Tethys Petroleum (CVE:TPL) has had a great run on the stock market, with its share price up a massive 64% over the past three months. As most people know, fundamentals typically guide market price movements over the long term, so today we'll take a look at the company's key financial metrics to see if they play any role in the recent price movement. I decided to judge. Specifically, we decided to examine Tethys Petroleum's ROE in this article.

Return on equity or ROE tests how effectively a company is growing its value and managing investors' money. In other words, it is a profitability ratio that measures the rate of return on the capital provided by a company's shareholders.

See our latest analysis for Tethys Oil.

How do you calculate return on equity?

of Calculation formula for return on equity teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Tethys Oil's ROE is:

3.8% = USD 1.7 million ÷ USD 43 million (based on trailing twelve months to September 2023).

“Revenue” is the income a company has earned over the past year. Another way to think of it is that for every CA$1 worth of stock, the company allowed him to earn a profit of CA$0.04.

What is the relationship between ROE and profit growth rate?

So far, we have learned that ROE is a measure of a company's profitability. We are then able to evaluate a company's future ability to generate profits based on how much of its profits it chooses to reinvest or “retain.” Assuming everything else remains constant, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily have these characteristics.

Tethys Petroleum's earnings growth and ROE 3.8%

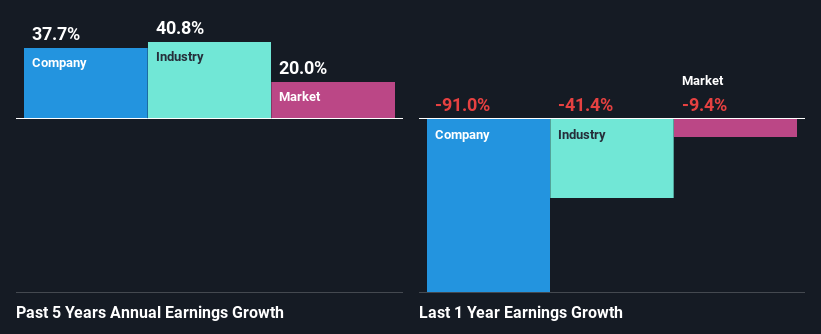

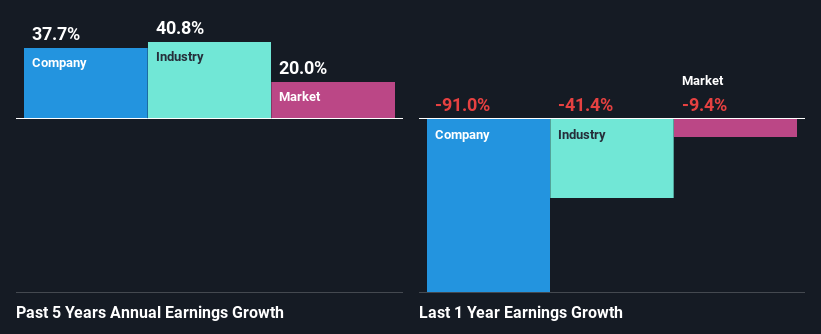

As you can see, Tethys Petroleum's ROE seems quite low. Not only that, but compared to the industry average of 11%, the company's ROE is completely unremarkable. Nevertheless, surprisingly, Tethys Petroleum posted an exceptional net income growth of 38% over the past five years. We believe there may be other aspects that are positively impacting the company's earnings growth. For example, the company's management may have made some good strategic decisions, or the company may have a low dividend payout ratio.

We then compared Tethys Petroleum's net income growth with the industry and found that the company's growth was on par with the industry's average growth rate of 41% over the same five-year period.

Earnings growth is a big factor in stock valuation. The next thing investors need to determine is whether the expected earnings growth is already built into the stock price, or the lack thereof. That way, you'll know if the stock is headed for clear blue waters or if a swamp awaits. Is Tethys Petroleum fairly valued compared to other companies? These 3 valuation metrics may help you decide.

Is Tethys Petroleum using its profits efficiently?

Tethys Petroleum's median three-year payout ratio is 44% (retaining 56% of its earnings), which is neither too low nor too high. This suggests that the company's dividend is well covered, and given the high growth discussed above, Tethys Petroleum appears to be reinvesting its earnings efficiently.

Tethys Petroleum has been growing its earnings, but it only recently started paying a dividend. The company most likely decided to impress new and existing shareholders with the dividend.

summary

Overall, we feel Tethys Petroleum certainly has some positive factors to consider. Despite low profit margins, the company has recorded impressive revenue growth as a result of significant reinvestment in the business. We don't want to completely fire the company, but we do try to see how risky the business is in order to make more informed decisions about the company. To learn about the 4 risks we have identified for Tethys Petroleum, visit our risks dashboard for free.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.