When you buy stock in a company, there is always a risk that the price will go to zero. However, if you choose a company that is truly prosperous, make over 100. for example, Regis Healthcare Limited (ASX:REG) share price has returned 106% in just one year. On top of that, the stock is up 23% in about a quarter. Looking back even further, the stock is up 97% from where he was three years ago.

Let's look at the underlying fundamentals over the long term and see if they are aligned with shareholder returns.

Check out our latest analysis for Regis Healthcare.

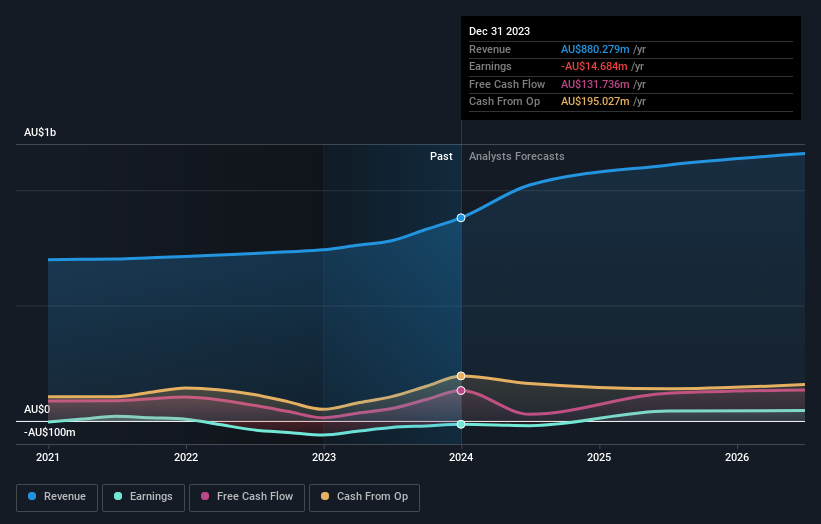

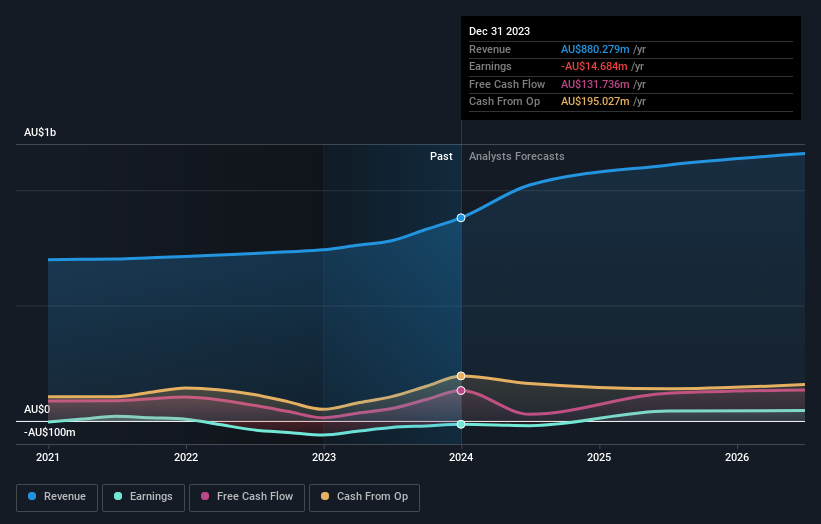

Regis Healthcare made a loss in the last twelve months, so we think the market is probably more focused on revenue and revenue growth, at least for now. Shareholders of unprofitable companies typically want strong earnings growth. It's hard to be confident that a company is sustainable when its revenue growth is modest and it doesn't make any profits.

Regis Healthcare's revenue grew 19% last year. This is a pretty impressive growth rate. Revenue growth has been decent, but the stock price has been even better, rising 106%. Given the business's good progress on the top line, it's worth considering its path to profitability. But investors need to be aware of how fear of missing out can influence them to buy without thorough research.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

this free This interactive report on Regis Healthcare's balance sheet strength is a great starting point, if you want to investigate the stock further.

What will happen to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that Regis Healthcare's TSR over the past year was 116%, which is better than the share price return mentioned above. And there's no kudos to speculating that dividend payments are the main explanation for the divergence.

different perspective

It's good to see that Regis Healthcare delivered shareholder returns of 116% over the last twelve months. And this includes dividends. The stock appears to have performed better of late, as the 1-year TSR is better than his 5-year TSR (the latter at 7% per annum). Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don't miss out. Before investing more time in Regis Healthcare, it might be wise to click here to see if insiders have been buying or selling shares.

If you're like me, you will. do not have I want to miss this free A list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.