Invest like the leading funds for less than $9 a month using the AI-powered ProPicks stock picker. Click here for details >>

The term “100 Bagger” first came to my attention in the 1989 Peter Lynch classic “One Up on Wall Street.” Names like Microsoft (NASDAQ:), Dell (NYSE:), Nvidia (NASDAQ:), and Apple (NASDAQ:) are just some of the names Lynch used to explain the potential for stocks to grow 10 times his This is just one example.

But how often do such explosive gains occur, and can we identify the next breakout star?

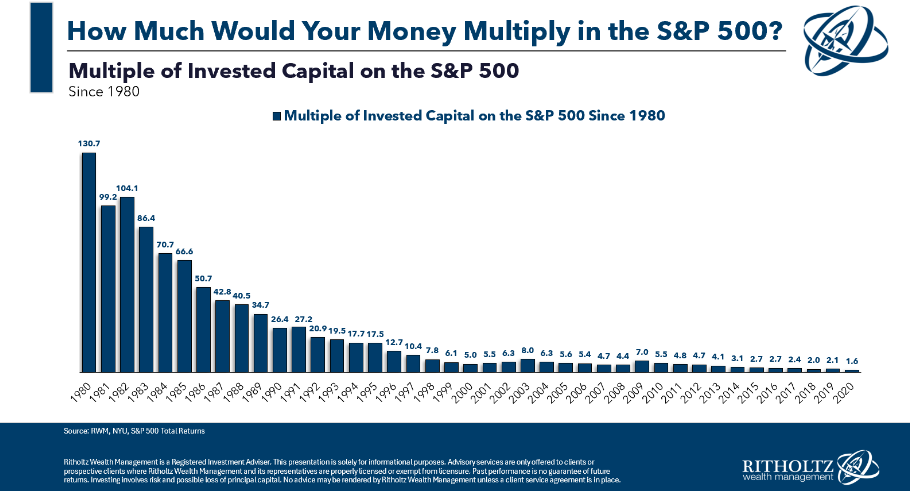

Let's take a look into the world of 100 bags. The chart below reveals an interesting truth. To find Tenbagger as of late 2023, we have to rewind to the 1980s.

What's really amazing is that investors in the 1980s saw the value of some stocks increase 100 times in a few years. This is a testament to the stock market's long-term growth potential, with the S&P 500's average annual return since 1980 being 11%.

Every investor dreams of buying a stock at a low price and then selling it for 100 times the price. A list of stocks that achieved this feat from 1962 to 2014 reveals nearly 400 such examples. But what makes these stocks unique, and how can investors identify them?

Identifying Potential 100 Buggers

There is no guaranteed formula, but when analyzing past 100 baggers, some important characteristics often emerge. Here are some important factors:

- Consistent growth: In particular, companies with a track record of stable profit growth tend to be strong competitors.

- Low starting price: Look for stocks with attractive valuations, such as low price-to-earnings ratios (P/E).

- Small market capitalization: Historically, companies with market capitalizations below $500 million are more likely to achieve 100 bagger status due to their explosive growth potential.

Achieving a 100x increase often requires steady growth in earnings, among other things, and requires starting from a low valuation, such as a low price-to-earnings ratio (P/E). Additionally, many of these stocks started out as small companies, as it is more difficult for large companies to grow this large.

Create a Watchlist: Filter 100 Possible Buggers

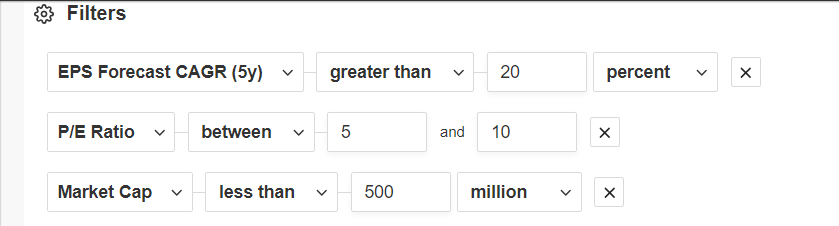

Good news? You can leverage tools like InvestingPro to set up filters to identify stocks with characteristics that match the historical 100 baggers. In this example, we applied three main filters.

- Compound annual revenue growth: At least 20% in the last 5 years.

- PER: Between 5 and 10.

- Market capitalization: Less than $500 million.

Source: InvestingPro

By applying these filters to the entire U.S. and European stock markets, we narrowed down our vast database of over 162,000 stocks to 113 shortlisted stocks. Will anyone become the next 100 bagger? only time will tell.

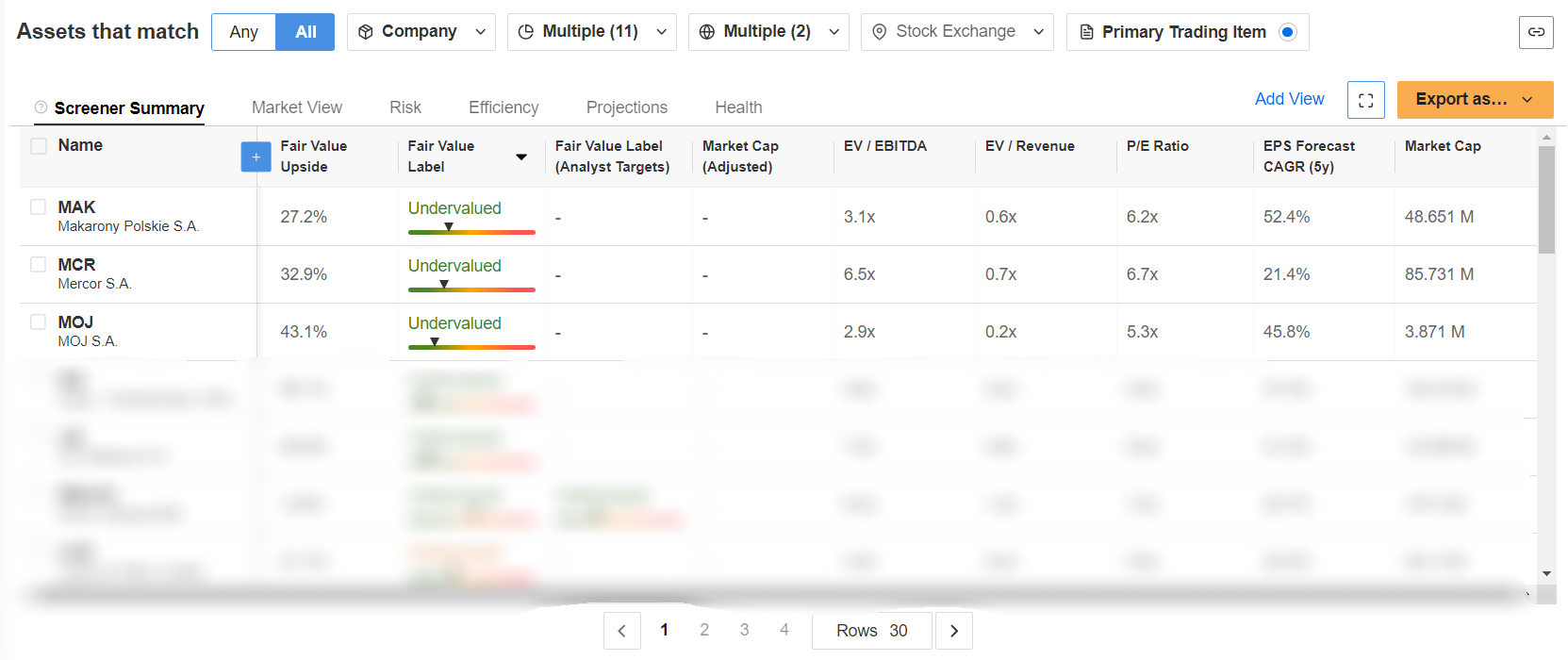

Could there be a Hundred Bugger among them? Here are the top three suggestions for your watchlist (in no particular order):

Source: InvestingPro

Discover 100 Bagger Stocks and their Fair Values on InvestingPro+. Subscribe now and save over 40% on annual plans for a limited time! Subscribe here now!

Disclaimer: This article is written for informational purposes only. This does not constitute an investment solicitation, offer, advice or recommendation and is not intended to encourage the purchase of any assets in any way. We would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky, so the investment decision and associated risks are borne by the investor.

remove ads

.