Some investors rely on dividends to grow their wealth. If you're one of those dividend experts, you might want to know the following: Bridge Investment Group Holdings Co., Ltd. (NYSE:BRDG) is about to go ex-dividend in just four days. The ex-dividend date is one day before the record date. The record date is the date on which a shareholder must appear on the company's books in order to receive the dividend. The ex-dividend date is important because trades in the stock must be settled before the record date in order to receive the dividend. This means that investors who purchased Bridge Investment Group Holdings shares after March 7th will not receive the dividend paid on March 22nd.

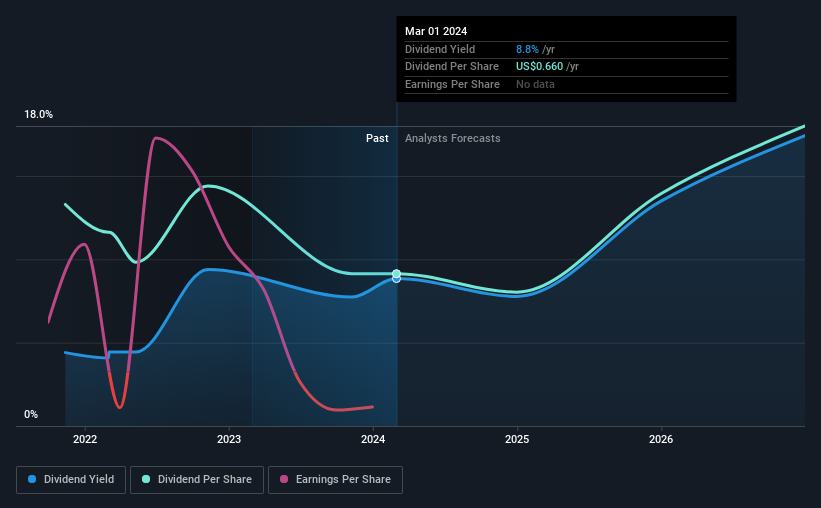

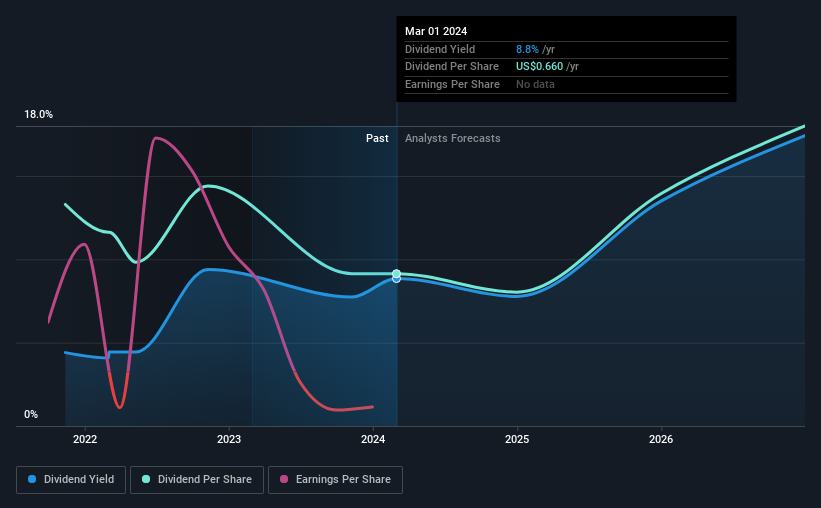

The company's next dividend payment will be US$0.07 per share. Last year, the company distributed a total of US$0.66 to shareholders. Looking at the last 12 months of distributions, Bridge Investment Group Holdings has a yield of approximately 8.8% on the current stock price of $7.46. Dividends are an important source of income for many shareholders, but the health of the business is critical to maintaining dividends. As a result, readers should always check whether Bridge Investment Group Holdings has been able to grow its dividends, or if the dividends could be cut.

Check out our latest analysis for Bridge Investment Group Holdings.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Bridge Investment Group Holdings reported an after-tax loss last year, meaning it is paying a dividend despite being unprofitable. This may be a one-time event, but it is not sustainable in the long run.

Click here to see the company's payout ratio and analyst estimates of its future dividends.

Are profits and dividends growing?

Companies whose profits are shrinking are difficult to view from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is cut, you can expect the stock to sell off heavily at the same time. Bridge Investment Group Holdings was unprofitable last year, with its loss per share sadly worsening by 128% year-on-year.

Many investors assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Bridge Investment Group Holdings' dividends have fallen by an average of 17% a year over the past two years, which isn't very encouraging. It's not great that earnings per share and dividends have declined in recent years, but rather than risk over-committing to the company in order to maintain yields for shareholders, management should I'm encouraged by the fact that we've cut back on money.

Remember, you can always take a snapshot of Bridge Investment Group Holdings' financial health, by checking our visualization of its financial health here.

final point

From a dividend perspective, should investors buy or avoid Bridge Investment Group Holdings? First, we see that the company paid a dividend despite making a loss last year. is not great. To make matters worse, the overall trend in earnings seems to be negative in recent years. These characteristics usually do not translate into good dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

That said, if you're considering this stock without worrying too much about its dividend, you should be aware of the risks associated with Bridge Investment Group Holdings. For example, I found that: 3 warning signs for Bridge Investment Group Holdings We recommend that you consider this before investing in your business.

Generally speaking, we don't recommend just buying the first dividend stock you see.Here it is A curated list of interesting stocks with strong dividends.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.