robin hood

If you purchase an independently reviewed product or service through a link on our website, The Hollywood Reporter may receive an affiliate commission.

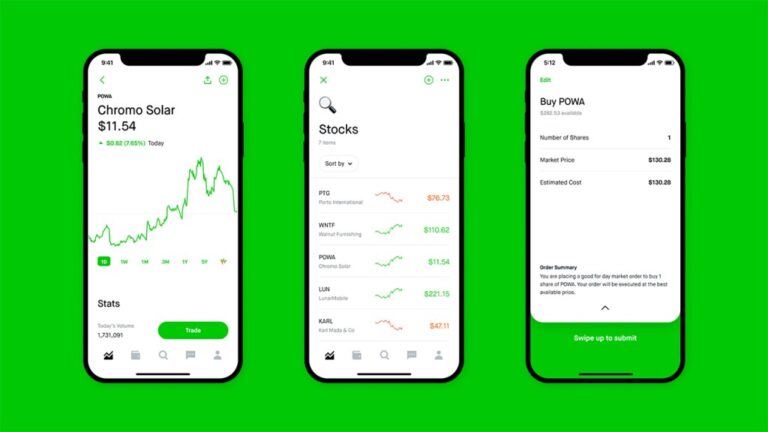

In an ever-evolving financial landscape, investment choices are becoming increasingly complex. Managing your personal finances may seem increasingly difficult. Now celebrating its 10th anniversary, Robinhood is making it easier than ever to navigate the brave new world of everyday investing. Robinhood continues to redefine the investing experience, offering user-friendly mobile apps and websites that streamline the complexity of personal finance.

The innovative, commission-free platform offers a wealth of products and resources to help individuals manage their money easily. As Robinhood continues to disrupt the investment space, the company is democratizing finance for a new generation of investors. Continue reading below to learn more about Robinhood's services, from commission-free trading and retirement planning to educational resources and more.

1. Commission-free trading – 24/7

Robinhood simplifies the process of buying and selling stocks, ETFs, options, and cryptocurrencies, making it more accessible than ever. Known for its intuitive interface and easy approach, Robinhood provides users with an easy-to-use platform to manage their portfolio, track market trends, and execute trades from their mobile device or desktop computer. The app provides real-time market data, customizable watchlists, and easy-to-use trading tools to help users stay informed and easily execute trades from anywhere.

Robinhood's 24-Hour Market is the only U.S. retail brokerage to offer 24/7 trading of single-name stocks, allowing traders to react to market-moving news in real time. This feature allows traders to adapt their portfolios based on the latest information, leveling the playing field and making extended trading less exclusive.

2. Educational resources and timely news and information

It can be difficult to understand and keep track of the latest information and news related to investing. Robinhood offers educational resources such as articles, tutorials, and investment guides that cover topics such as stock market 101, investment strategies, and financial planning. Other resources include timely news updates, market data, research reports, earnings calendars, and analyst ratings, giving users everything they need to stay informed.

3. Advanced trading options

For experienced users, Robinhood Gold offers a premium membership with exclusive benefits. With features like 5.0 percent interest on uninvested brokerage cash and access to powerful investment tools, Robinhood Gold offers added value for investors who want to get more out of their trading experience. Users can take advantage of benefits to manage their profits and optimize their investment strategies for a low monthly subscription fee.

4. Post-retirement planning

Planning for retirement is one of the key tenets of investment planning, and Robinhood Retirement makes it easy. This innovative feature provides the first IRA with a 1% match rate, making IRAs accessible to gig economy workers and others without employer-sponsored plans. Robinhood Retirement allows users to not only easily invest in their future, but also earn free money through a matching program.

5. Shares less than one unit

By investing in fractional shares of stocks and ETFs, users can diversify their portfolios and invest in high-value assets with less capital. Robinhood uses fractional shares to make diversification easier, allowing users to invest in fractional shares for as little as $1. This helps with risk management and allows you to build a diversified portfolio on any budget.

Diversification is the key to building a resilient investment portfolio, and Robinhood makes it easy with fractional shares. Instead of buying expensive stocks or whole shares in his ETF, you can invest in fractions for as little as $1. This allows you to spread your investments across different assets and helps with risk management. Whether you're interested in tech giants like Amazon or blue-chip stocks like Apple, fractional shares allow you to build a diversified portfolio on any budget.

6. Robust security measures

Robinhood prioritizes the security of your account and personal information. The platform employs industry standard security protocols such as encryption and two-factor authentication to protect user data and prevent unauthorized access.

disclosure

*As of November 2, 2023, via Bankrate.

All investments involve risk and possible loss of principal. Robinhood Gold is offered through Robinhood Financial LLC and is a paid subscription for premium services. The Brokered Cash Sweep Program is a feature added to Robinhood Financial LLC Brokered Accounts. Interest is earned on uninvested cash paid into the program bank from the brokerage account. The Program Bank will pay you interest on the cash you receive, less any fees paid to Robinhood. As of March 15, 2024, Robinhood Gold members receive an Annual Percentage Yield (APY) of 5.00%. APY is subject to change at any time at Program Bank's discretion. Additionally, the fees Robinhood receives may vary and are subject to change. Neither Robinhood Financial LLC nor its affiliates are banks.

Terms and conditions apply to Boost Rate promotions. Please see our Terms of Use for more information.

You must have compensation (salary income) to contribute to an IRA. Funds won from matches must be held in your account at least 5 times. Contributions are limited and withdrawals made before age 59 1/2 may be subject to a penalty tax year to avoid potential early IRA match removal fees. See the IRA Match FAQ for more information.

Contributions to or distributions from retirement accounts may be subject to taxes. Contributions are limited and withdrawals made before age 59 1/2 may be subject to penalty taxes. Robinhood does not provide tax advice. If you have any questions, please consult your tax advisor.

Robinhood Financial LLC offers commission-free trading in stocks, ETFs, and options. Other charges may apply. Please see Robinhood Financial's fee schedule for more information. Fractional shares are illiquid and cannot be transferred outside of Robinhood. Not all securities available through Robinhood are eligible for fractional share orders. Diversification does not guarantee profits or guarantee against losses. Trading over extended periods of time involves additional risks. Please see our Extended Time Trading Disclosure for more information.

Robinhood Financial LLC (member SIPC) is a registered broker-dealer. Robinhood Securities, LLC (member SIPC) is a registered broker-dealer and provides broker clearing services. Both are subsidiaries of Robinhood Markets, Inc. (“Robinhood”).