Stock pickers are typically looking for stocks that outperform the overall market. Acquiring undervalued companies is one path to excess profits.For example, in the long run Amazon.com Inc. (NASDAQ:AMZN) shareholders have enjoyed an 83% share price increase over the past five years, which significantly outpaces the market return of approximately 66% (not including dividends).

Let's look at the underlying fundamentals over the long term and see if they are aligned with shareholder returns.

Check out our latest analysis for Amazon.com.

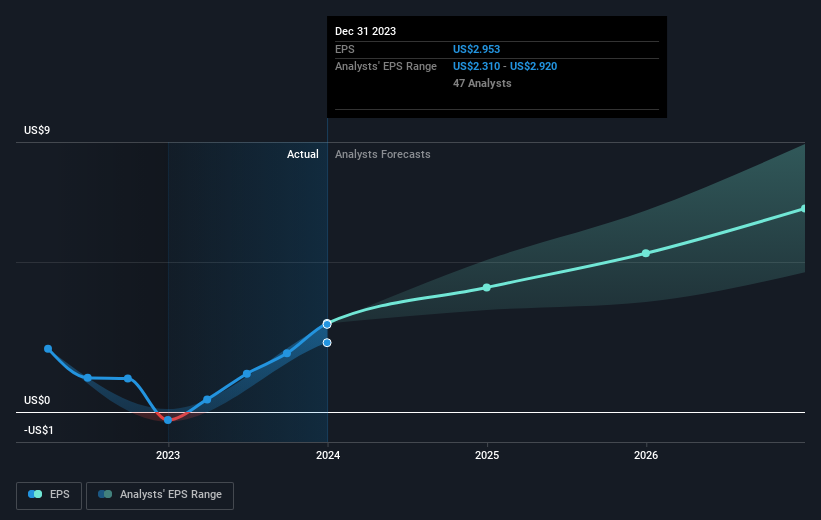

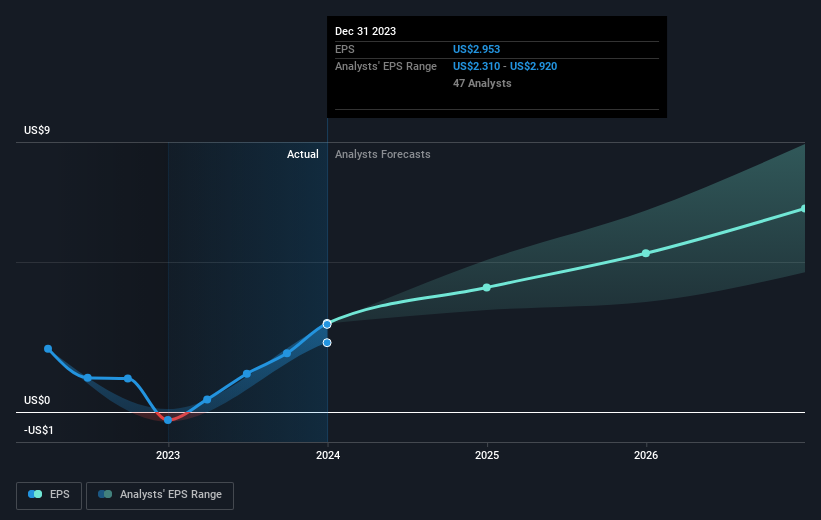

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of stock price growth, Amazon.com went from a loss to a profit. This is generally considered a positive, so we would expect the stock price to rise.

You can see below how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that CEO salaries are lower than the median for similarly sized companies. But while CEO pay is always worth checking, the really important question is whether the company can grow its earnings going forward.It might be well worth taking a look at ours free Amazon.com earnings, revenue, and cash flow reports.

different perspective

It's good to see that Amazon.com has returned a total return of 70% to shareholders over the last twelve months. This is better than the 13% annualized return over the past five years, suggesting that the company has performed well of late. In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. Before you spend more time on Amazon.com, it might be wise to click here to see if insiders have been buying or selling shares.

If you want to check out another company with potentially better financials, don't miss this free A list of companies that have proven they can grow revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.