Monday is Earth Day. This year's theme is “Planet vs. Plastics.”

Plastic usage skyrocketed throughout the 20th century, but it soon became clear that plastic was having a negative impact on the environment. We now know that once plastic is produced, it remains in the environment forever, poses a risk to human health, and contributes to climate change.

In the spirit of Earth Day, here are some statistics on plastic use, climate change impact, and investor reaction. These statistics highlight the scale of this problem and the associated risks and opportunities.

Here are some statistics investors should know.

Earth vs. Plastic

Plastic was introduced in the 1950s and by 2017, 8.3 billion tons were produced. World plastic production in 2022 was 400.3 million tons.

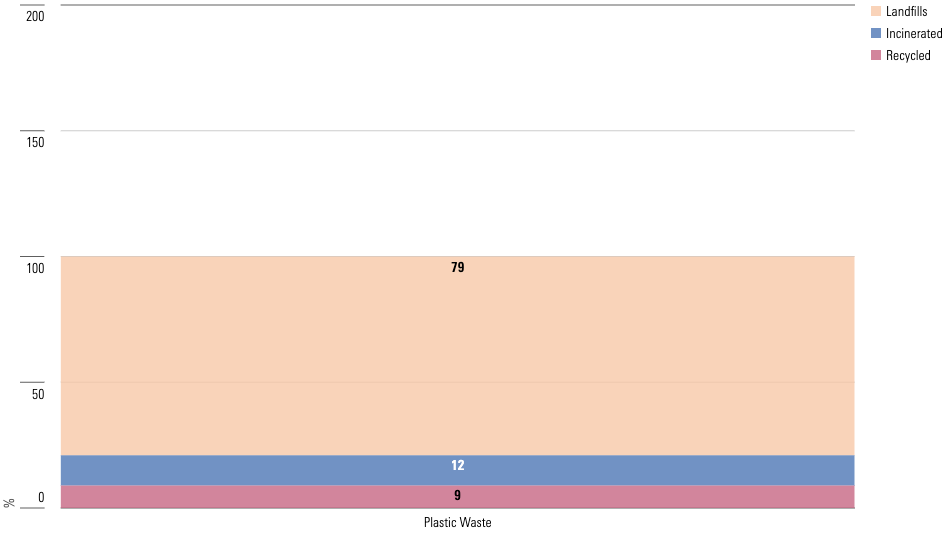

And most of that plastic remains around. As of 2017, 79% of all plastics ever produced still end up in landfills or the natural environment (excluding small amounts that are incinerated or recycled).

Here are some more statistics on global plastic use.

- The world produces more than 26 million tons of polystyrene (plastic foam) each year.

- Each year, the average American ingests more than 70,000 microplastics from their drinking water supply. These plastics come from multiple sources, most of which are related to littering, stormwater runoff, and poor wastewater management at treatment facilities.

Plastic production contributes to climate change

Plastic production is directly linked to pollution and climate change.

- Approximately 4% of total greenhouse gas emissions are generated by plastic production, conversion, and waste management.

- Currently, 93% of plastics are produced using fossil fuels.

- Emissions associated with fossil-based plastics are expected to more than double, and global plastic use is predicted to triple, resulting in a doubling of plastic leakage into the environment (more (in the absence of strict policies).

- More than 15% of methane emissions come from landfills, where most single-use plastics end up. More plastic being disposed of in landfills leads to an increase in landfill size and emissions.

The scale of climate change has increased consistently in recent decades, and rising global temperatures have a direct impact on our lives.

- Earth's temperature has risen on average by 0.11 degrees Fahrenheit (0.06 degrees Celsius) every decade since 1850, for a total of 2 degrees Fahrenheit.

- Since 1982, the rate of warming has more than tripled, to 0.36 degrees Fahrenheit (0.20 degrees Celsius) per decade.

- The 10 warmest years in historical record all occurred in the past decade (2014-2023).

- 2023 was the warmest year by a wide margin since world records began in 1850.

Climate change brings extreme weather events that cause heavy rain, flooding, winds, snow, and changes in temperature, which can stress or destroy existing infrastructure and facilities, especially along coastlines.

- Almost 40% of the U.S. population, and almost 40% of Japan's population, live in coastal counties.

- Approximately 3.6 billion people around the world already live in areas that are highly susceptible to the effects of climate change. Between 2030 and 2050, climate change is expected to cause about 250,000 additional deaths per year from malnutrition, malaria, and heat stress alone. Direct health costs are estimated to be $2 billion to $4 billion annually by 2030.

Climate change also has direct economic and financial impacts. In 2023, the United States will experience 28 weather and climate disasters, with damages amounting to at least $1 billion.

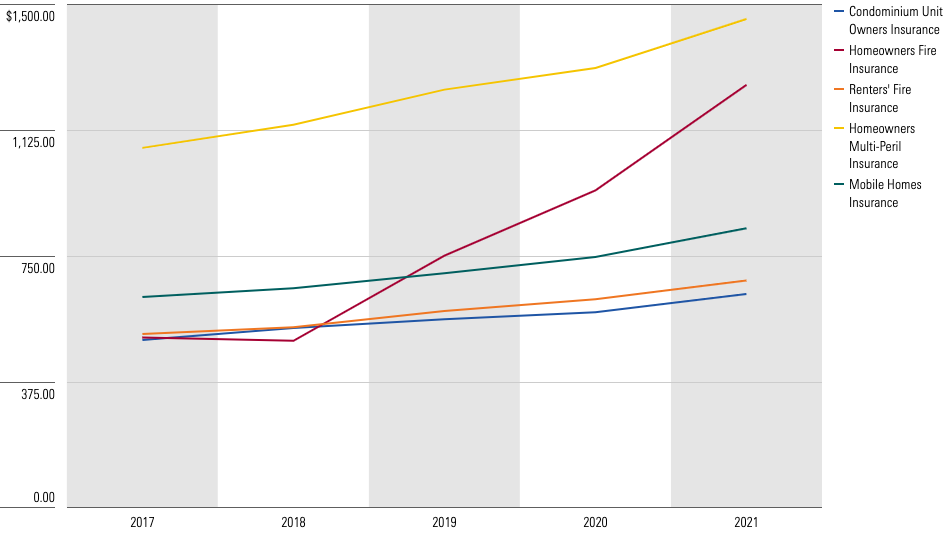

One of the effects of these weather events is an increase in the cost of home insurance. In California, home insurance premiums rose by about 35% on average between 2017 and 2022 due to historic wildfire losses. These premiums remain low compared to other large states with major climate risks. Includes Louisiana, Texas, and Florida.

Other economic impacts of climate change include:

- Residential properties at risk of flooding are overvalued by $121 billion to $237 billion, depending on the discount rate.

- Disasters caused by climate change could put at least $314 billion of annual wheat, rice, corn, and soybean production at risk.

What are investors doing to manage this risk?

As governments work to build infrastructure that reflects the realities of climate change, individuals are also seeking opportunities to invest in this new world and reduce the risks associated with it.

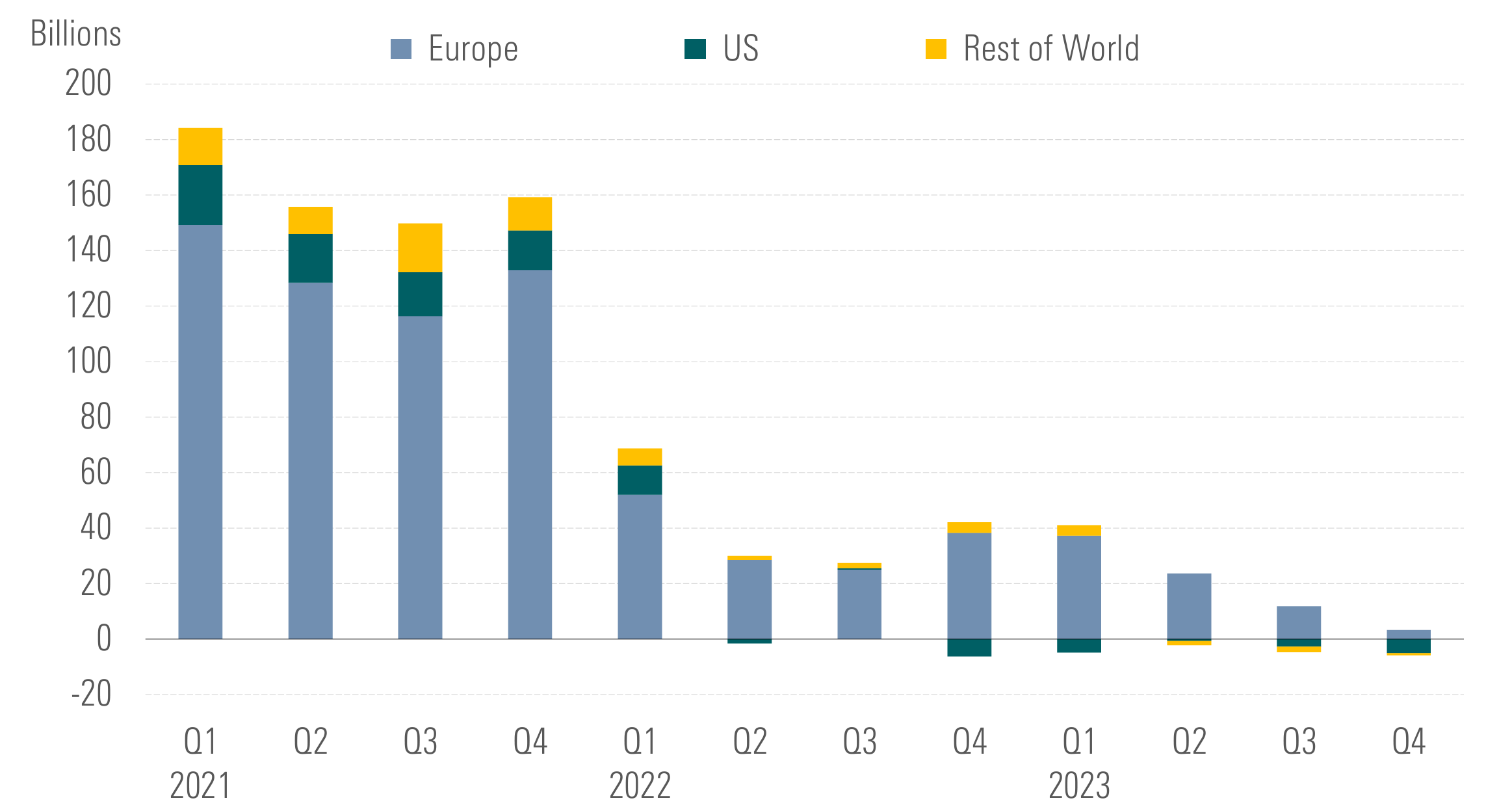

The growth of sustainable funds will further increase this interest. From 2019 to 2022, global sustainable financial flows increased threefold, but in the fourth quarter of 2023 they experienced their first-ever quarterly net outflow.

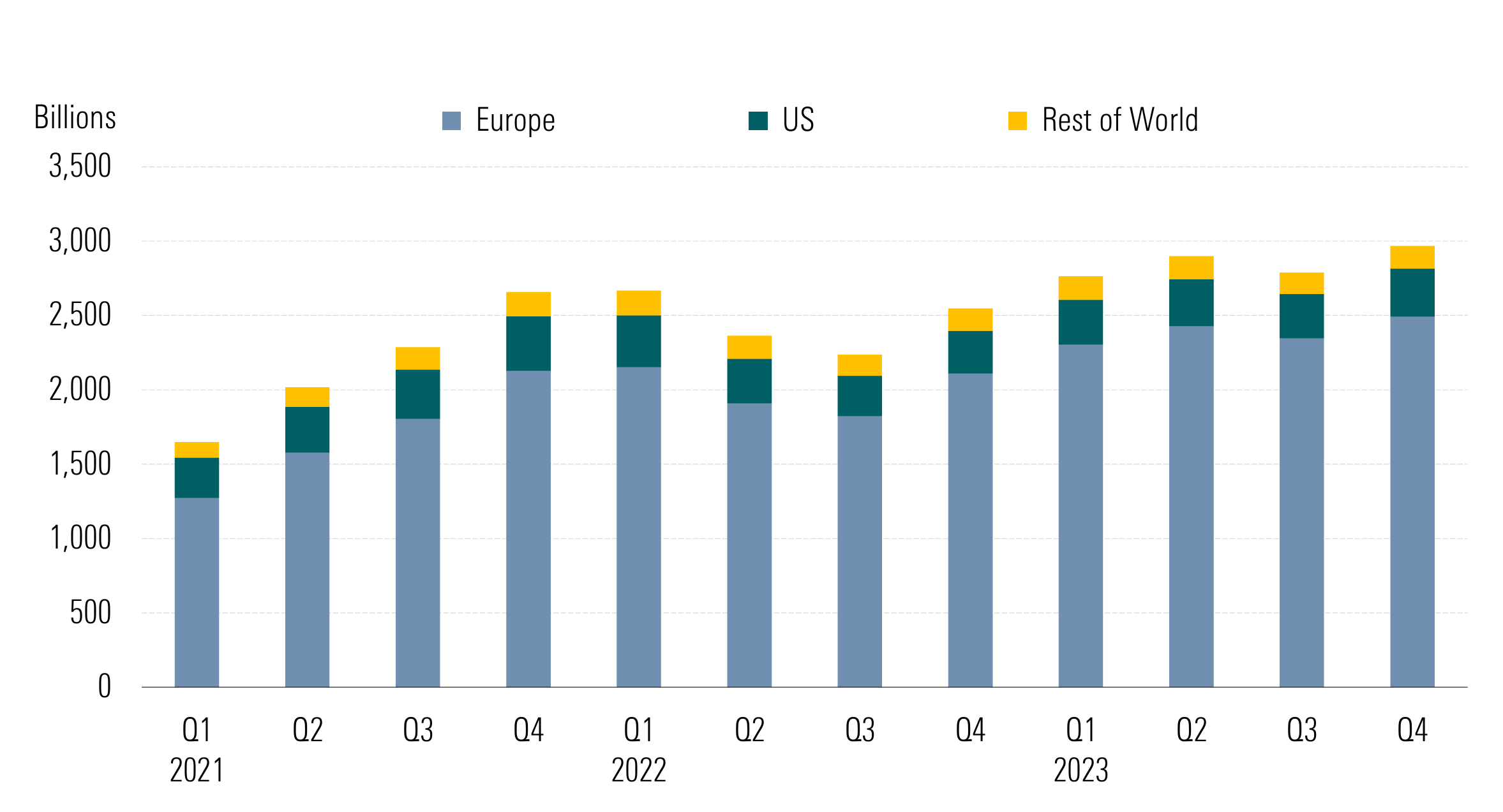

Against a complex and turbulent macroeconomic backdrop, fund assets rose 8.2% to $3 trillion at the end of 2023, from $2.7 trillion three months ago.

At the regulatory level, government programs in the United States and Europe are encouraging climate change technologies.

- The U.S. Inflation Control Act allocates more than $370 billion to foster innovation in energy technology and accelerate adaptation to climate change.

- U.S. greenhouse gas emissions are projected to decline by 33% to 40% by 2030 compared to 2005 levels. This is due to funding and fiscal incentives from the Inflation Control Act to encourage the adoption of low and zero greenhouse gas emission technologies.

The status of other major climate investments is as follows:

- Venture capital investments in climate technology and investments in sustainability funds have grown in popularity in recent years, but will be more sensitive to market conditions in 2023. Overall venture capital investment in climate technology in 2023 fell 14.5% to $41.1 billion, reflecting a more challenging environment for VC investing. The high point was in 2021 with $51 billion in total VC deals.

- To date, a total of $3 trillion in green bonds have been issued, and as of April 2024, approximately $200 billion will be issued.

- More than 1,500 organizations and investors with more than $40 trillion in assets are committed to divesting from fossil fuels to fight climate change.

- Eighty-nine asset owners with a combined $9.5 trillion in assets under management have joined the United Nations-convened Net Zero Asset Owners Alliance.

- 69 property owners have set their own net zero targets.

“[The transition to a low-carbon economy] “We are excited to see the impact of climate change on climate change,” said Alicia White, senior product manager for climate solutions at Morningstar Sustainalytics. “Investors need to understand their exposure to transition risk at the company level and how this risk is managed.”

To further understand this risk, investors can use Morningstar Sustainalytics' Low Carbon Transition Rating and Physical Climate Risk Index. These indicators are designed to improve climate-focused investments, particularly in two key areas: identifying companies at the forefront of global decarbonization and assessing the physical risks associated with climate change within companies. Designed to support investors seeking innovation in