The easiest way to invest in stocks is to buy exchange traded funds. However, investors can increase their returns by choosing and owning stocks in companies that are outperforming the market. Hongryong Industries Berhad (KLSE:HLIND)'s share price is up 22% from a year ago, significantly better than the market return of around 9.9% (not including dividends) over the same period. If it can sustain that outperformance over time, investors will do very well. However, the stock hasn't fared so well in the long run, with the stock only up 16% in three years.

Let's look at the underlying fundamentals over the long term and see if they are aligned with shareholder returns.

Check out our latest analysis for Hon Leong Industries Berhad.

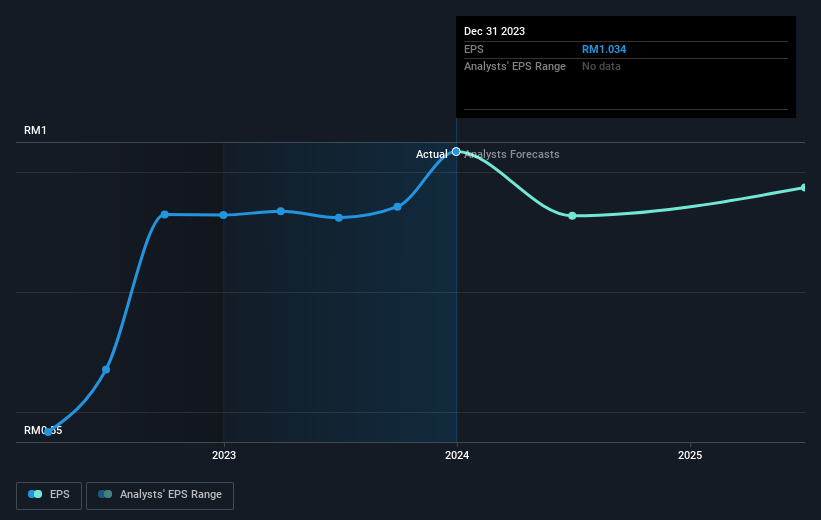

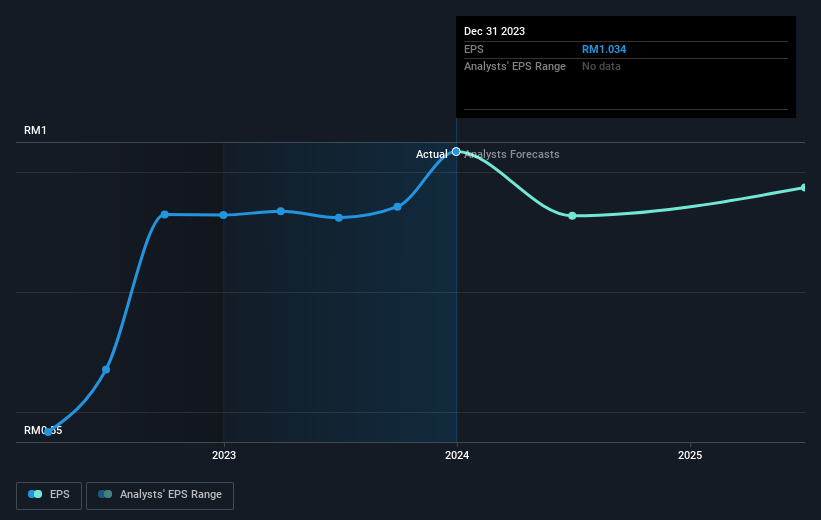

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Hon Leong Industries Berhad was able to grow its EPS by 11% in the last twelve months. The 22% share price increase certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

We know that Hong Leong Industries Berhad's earnings have been improving lately, but will its earnings grow? If you're curious, check out this free A report showing consensus revenue forecasts.

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. For Hon Leong Industries Berhad, the TSR for the last year was 36%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

It's good to see that Hongryong Industries Berhad shareholders received a total shareholder return of 36% last year. And this includes dividends. This is better than the 7% annualized return over the past five years, suggesting that the company has performed well of late. In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. It's always interesting to track stock performance over the long term. But to understand Hong Leong Industries Berhad better, you need to consider many other factors.For example, take risks – Hon Leong Industries Berhad two warning signs (and #1 is a little off-putting) but I think you should know.

We would like Hong Leong Industries Berhad even more if we see some significant insider buying.While you wait, check this out free A list of growing companies with significant recent insider purchasing.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.