The stock market is off to a hot start in 2024. S&P500 and Nasdaq Composite It has reached record levels, thanks in large part to the giant companies that are leading the way in the field of artificial intelligence (AI).

AI is certainly an attractive growth market at the moment. However, investors can also supplement their portfolio with other opportunities. One reliable source of growth is in dividend stocks.

In particular, business development companies (BDCs) are a unique source of passive income as they are required to pay out 90% of their taxable income to investors each year. Let's analyze three major BDCs that can help drive more returns for your portfolio.

1. Hercules Capital: Dividend yield 10.4%

Hercules Capital (NYSE:HTGC) is a leading BDC in the technology, life sciences and sustainable energy businesses. We specialize in an investment vehicle called venture debt.

Typically, in the early stages of establishing a startup, companies need to raise funding from venture capital or private equity firms. However, as the company matures, raising additional capital becomes less optimal for the founders as dilution occurs.

This is a characteristic of Hercules. Debt is not dilutive, so founders' and employees' equity ownership does not decrease. Additionally, Hercules typically writes larger checks compared to typical banks.

The problem is that Hercules term loans have much higher interest rates to account for this risk. Additionally, BDCs typically include warrants that can be converted into equity in their transactions, providing additional sweeteners if one of the borrowers is acquired or pursues an initial public offering (IPO).

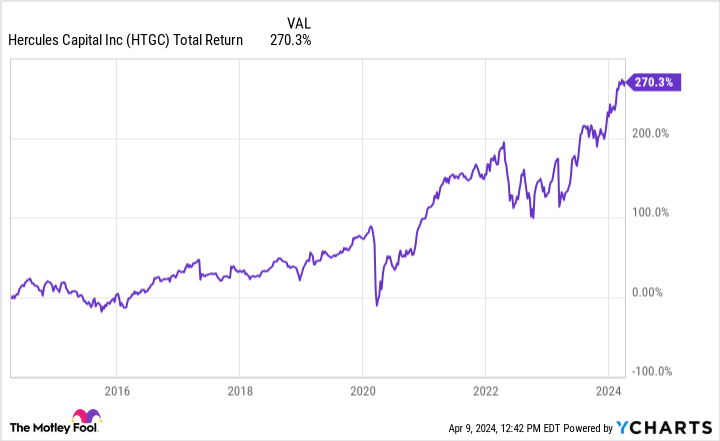

Over the past 10 years, Hercules stock has had a total return of 270%. This not only indicates the company's excellent investment prospects, but also highlights the importance of dividend reinvestment.

With Hercules' impressive dividend yield of 10.4%, it looks like a great opportunity to scoop up stock in this large BDC.

2. Horizon Technology Finance Corporation: Dividend yield 11.7%

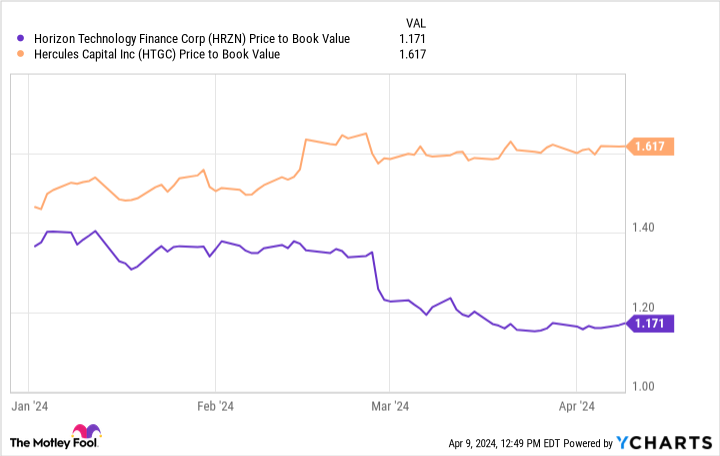

horizon technology (NASDAQ:HRZN) It is Hercules' main competitor. The firm also specializes in high-yield financing for venture capital-backed technology, energy, and healthcare startups. The total return of 147% over the past 10 years is not as bad as Hercules, but I don't think it's that bad.

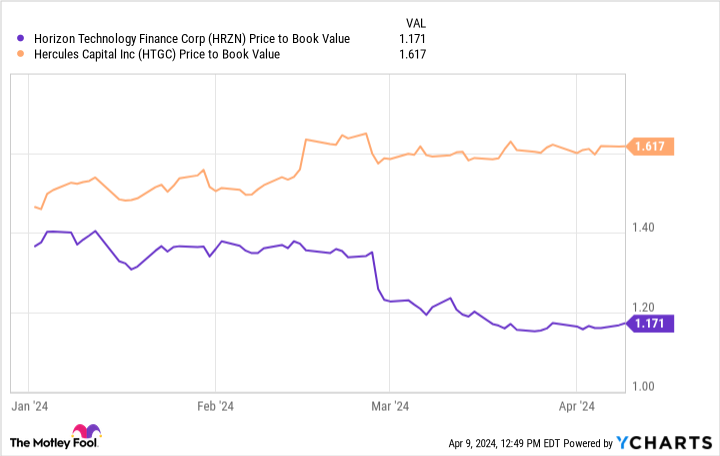

Additionally, Horizon's price-to-book ratio (P/B) is approximately 1.2, which is significantly lower than Hercules' P/B. Both companies are leading BDCs among emerging companies, but the difference in valuation multiples shown above may indicate that Horizon represents better value at this time.

With an impressive yield of 11.7%, Horizon will be hard to pass up. This could be a solid opportunity to complement other dividend investments in your portfolio at this time.

3. Ares Capital: Dividend yield 9.4%

The last BDC on my list is ares capital (NASDAQ:ARCC). Ares is actually quite different from Hercules or Horizon.

The company tends to focus on lower middle market companies across a wide range of industry sectors. Essentially, Ares has carved out a unique little niche within his BDC realm. The firm works with companies that may be considered too risky or not attractive enough to work with traditional investment banks.

However, Ares' large balance sheet and prudent approach to due diligence give the company a high degree of financial flexibility. As such, Ares is able to offer a wider range of more advanced financial solutions, including leveraged buyouts (LBOs), compared to other BDCs.

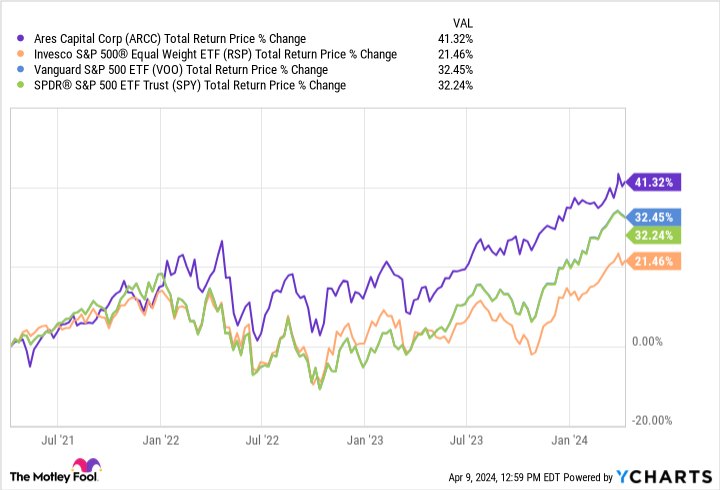

One of the most appealing aspects of Ares is that it has consistently outperformed some major exchange-traded funds (ETFs) over the past few years. As we saw above, investing in Ares SPDR S&P 500 ETF Trust, Invesco S&P 500 Equal Weight ETFand Vanguard S&P 500 ETF.

Ares has a valuable historical track record and offers a business model that differentiates it from other BDCs. As a result, now could be a great time to pick up stocks with yields above 9%.

Should you invest $1,000 in Hercules Capital now?

Before buying Hercules Capital stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Hercules Capital wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of April 8, 2024

Adam Spatako has no position in any stocks mentioned. The Motley Fool owns a position in and recommends the Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

“Here are the top 3 ultra-high dividend stocks to buy in April” was originally published by The Motley Fool