Any stock business can lag the overall market, so it's always best to build a diversified stock portfolio. Of course, the goal of the game is to pick stocks that outperform index funds. GlaxoSmithKline Pharmaceuticals Limited (NSE:GLAXO) has performed well over the last year, with the share price up 52%, outpacing the market return of 47% (not including dividends). Shareholder performance has also been good over the long term, with him increasing by 40% over the past three years.

So let's do some research and see if the company's long-term performance is in line with the progress of its underlying business.

See our latest analysis for GlaxoSmithKline Pharmaceuticals.

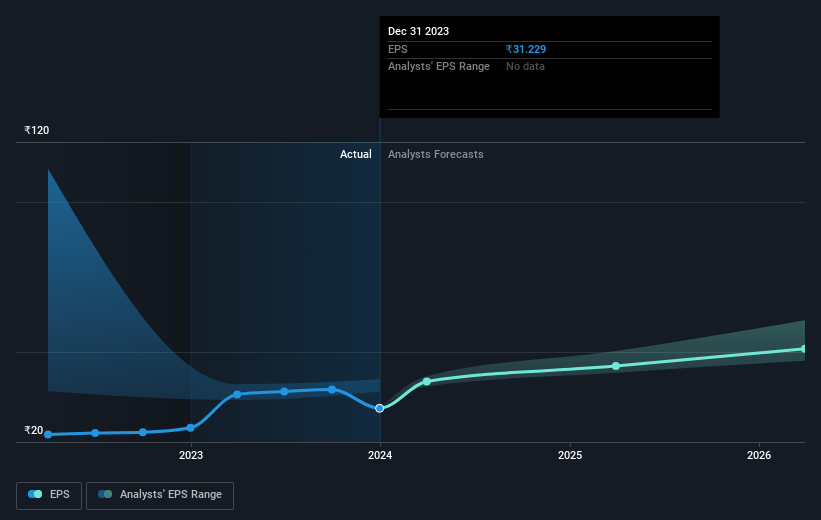

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

Over the last year, GlaxoSmithKline Pharmaceuticals grew its earnings per share (EPS) by 26%. This EPS growth is significantly lower than the 52% increase in the share price. So it's fair to think the market has a higher valuation for this business than it did a year ago. This positive sentiment is reflected in the company's (rather optimistic) P/E ratio of 62.89.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that GlaxoSmithKline Pharmaceuticals has improved its earnings lately, but will it grow? free A report showing analyst revenue forecasts can help determine whether EPS growth is sustainable.

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. Coincidentally, GlaxoSmithKline Pharmaceuticals' TSR over the past year was 56%, which is better than the share price return mentioned above. And there's no kudos to speculating that dividend payments are the main explanation for the divergence.

different perspective

It's good to see that GlaxoSmithKline Pharmaceuticals shareholders received a total shareholder return of 56% over the last year. And this includes dividends. This is better than the 12% annualized return over the past five years, suggesting that the company has performed well of late. Optimists might think that the recent improvement in TSR indicates that the business itself is improving over time. It's always interesting to track stock performance over the long term. However, to understand GlaxoSmithKline Pharmaceuticals better, you need to consider many other factors. For example, consider the ever-present fear of investment risk. We've identified 1 warning sign If you are considering partnering with GlaxoSmithKline Pharmaceuticals, understanding them should be part of your investment process.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we help make it simple.

Please check it out GlaxoSmithKline Pharmaceuticals Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.