For the uninitiated, it may seem like a good idea (and an attractive prospect) to buy companies that tell investors a good story, even if they don't currently have a track record of revenue or profits. Unfortunately, these high-risk investments often have little chance of return, and many investors pay a price to learn their lesson. Because loss-making companies are always in a race against time to achieve financial sustainability, investors in these companies may be taking on more risk than necessary.

If this kind of company isn't your style, but you like companies that generate revenue and even profits, you might be interested in companies like: premier foods (LON:PFD). This is not to say that the company offers the best investment opportunities, but profitability is a key factor in business success.

Check out our latest analysis for Premier Foods.

Premier Foods' earnings per share are increasing

If you believe that markets are even vaguely efficient, you would expect a company's stock price to follow its earnings per share (EPS) results in the long run. This means that most successful long-term investors consider his EPS growth to be substantially positive. Over the past three years, Premier Foods has grown his EPS by 7.2% per year. This may not light up the world, but it does indicate that EPS is trending upwards.

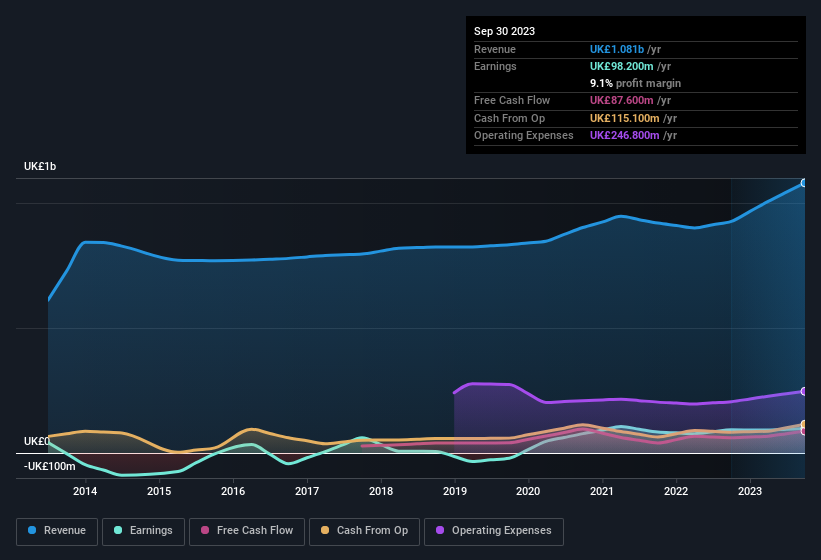

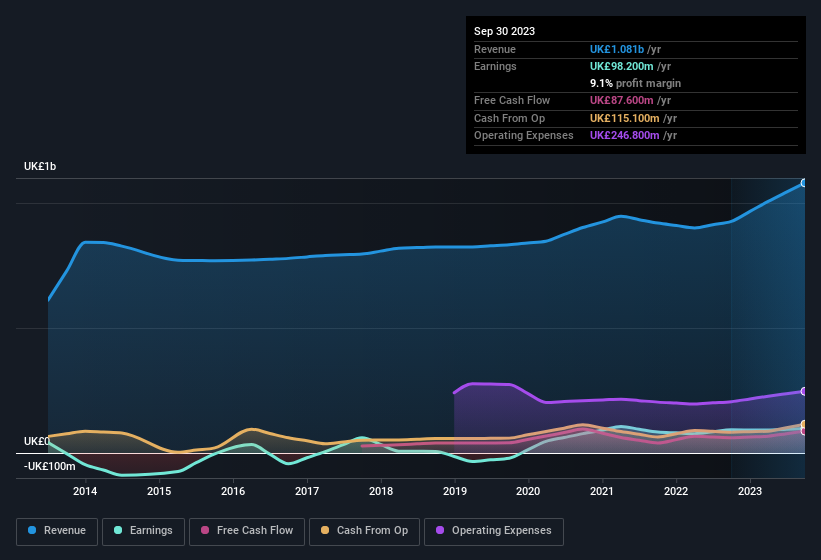

Revenue growth is a good indicator that growth is sustainable and, when combined with high earnings before interest and tax (EBIT) margins, can help a company maintain a competitive advantage in the market. This is an excellent method. Premier Foods' EBIT margins are roughly unchanged from last year, but the company is pleased to see that its revenue for the period increased by 17% to UK£1.1bn. That's a really positive thing.

In the graph below, you can see how the company has grown its revenue and revenue over time. Click on the graph to see the actual numbers.

I don't drive while looking in my rearview mirror, so this may be of interest to me. free Report showing analyst forecasts for Premier Foods future profit.

Are Premier Foods Inc. insiders aligned with all shareholders?

Investors are always looking for a vote of confidence in the companies they own, and insider buying is one of the key indicators of market optimism. This is because buying a stock often indicates that the buyer considers the stock to be undervalued. However, small purchases don't always imply conviction, and insiders don't always get it right.

Over the last twelve months, Premier Foods insiders spent UK£86,000 buying shares more than they earned from selling them. Overall, that's a good sign. Zooming in, we can see that the biggest insider purchase was by the Non-Executive Group Chairman, Colin Day, for UK£77,000 worth of shares (approximately UK£1.54 per share).

Is Premier Foods worth putting on your watchlist?

One positive thing for Premier Foods is that its EPS is growing. That makes me happy. Not all companies can grow their EPS, but Premier Foods certainly can. The real key is that the insiders are accumulating, suggesting that the people who know the company best see some potential. Now, you can decide whether to choose Premier Foods or not by focusing on these factors alone. or you could Also Compare the company's price-to-earnings ratio with its peers.

The good news is that Premier Foods isn't the only growth stock with insider buying. Here is a list of growth-oriented companies in GB with insider purchases in the last 3 months.

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.