key insights

-

Significant institutional ownership in Grit Real Estate Income Group means they have a significant influence on the company's share price.

-

A total of 5 investors hold a majority stake in the company, with an ownership of 54%.

-

Ownership research combined with historical performance data can help you fully understand stock opportunities

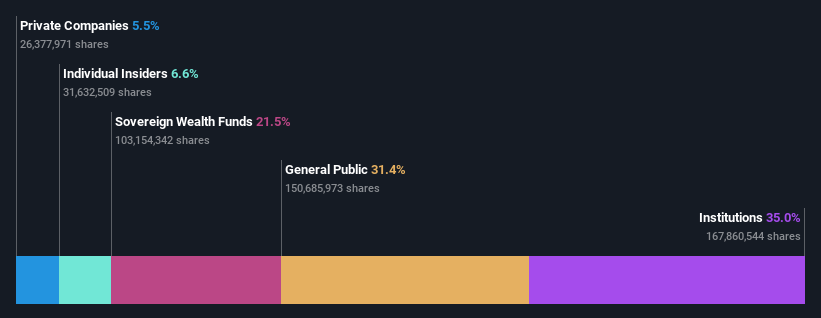

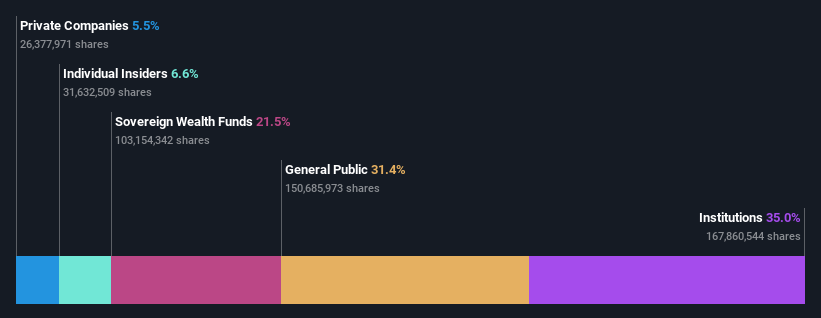

Every investor in Grit Real Estate Income Group Limited (LON:GR1T) should be aware of the most powerful shareholder groups. And the groups that hold the biggest piece of the pie are institutions with 35% ownership. That is, if the stock price rises, the group will gain the most (or if the stock price falls, it will suffer the maximum loss).

Because institutional investors have vast resources and liquidity, their investment decisions tend to have significant influence, especially for individual investors. As a result, large amounts of institutional funds invested in a company are generally considered a positive attribute.

Let's delve deeper into each type of owner for Grit Real Estate Income Group, starting from the graph below.

Check out our latest analysis for Grit Real Estate Income Group.

What does institutional ownership tell us about Grit Real Estate Income Group?

Financial institutions typically measure themselves against a benchmark when reporting to their own investors, so they often see increased enthusiasm for a stock once it's included in a major index. We would expect most companies to have some institutions on their register, especially if they are growing.

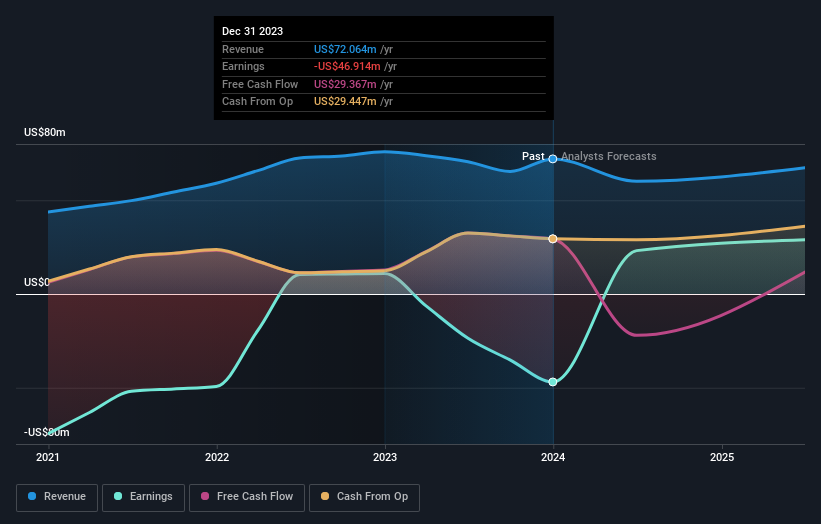

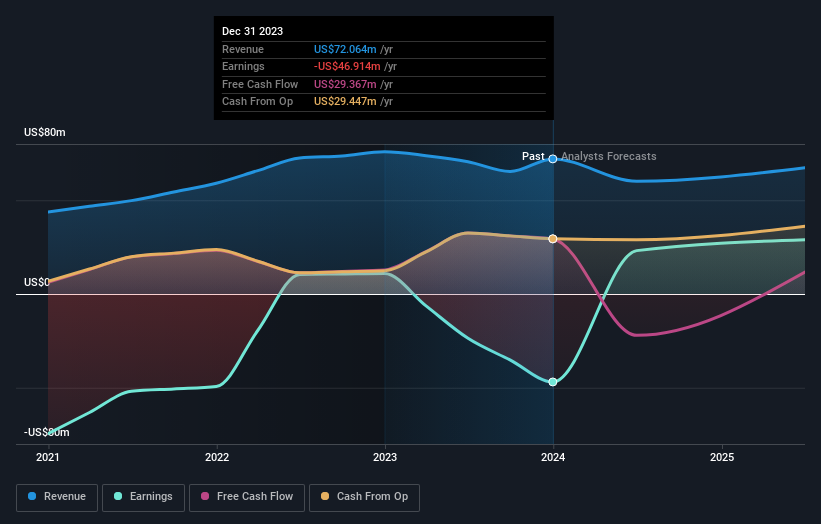

As you can see, institutional investors have a fair amount of stake in Grit Real Estate Income Group. This implies the analysts working for these institutions have considered the stock and they like it. But just like anyone else, they can be wrong. If multiple financial institutions change their view on a stock at the same time, you could see the stock price drop fast. It is therefore worth checking Grit Real Estate Income Group's earnings history, below. Of course, what really matters is the future.

Grit Real Estate Income Group is not owned by hedge funds. Our data shows that Public Investment Corporation Limited is the largest shareholder with 22% of shares outstanding. M&G Investment Management Limited and Eskom Pension and Provident Fund are the second and third largest shareholders, holding 15% and 6.8% of the shares outstanding, respectively. Additionally, CEO Bronwyn Knight owns 2.9% of the company's shares.

Our research also revealed that around 54% of the company is controlled by the top 5 shareholders, suggesting that these owners exercise significant influence over the business .

While researching institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. . There is some analyst coverage of the stock, but not a lot. Therefore, there is room for more coverage.

Grit Real Estate Income Group Insider Ownership

The precise definition of an insider can be subjective, but almost everyone considers board members to be insiders. The answers of company management to the board of directors and the latter must represent the interests of shareholders. In particular, top-level managers may serve on the board themselves.

I generally consider insider ownership to be a good thing. However, in some cases, it may be more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own some shares in Grit Real Estate Income Group Limited. As individuals, insiders collectively own UK£7m worth of the UK£106m company. It's good to see insider investment, and we usually like to see insider ownership increasing. It might be worth checking if those insiders have been buying.

Open to the public

The general public, usually retail investors, owns 31% of Grit Real Estate Income Group's shares. While this size of ownership may not be enough to sway policy decisions in their favor, they can still collectively influence company policy.

Private company ownership

We can see that Private companies own 5.5% of the shares outstanding. It's hard to draw any conclusions from this fact alone, so it's worth finding out who owns these private companies. Insiders and other parties may have an interest in the stock of a public company through another private company.

Next steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Grit Real Estate Income Group better, you need to consider many other factors.

I like to dive deeper Analyze how a company has performed in the past.You can access this interactive graph Check past earnings, revenue, and cash flow for free.

But in the end it's the futureIt, not the past, determines how well the owner of this business will do. So we might consider this free report showing whether analysts are predicting a bright future.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.