If you're not sure where to start when looking for your next multibagger, there are some important trends to look out for. Ideally, your business will see two trends.grow first return One is capital employed (ROCE) and the second is increasing. amount of capital employed. If you see this, it usually means the company has a good business model and plenty of opportunities for profitable reinvestment.With that in mind, the ROCE dunelm group (LON:DNLM) looks great, so let's see what the trend tells us.

Return on Capital Employed (ROCE): What is it?

For those who aren't sure what ROCE is, it measures the amount of pre-tax profit a company can generate from the capital employed in its business. The formula for this calculation in Dunelm Group is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.48 = GBP 204 million ÷ (GBP 721 million – GBP 294 million) (Based on the previous 12 months to December 2023).

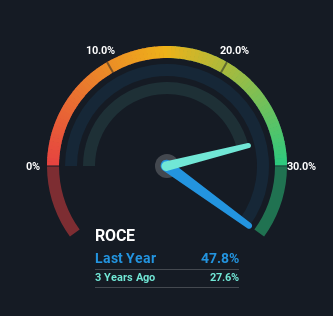

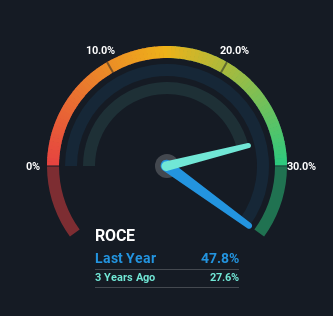

therefore, Dunelm Group's ROCE is 48%. In absolute terms, this is a significant gain, even better than the specialty retail industry average of 14%.

Check out our latest analysis for Dunelm Group.

In the graph above, we have measured Dunelm Group's previous ROCE against its previous performance, but the future is probably more important. If you're interested, take a look at our analyst forecasts. free Dunelm Group Analyst Report.

What can we learn from Dunelm Group's ROCE trend?

Dunelm Group is showing some positive trends. Over the past five years, return on capital employed has increased significantly to 48%. It is worth noting that the company has virtually increased its return per dollar of capital employed, and the amount of capital has also increased by 48%. This could indicate that there are plenty of opportunities inside to invest capital at ever-higher interest rates, and this combination is common among multibaggers.

On another related note, it's important to know that Dunelm Group's current liabilities to total assets ratio is 41%, which we consider to be quite high. This may create a certain degree of risk because we essentially operate with a substantial reliance on suppliers and other short-term creditors. Ideally, we would like this to decrease, as a decrease would mean fewer risk-bearing obligations.

Important points

In summary, it's great to see that Dunelm Group is able to double its earnings by continually reinvesting capital at increasing rates of return. Because these are some of the key elements of the very popular multibagger. And the stock has delivered an 82% return for shareholders over the past five years, so investors seem to be counting on it to continue doing so. That said, we still think promising fundamentals mean the company requires further due diligence.

Like most companies, Dunelm Group is subject to several risks. 1 warning sign What you need to know.

If you want to find more stocks with high returns, check this out. free This is a list of stocks with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.