By purchasing an index fund, you can easily match market returns closely. However, if you buy quality companies at attractive prices, your portfolio's returns can exceed the average market return.Please take a look Perdoceo Educational Corporation (NASDAQ:PRDO) is up 42% in three years, well above the market return of 19% (not including dividends).

With that in mind, it's worth checking whether a company's underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Perdoceo Education.

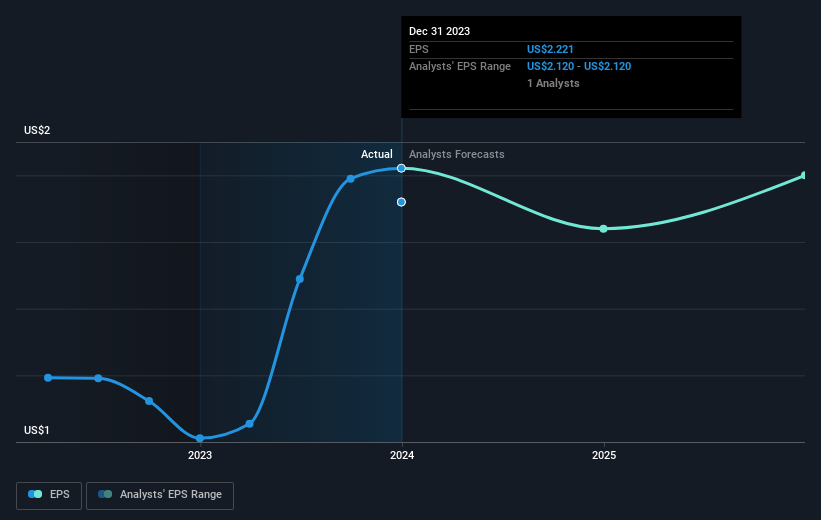

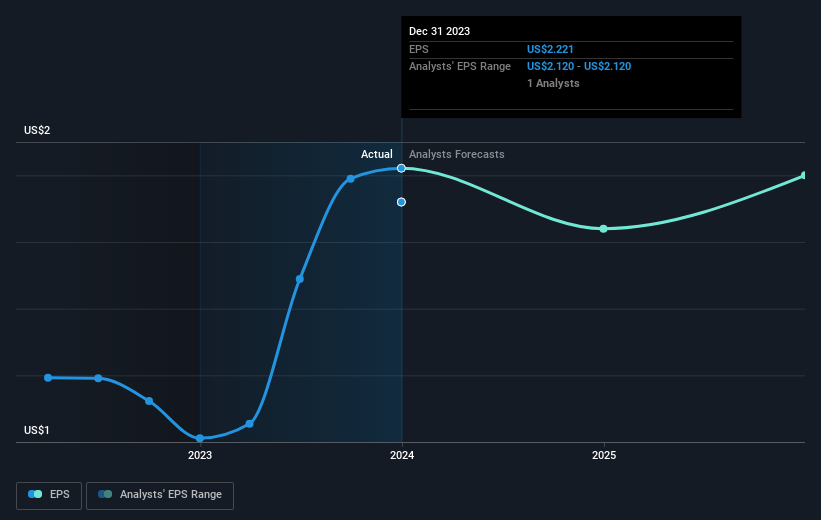

In Buffett's words, “Ships will sail around the world, but a flat-Earth society will thrive.'' There will continue to be a wide discrepancy between prices and market values. ..'' By comparing earnings per share (EPS) and share price changes over time, we can see how investor attitudes to a company have changed over time.

Perdoceo Education was able to grow its EPS by 7.9% per year over three years, driving the share price higher. This EPS growth rate is lower than the average annual increase in the share price of 12%. So it's fair to think the market has a higher valuation for this business than it did three years ago. It's common for investors to become enamored with a business after several years of steady progress.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

We know that Perdoceo Education has been improving its earnings lately, but will its earnings grow? If you're interested, you might want to check this out free A report showing consensus revenue forecasts.

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. Coincidentally, Perdoceo Education's TSR over the last three years was 45%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

It's good to see that Perdoceo Education shareholders received a total shareholder return of 41% over the last year. And this includes dividends. The 1-year TSR is better than his 5-year TSR (the latter at 2% per annum), so it looks like the stock has been performing better recently. In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. It's always interesting to track stock performance over the long term. However, to better understand perdoseo education, many other factors need to be considered. For example, we identified 2 warning signs for Perdoceo Education What you need to know.

of course Perdoceo Education may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.