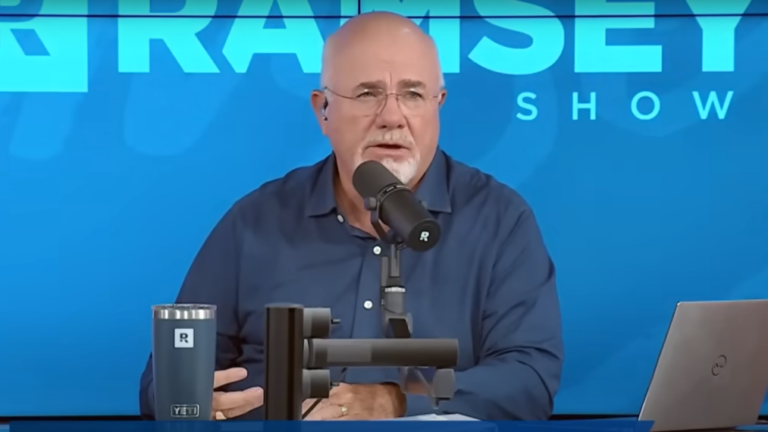

Personal finance expert Dave Ramsey offered advice to a 29-year-old caller from Washington, D.C., who is facing nearly $1 million in debt. In a YouTube video, a newlywed woman asked Ramsey for advice on his radio show on how to overcome a large amount of debt without resorting to bankruptcy. Their financial obligations included mortgages, student loans, credit cards, personal loans, and car loans.

Ramsey disclosed details of his debts, highlighting a $210,000 mortgage, $335,000 in student loans, and significant credit card and personal loan debt. He labeled their situation absurd, pointing out the stark contrast between their lifestyles and incomes. Despite earning advanced degrees, government jobs, and a combined income of about $230,000, the couple was well aware of their dire financial predicament. “You're scared and you should be. You're disgusted and you should be,” Ramsey asserted, emphasizing the seriousness of their predicament.

Do not miss it:

-

For many first-time buyers, a home costs about three to five times their annual household income. Are you making enough?

-

Are you rich? Americans think about what it takes to be considered wealthy.

According to Ramsey, the solution involved a radical overhaul of her lifestyle. “As you know, I am preparing to destroy your life,” he warned, advocating extreme frugality and sharp cuts in spending. The essence of his advice is encapsulated in his instruction to adopt a “beans and rice, rice and beans” lifestyle, symbolizing the need to cut all unnecessary expenditures. This approach required selling non-essential assets and embracing a simpler lifestyle.

Mr. Ramsey's coaching focused not only on financial strategy, but also on the emotional and spiritual growth that comes from facing and overcoming such challenges. he said: “You live in about 10 times the area you're supposed to live in. You're used to spending the same way you do when you're in Congress. That's what caused you to do this. It's going to shatter a lot of crap in your soul.'' He emphasizes the importance of confronting the behaviors and attitudes that led to debt, and in the process, challenges social perceptions and material desires. He even predicted that it would lead them to the point where it no longer influenced their choices.

The financial expert did not hesitate to explain the harsh realities of the future, including the prospect of driving a “clunker” as a sign of his commitment to fiscal consolidation. He bluntly stated, “I make a quarter of my income, but I end up driving a crappy car and stopping at a traffic light next to people who drive nicer cars than I do,'' he says, and says, “I'm going to be stopped at a traffic light next to people who make a quarter of my income but have nicer cars than me.'' He emphasized the need for humility and sacrifice to escape. Financial quagmire.

trend: The average American couple saves this much money for retirement. how do you compare?

Anticipating the social and familial skepticism the couple would face, Ramsey suggested, “Your friends will think you've lost your mind and your mother will think you need counseling.” This advice highlighted broader societal challenges and the need to overcome peer pressures into certain financial behaviors.

Mr. Ramsey suggested selling the condominium they had rented out in order to resume debt repayments, but this could significantly reduce their overall debt, making it difficult for them to turn their financial situation around. It can be a symbol of dedication.

While not everyone needs Dave Ramsey's specific guidance to straighten out their money flow, it's hard to overstate the value of financial advice in supporting one's personal financial journey. There is no such thing as too much if. Customized advice from a financial advisor is invaluable, providing a personalized strategy tailored to an individual's unique situation. This support is essential whether your goal is to save for retirement, prepare for a major purchase, or manage debt effectively.

Ramsey and his wife's conversation is a powerful reminder of America's pervasive debt problem and emphasizes the importance of financial literacy. His tough-love approach, while daunting, provides a clear blueprint for those willing to face their financial realities head-on and work hard toward a debt-free future. Offers. Through this conversation, Ramsey offers not only financial advice, but also a path to personal and spiritual growth, encouraging individuals to reconsider their values and the impact their financial decisions have on their lives.

Read next:

*This information is not financial advice. To make informed decisions, we recommend individual guidance from a financial advisor.

Jeannine Mancini has been writing about personal finance and investing for the past 13 years for a variety of publications including Zacks, The Nest, and eHow. She is not a licensed financial advisor and the content herein is for informational purposes only and does not constitute, and is not intended to constitute, investment advice or investment services. She Mancini believes that the information contained herein is reliable and obtained from reliable sources, but makes no representations, express or implied, as to the accuracy or completeness of the information; There are no guarantees or promises.

“The Active Investor's Secret Weapon'' Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

This article Dave Ramsey tells 29-year-old he's $1 million in debt that he plans to ruin his life – 'Your friends will think you've lost your mind and your mother will need counseling for you' ” originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.