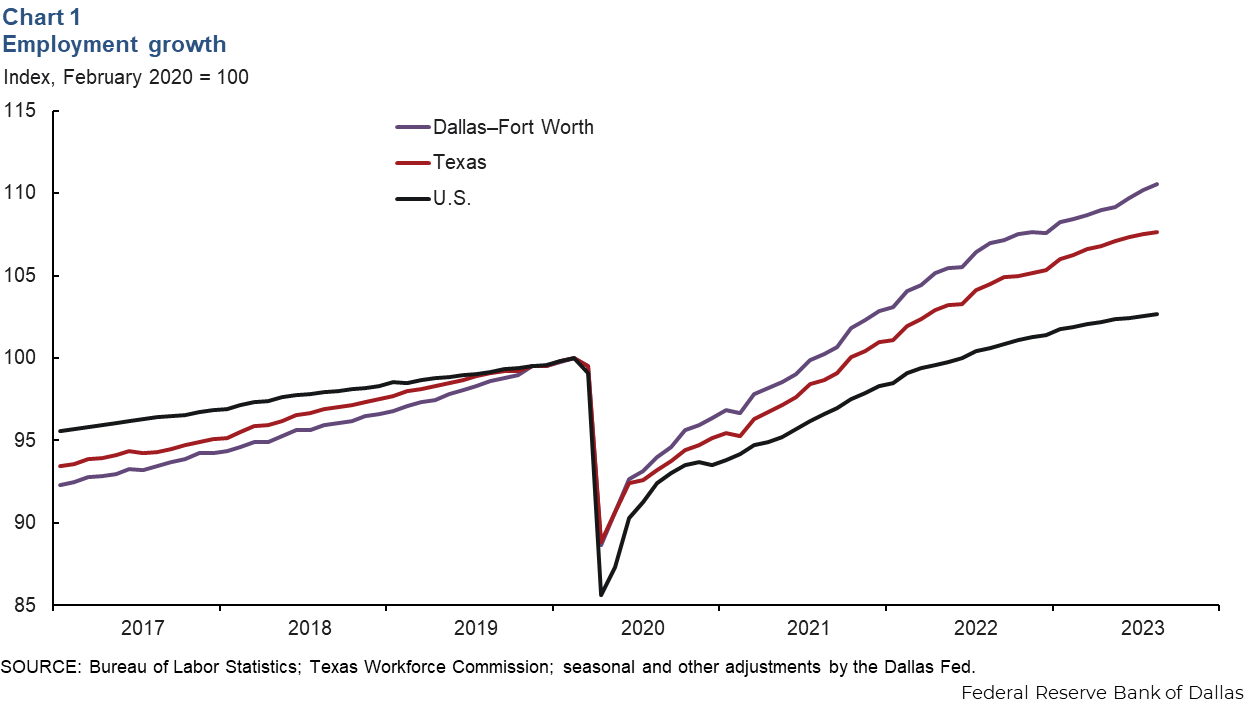

DFW salaried employment grew at an annual rate of 3.7% (13,000 jobs) in August (chart 1). In his three months ending in August, DFW employment grew at an annualized rate of 5.1%, double the trend growth rate. Employment growth during this period was largely broad-based across sectors, with employment declines in education and health services and slower growth in trade, transportation and utilities (1.7%). Texas payrolls grew at an annual rate of 2.0% in the three months through August, while U.S. employment rose 1.2%. DFW's unemployment rate rose to 3.9% in August, but remained below the state's unemployment rate of 4.1%.

housing

Single-family home construction increases

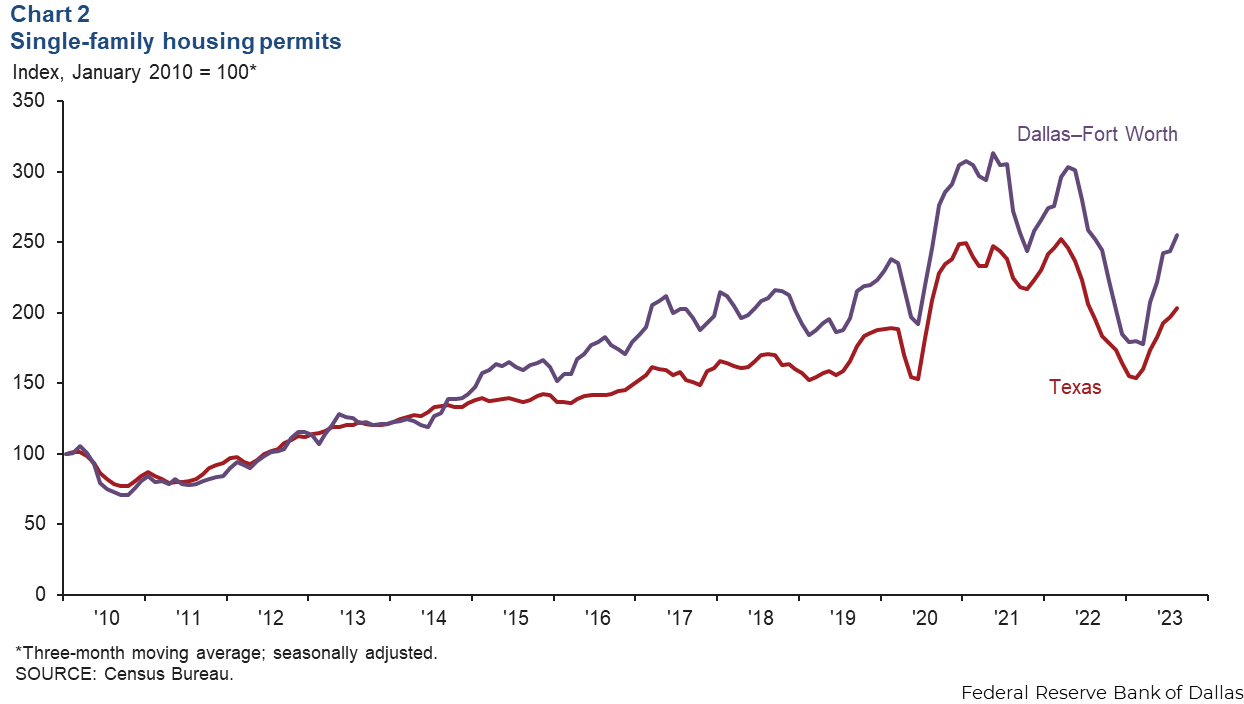

Single-family home permit issuance, which drives residential construction, further increased in August. Permit issuance increased by 5.5% in DFW and 6.3% in Texas. DFW and the state also saw an increase in the three-month moving average for single-family home permits (chart 2). Despite a steady increase since spring 2023, single-family permit issuance year-to-date is down 19.8% in DFW and 18.4% in Texas compared to the same period last year.

Issuance of multi-family housing permits has decreased.

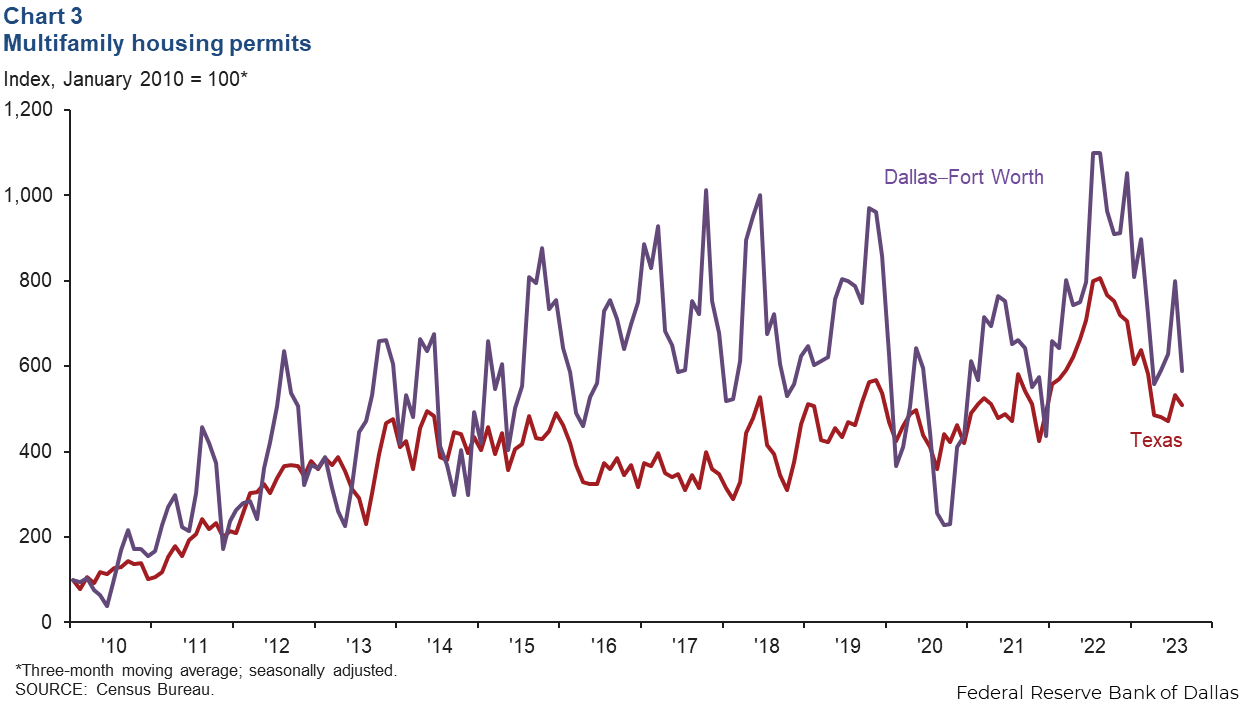

Issuance of multifamily permits, which drive apartment construction, slowed in August (chart 3). The three-month rolling average of multifamily permits fell 26.4% in DFW and 4.1% in Texas due to higher construction and financing costs. Despite the recent contraction, multifamily permit issuance in DFW is still increasing compared to historical levels. This metroplex is one of the busiest in apartment construction among major metropolitan areas in the United States.

Demand for condominiums is steady

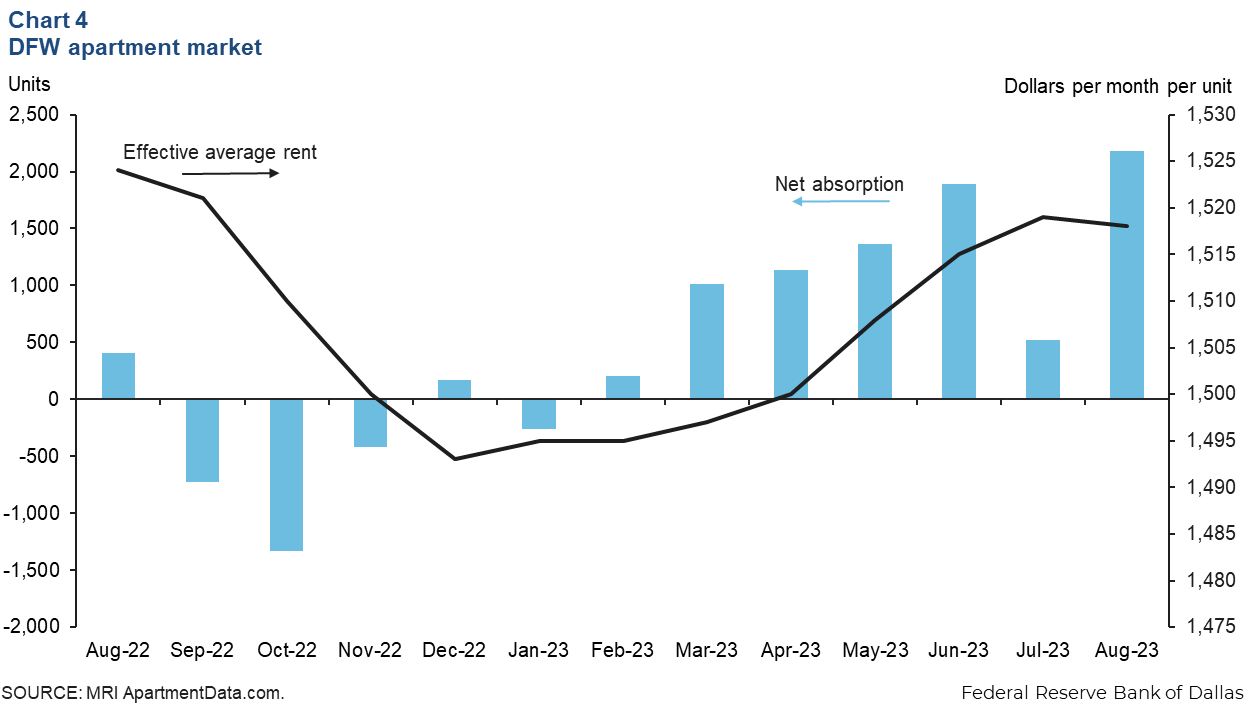

DFW apartment absorption remained strong over the summer. Net absorption was 4,600 units from June to August, following an increase of approximately 3,500 units from March to May (chart 4). As demand held, effective monthly rents in DFW remained stable at $1,518 per unit in August, little changed from a year earlier. The occupancy rate has remained stable at about 91.1 percent, and sources said leasing activity is healthy, but rising apartment completion levels are weighing on occupancy and rent growth.

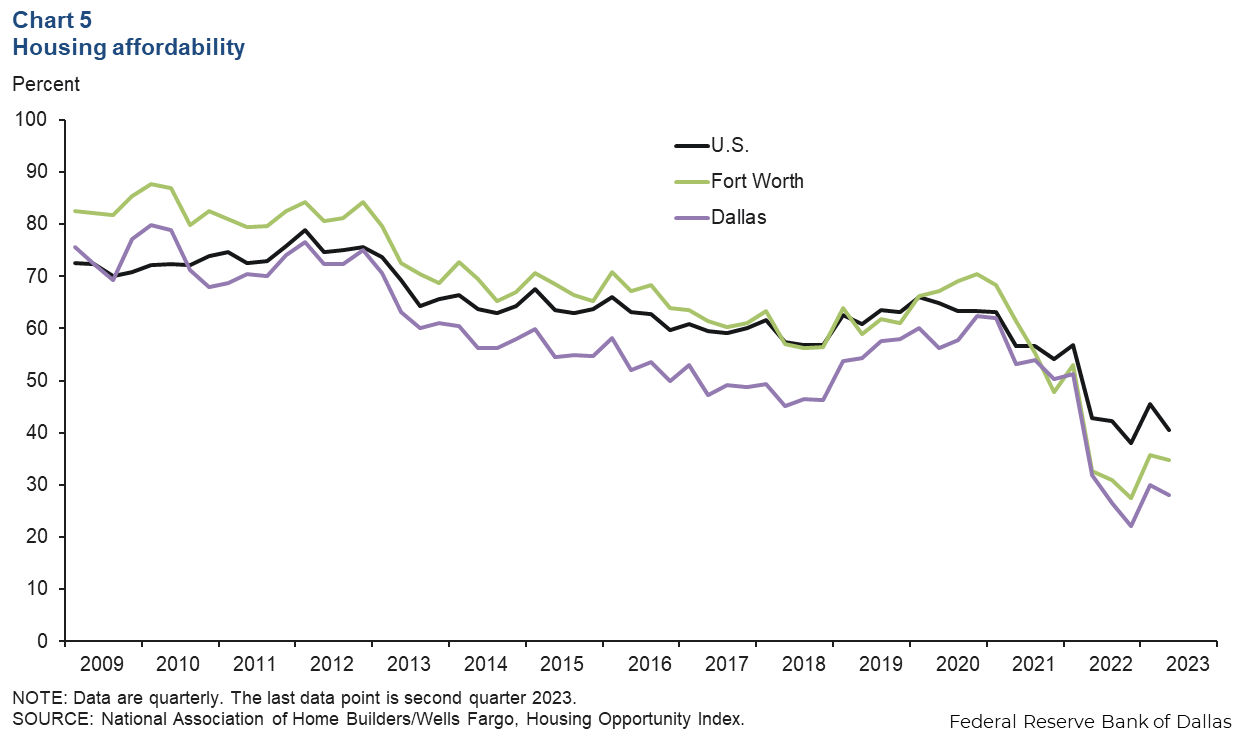

Affordability remains low

Housing affordability declined in the second quarter due to rising home prices and rising mortgage rates (chart 5). In Dallas, the percentage of homes sold that average income households could afford fell from 30.0% in the first quarter of 2023 to 28.1% in the second quarter. Fort Worth's affordability dropped by 1 point in the second quarter to 34.8%. Affordability in the US also fell sharply last quarter, dropping 5.1 percentage points to 40.5%. The median home sales price in DFW in August was little changed at $396,300, down 0.8% from the same month last year.

Note: Data may not match previously published numbers due to revisions.

About economic indicators for Dallas-Fort Worth

Questions and suggestions can be sent to Laila Assanie at: laila.assanie@dal.frb.org. Dallas-Fort Worth Economic Indicators Published monthly after state and metro employment data is released.