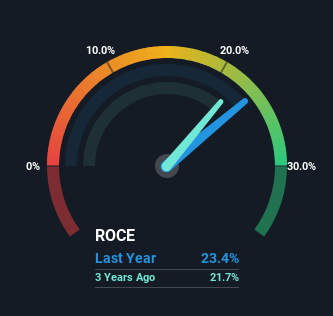

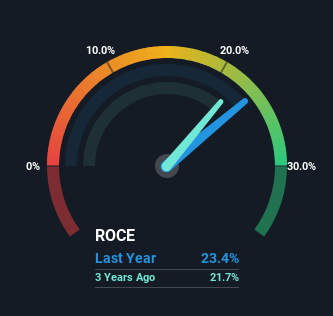

To find multibagger stocks, what are the fundamental trends in a company? Ideally, you'll see two trends in a business.grow first return One is capital employed (ROCE) and the second is increasing. amount of capital employed. After all, this shows that this is a business that is increasing its profitability and reinvesting its profits. So, I did a quick search and found that Frontken Co., Ltd. Berhad's (KLSE:FRONTKN) ROCE Trend, we were very happy with what we saw.

Return on Capital Employed (ROCE): What is it?

For those who have never used ROCE before, it measures the “return” (pre-tax profit) that a company generates from the capital employed in its business. To calculate this metric for Frontken Corporation Berhad, use the following formula:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.23 = RM168m ÷ (RM886m – RM166m) (Based on the previous 12 months to December 2023).

So, Frontken Corporation Berhad's ROCE is 23%. Not only is this an impressive return, but it's also higher than the average return for companies in a similar industry, which is 5.9%.

Check out our latest analysis for Frontken Corporation Berhad.

Above you can see how Frontken Corporation Berhad's current ROCE compares to its previous return on equity, but history can only tell us so much. If you're interested, take a look at our analyst forecasts. free Frontken Corporation Berhad Analyst Report.

ROCE trends

When it comes to Frontken Corporation Berhad's ROCE history, it is quite impressive. Over the past five years, the ROCE has remained relatively flat at around 23%, and the business operations are more than 101% capitalized. Considering the ROCE is an attractive 23%, this combination is actually quite attractive. Because this combination means that companies can consistently invest money and generate these high profits. If this trend continues, it wouldn't be surprising if the company becomes a multibagger.

The conclusion is…

Frontken Corporation Berhad has demonstrated its proficiency in generating high returns on increased capital employed, and we are excited about this. On top of that, the stock has returned an impressive 438% to shareholders over the past five years. So while investors seem to be aware of these encouraging trends, they still think this stock deserves further research.

But before you jump to any conclusions, you need to know what value you're getting from the current share price.Check out ours there Free estimate of FRONTKN's intrinsic value Compare stock prices and estimated values.

High returns are a key element of strong performance. free A list of stocks with solid balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.