According to the latest IAB and PwC figures, UK digital ad spend rose 11% last year to £29.6bn, outpacing GDP growth by 0.1%. digital ad spending report.

Podcast ads, connected TV (CTV) devices, and social video saw the highest spending growth, increasing 23%, 21%, and 20% year over year, respectively.

These three have “outperformed” other digital advertising markets. One factor behind this is the “resistance” of cookies to future changes compared to other forms of advertising.

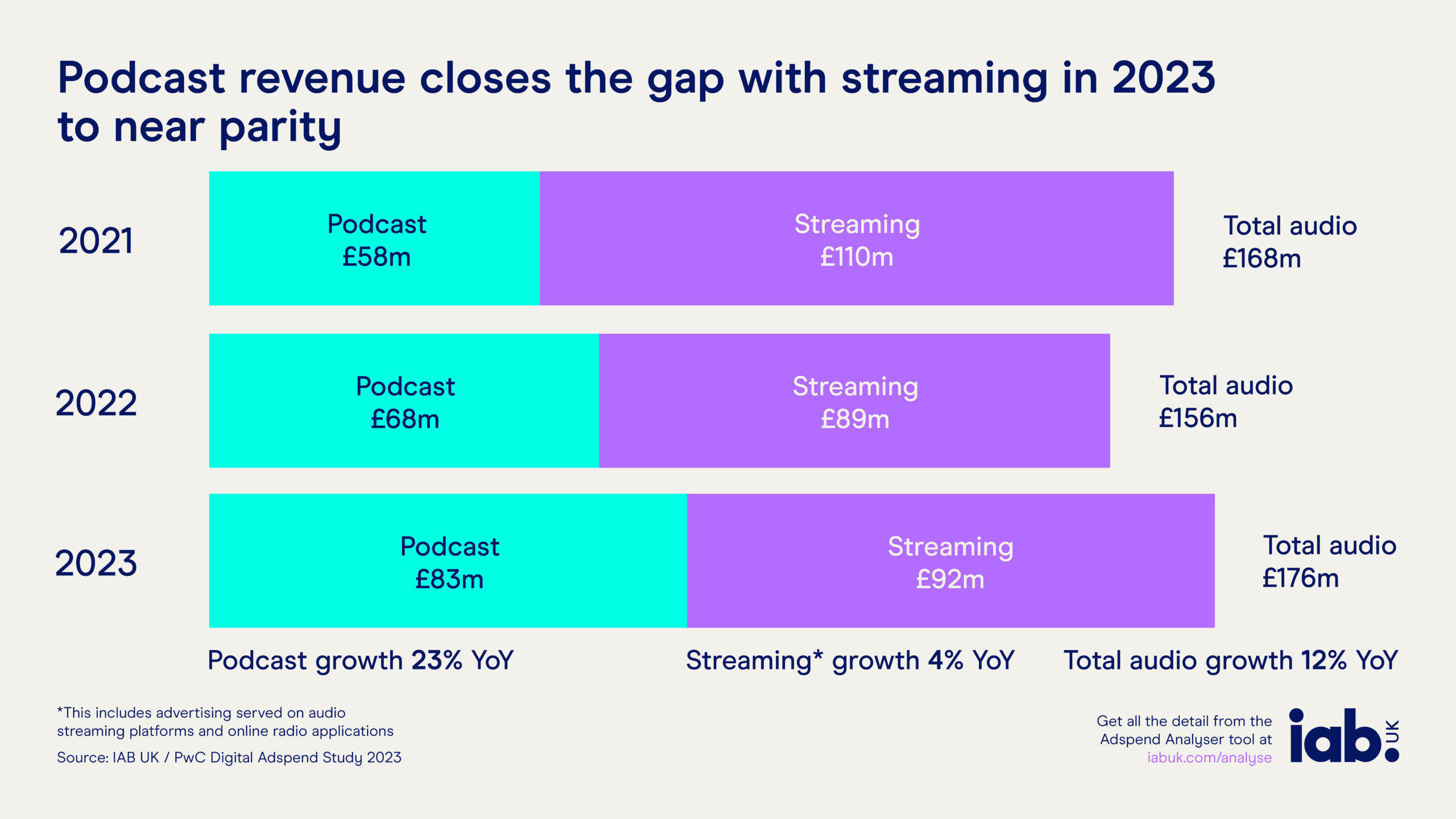

Podcasting in particular has overtaken spending on streaming audio, with annual spending at £83m compared to £92m.

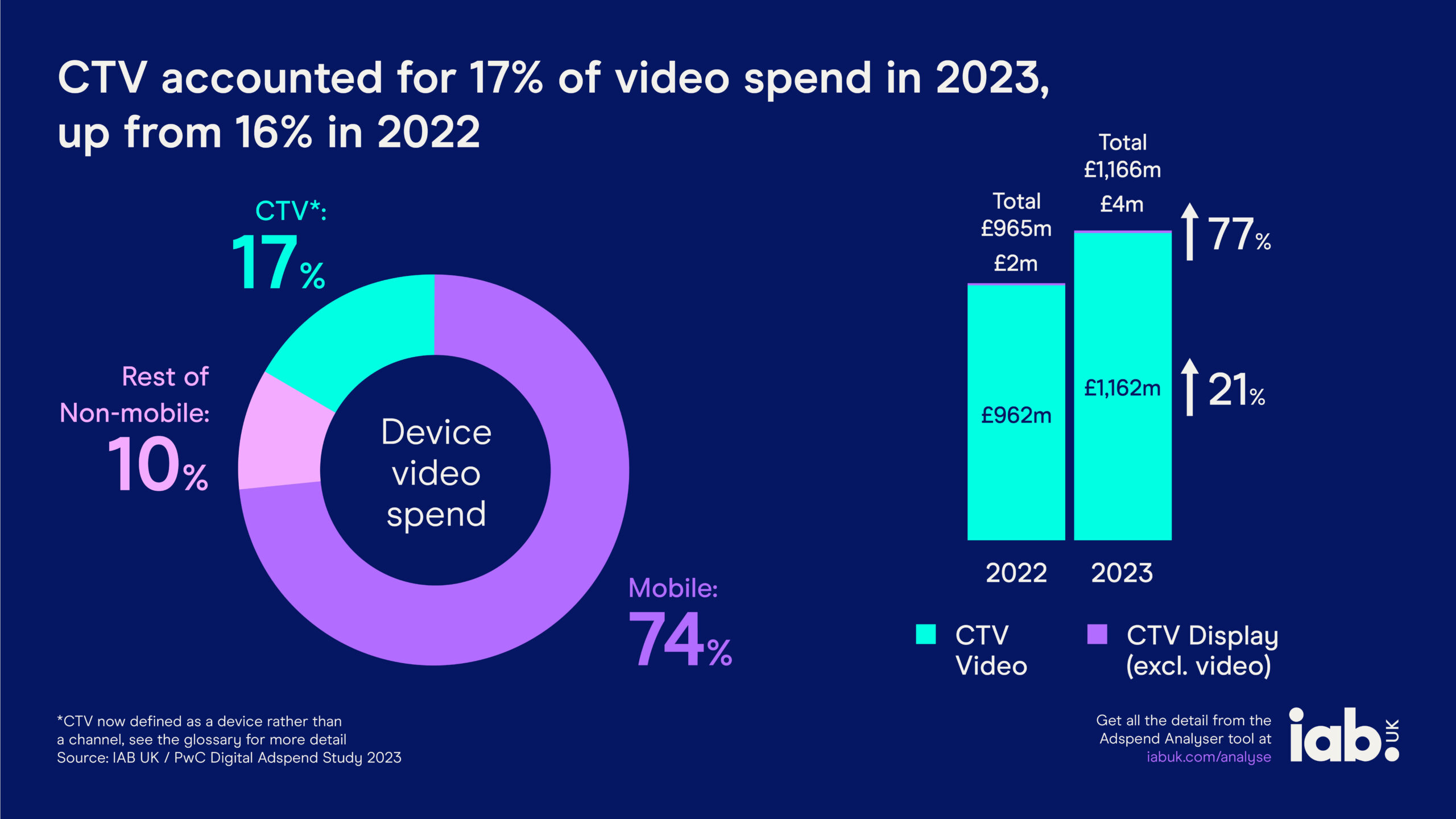

CTV accounted for 17% of video spend last year, second only to mobile advertising at 74%. Spending on CTV displays (excluding video) doubled to his £4m in 2023 compared to the previous year.

DOOH participates in research

Meanwhile, digital OOH spend is included in the report for the first time, with ad spend increasing by 12% to £841m in 2023.

Spend on digital retail media rose 12% to £283m, with retailers' wealth of first-party data a big draw for advertisers.

Following Apple's privacy changes, investment in mobile advertising will 'accelerate' from 4% growth in 2022 to 15% growth, reaching £16.7bn last year.

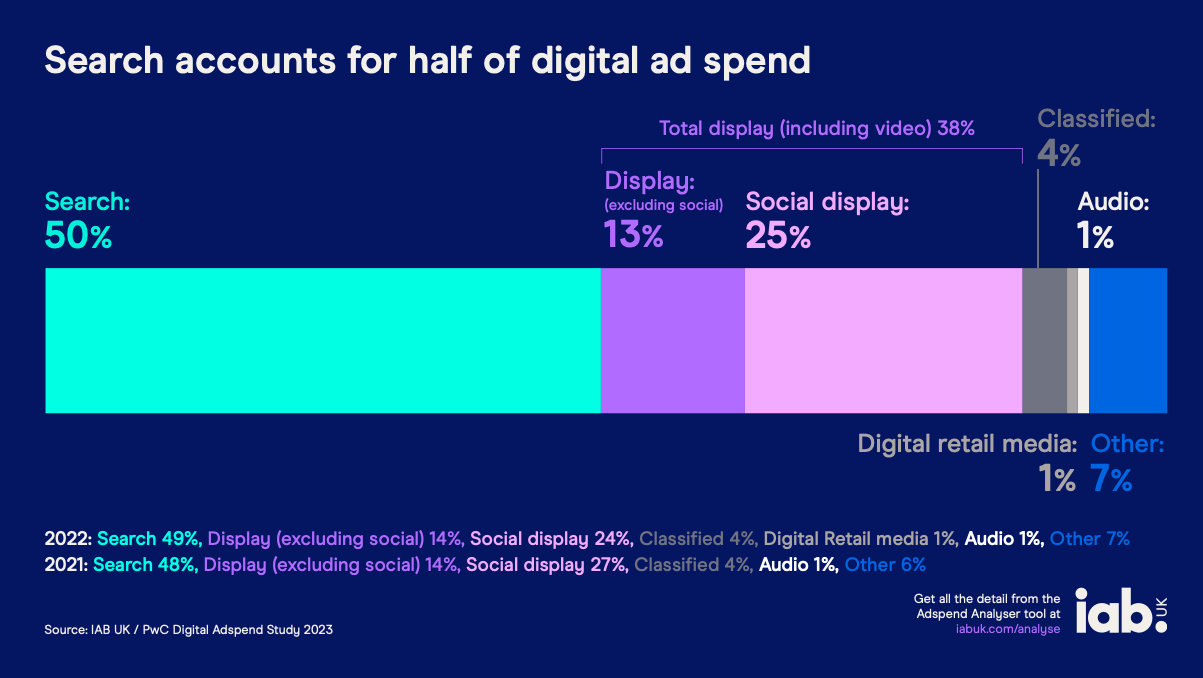

However, search continues to 'prop up' the market, accounting for half of digital ad spend last year at £14.7bn.

Display ad spend was driven by video, which rose 12% to £11.3bn and accounted for more than 60% of total display spend for the first time.

enthusiastic audience

James Chandler, chief marketing officer at IAB UK, said the latest results showed how advertisers were “embracing the variety of digital channels on offer”.

He added: “Media often referred to as 'emerging' are becoming increasingly established as ways to resonate with loyal audiences, such as the immersive nature of podcasts and CTV's high-impact prestige factor.

“With the impending retirement of third-party cookies, digital advertising is undergoing a transformation and we see the industry being reshaped in new ways over the next year. It's encouraging to see them increasing their investment in a wide range of online solutions.”

The IAB predicts that total digital ad spend will rise by 8.3% to £32bn in 2024.

Digital advertising spending 2023 This is based on both data submitted to the IAB and PwC, as well as modeled spending data for the digital advertising industry from January to December 2023.

In 2023, the IAB and PwC changed the definition of CTV from channels to devices, allowing all video and non-video (consisting of standard and other display formats) CTV advertising to be included in revenue figures.

Meanwhile, video measurements have been reclassified. Instead of instream and outstream, video ad spend now consists of broadcast VOD, social video, and online video (including outstream, publisher, and ad-supported VOD).

playout is Outsmart's new system that centralizes and standardizes playout reporting data for all outdoor media owners in the UK. space is a comprehensive industry inventory database provided through a collaboration between IPAO and Outsmart. RouteAPI is a SaaS solution that quickly and easily delivers industry audience data to client systems.

For more information about SPACE, J-ET, Audiotrack, or any of our data engines, please contact us.