AGNC investment (NASDAQ:AGNC) has a surprisingly attractive 15% dividend yield. Don't get too carried away with its dividends, though. It involves great risks. A better option is a company that is confident enough in its ability to pay dividends that it has trademarked the nickname “Monthly Dividend Company.” Here's what you need to know:

AGNC Investment, dividend ending soon

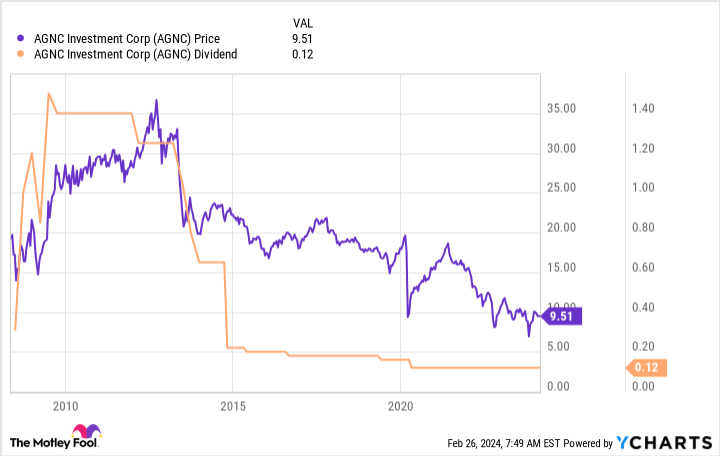

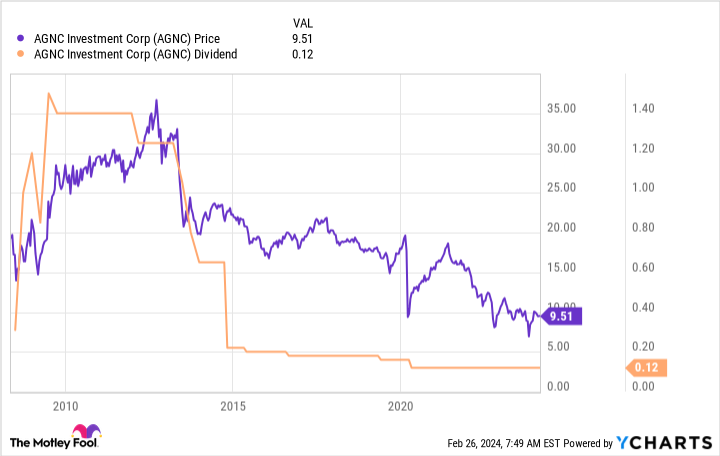

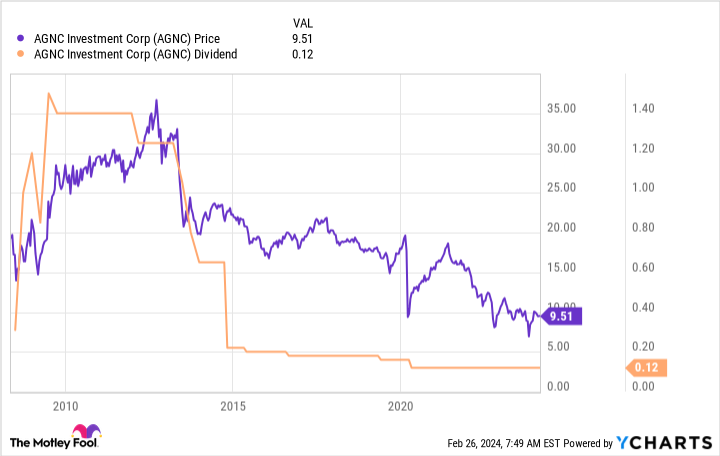

The most important thing dividend investors need to understand about AGNC Investment's dividend is that you simply can't rely on it. It has been cut many times over the past decade. As stock prices and dividends have fallen, investors are not only receiving less income, but are also facing capital losses.

To be fair, AGNC is a mortgage real estate investment trust (REIT). This is a very complex niche of his REIT sector, which is actually aimed at institutional level investors such as pension funds. The actual goal is not to generate large amounts of income for shareholders, but rather to provide a high total return, assuming dividends are reinvested. Small dividend investors are not our target market. Even though a hefty 15% dividend yield may be attractive to some smaller investors, most investors would be better off buying more reliable dividend stocks.

Let's take a look at real estate income

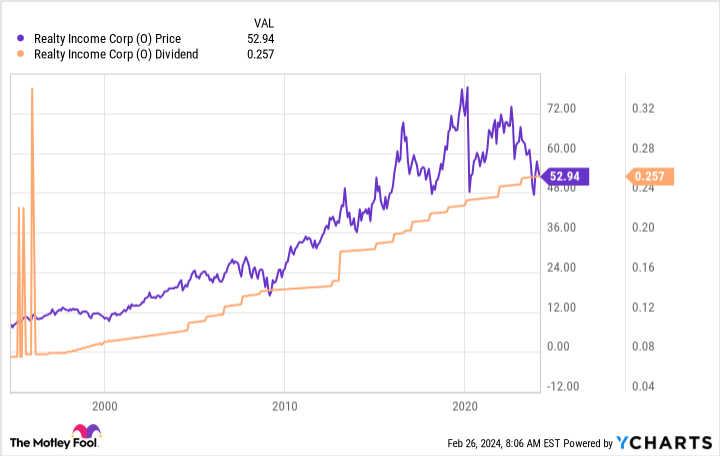

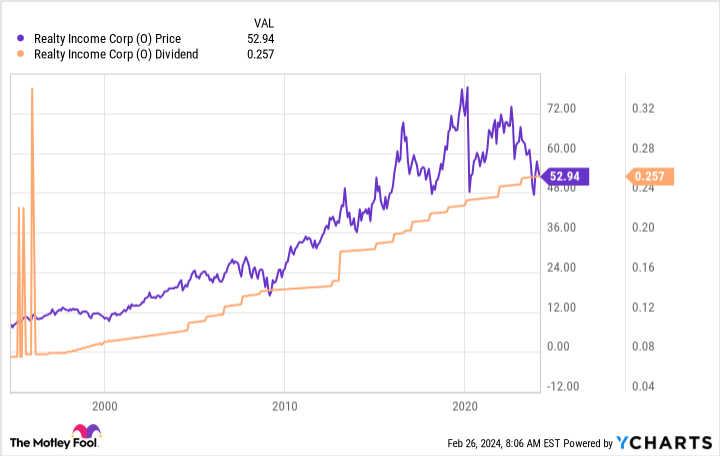

meanwhile real estate income's (New York Stock Exchange: O) The 5.8% dividend yield doesn't match AGNC's yield. We have a completely different track record here. Realty Income has increased its dividend every year for his 29 consecutive years. During this dividend streak, the monthly dividend has been increased quarterly for 105 quarters. If you're looking for a reliable dividend stock, Realty Income is a great place to start. And the offering yield is significantly higher than the average REIT (4.1%) and border market (1.4%). When you buy Realty Income, you're not necessarily satisfied with a low yield. That's just a lower yield than AGNC's worryingly high 15%.

Realty Income's dividend, on the other hand, is backed by an investment-grade balance sheet. Additionally, the adjusted funds from operations (FFO) payout ratio for 2023 was a solid 76.3%. The dividend is on very solid footing.

Meanwhile, this REIT is the largest net lease REIT available for purchase, with a market capitalization more than twice that of its next largest competitor. Scale comes with benefits, as greater liquidity makes it easier for real estate income to tap capital markets to fund growth. On the other hand, with a globally diversified portfolio of more than 15,000 properties, trouble with a single asset will not significantly impact the company's overall performance.

The only major drawback investors should consider with real estate income is that growth is modest at best. This depends on the size of your business, as growth will require significantly more investment than significantly changing your smaller peers. But if you're looking to maximize your current income, that's probably not that big of an obstacle. Notably, dividend growth of approximately 4.3% per year over the past 29 years has outpaced historical inflation growth. Therefore, the purchasing power of Realty Income's dividends has increased over time.

be careful what you wish for

If all you care about is huge yields, AGNC Investment may be appealing. The problem is that large yields can only be achieved if they are sustainable. A look at history shows that AGNC's dividend is hard to believe to be sustainable. However, Realty Income has a 29-year history of sustainability. Although the yield is not very high, S&P500 The index yield is only around 1.4%. If you're considering AGNC, you should probably lower your yield expectations and buy the more reliable Realty Income.

Need to invest $1,000 in real estate income right now?

Before purchasing real estate income stocks, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and real estate income wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Reuben Brewer holds a position in the real estate revenue sector. The Motley Fool has a position in and recommends Realty Income. The Motley Fool has a disclosure policy.

Forget about AGNC investing and buy this great high-yield stock instead Original article published by The Motley Fool