For the uninitiated, it may seem like a good idea (and an attractive prospect) to buy companies that tell investors a good story, even if they don't currently have a track record of revenue or profits. In some cases, these stories can cloud investors' minds and lead them to invest based on emotion rather than based on the fundamentals of a good company. Because loss-making companies are always in a race against time to achieve financial sustainability, investors in these companies may be taking on more risk than necessary.

Despite the era of open-air investing in tech stocks, many investors still employ traditional strategies.Buy shares in profitable companies such as Mestron Holdings Berhad (KLSE: Mestron). This is not to say that the company offers the best investment opportunities, but profitability is a key factor in business success.

Check out our latest analysis for Mestron Holdings Berhad.

Mestron Holdings Berhad's earnings per share are increasing

Generally, if a company is growing its earnings per share (EPS), the share price should follow a similar trend. Therefore, it makes sense for experienced investors to pay close attention to a company's EPS when doing investment research. Mestron Holdings Berhad managed to increase his EPS by 15% per year over three years. If we can maintain this, it will be a significant growth rate.

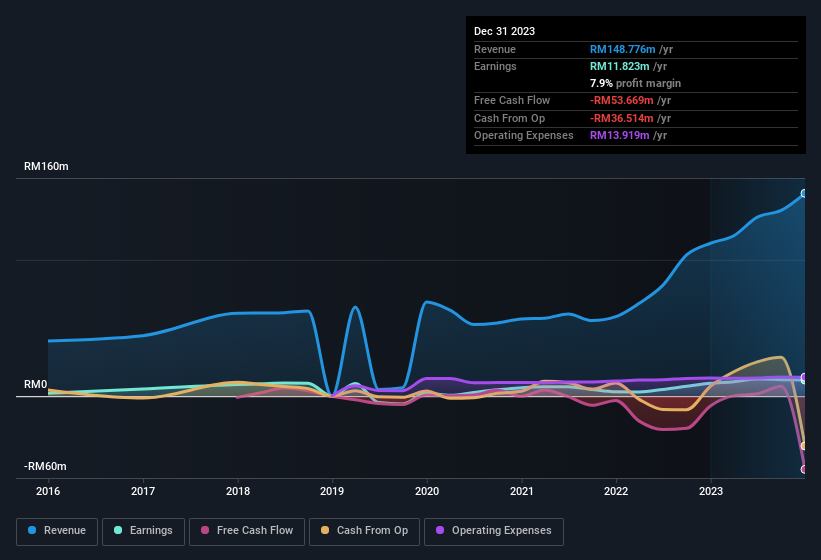

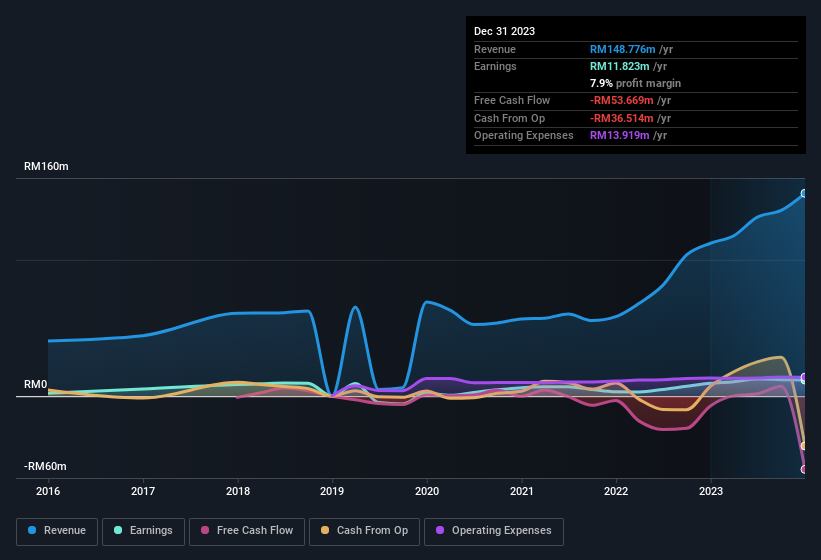

Revenue growth is a good indicator that growth is sustainable, and when combined with high earnings before interest, tax, and tax (EBIT) margins, it can be a good indicator for a company to maintain a competitive advantage in the market. This is the method. Mestron Holdings Berhad maintained stable EBIT margins last year while growing its revenue by 33% to RM149 million. That's encouraging news for the company!

You can see the company's revenue and profit growth trends in the graph below. Click on the graph to see exact numbers.

Mestron Holdings Berhad isn't exactly a huge company, considering it has a market capitalization of RM335m. Therefore, it is very important to check the strength of the balance sheet.

Are Mestron Holdings Berhad insiders aligned with all shareholders?

It's often a good sign to see insiders own a majority of outstanding shares. Their incentives are aligned with investors and there is less chance of a sudden sell-off that would affect the stock price. So we're pleased to report that Mestron Holdings Berhad insiders own a significant stake in the company. In fact, company insiders with a 56% stake are in control and have deep pockets in this venture. This should be seen as a good thing, because it means insiders have a personal interest in delivering the best outcome for shareholders. For reference, an insider's holdings in the business are valued at RM186m at the current share price. That's nothing to sneeze at!

Is Mestron Holdings Berhad worth putting on your watchlist?

One of the key encouraging features of Mestron Holdings Berhad is that its profits are growing. Adding to the spark, another highlight is the significant insider ownership within the company. This combination is definitely liked by investors, so consider keeping the company on your watch list. Still, it's worth noting what Mestron Holdings Berhad shows. 4 warning signs in investment analysis one of them is a little unpleasant…

While picking stocks with low earnings growth and no insider buying can still yield results, we recommend that you consider promising growth potential and insider confidence for investors who value these important metrics. Below is a carefully selected list of companies in My State with .

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.