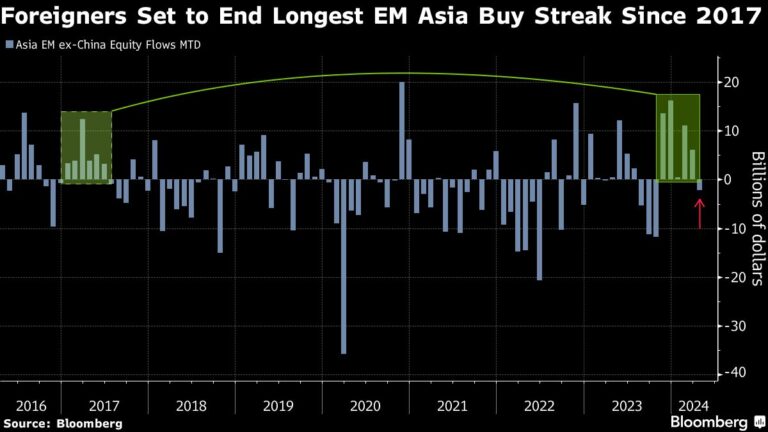

(Bloomberg) — Global funds are pulling out of emerging markets in Asia, ending a five-month stock buying spree as expectations for a U.S. interest rate cut fade.

Most Read Articles on Bloomberg

Foreign investors sold about $2.2 billion worth of net shares in the region's emerging markets in April, according to data compiled by Bloomberg excluding China. This ends the longest buying streak dating back to 2017.

Taiwan led this month's outflows, while South Korea recorded net inflows for the period. The MSCI Emerging Markets Asia Index is on the brink of giving up its year-to-date gains. The index had risen as much as 4.6% since the beginning of the year until concerns grew last week that the Federal Reserve would slow its rate cuts.

Following a series of unexpectedly high inflation rates, Federal Reserve Chairman Jerome Powell suggested Tuesday that policymakers will wait longer than originally expected to cut interest rates. Investors are concerned that the Fed's delay will force central banks in emerging markets to follow suit and postpone rate cuts.

Remaining high borrowing rates due to a strong US economy and rising oil prices will further exacerbate cost pressures from a strong dollar and dependence on imported energy from Asia. Rising U.S. interest rates have also made U.S. Treasuries more attractive as a safer option for regional stocks.

Emerging market active funds shed $2.7 billion in March as expectations grew that the Federal Reserve would slow down policy easing, Morgan Stanley strategist Jason Ng said. In particular, the company cut Taiwan, which is rich in high-tech industries, while increasing positions in Saudi Arabia, Turkey and the United Arab Emirates, he wrote in the report.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP