When buying shares in a company, it's worth bearing in mind that the company could fail and you could lose money. But on the bright side, you can earn well over 100% on really good stocks. One great example is Summit Materials Co., Ltd. (NYSE:SUM) stock is up 195% in five years. It's also good to see the stock price up 16% quarter-over-quarter. However, this move may have been driven by moderate market activity (up 9.4% in 90 days).

Let's look at the underlying fundamentals over the long term and see if they are aligned with shareholder returns.

Check out our latest analysis for Summit Materials.

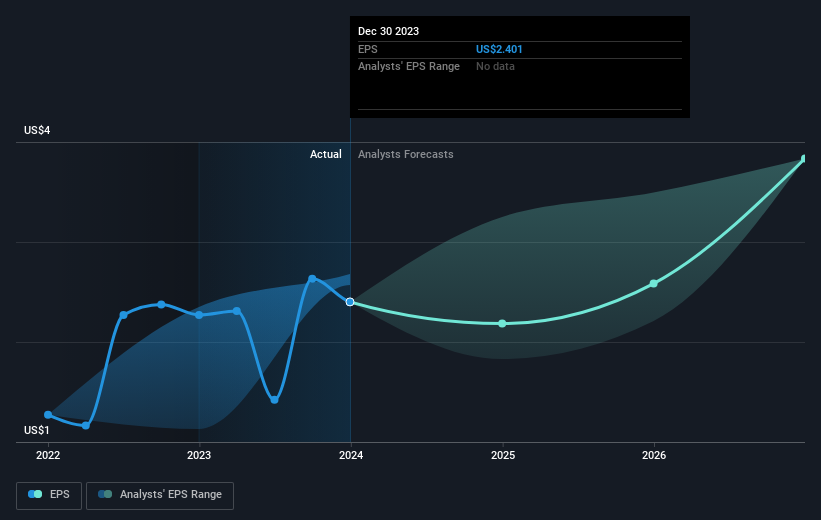

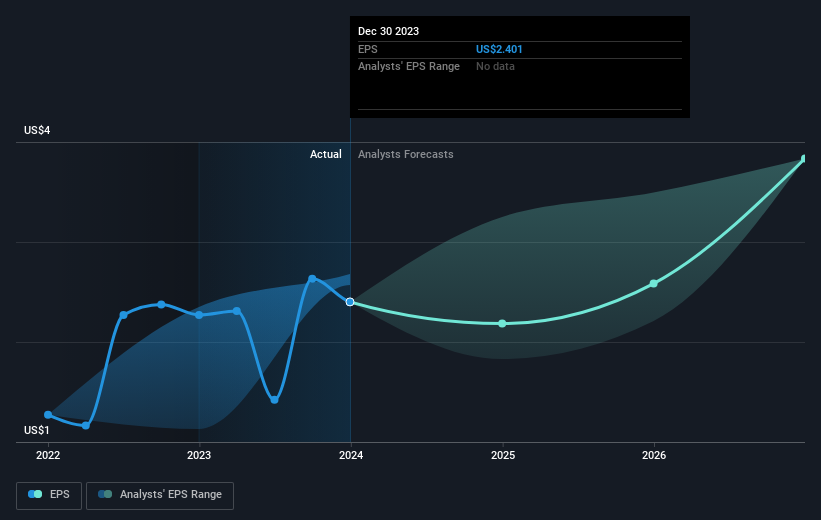

Markets are powerful pricing mechanisms, but stock prices reflect not only underlying business performance but also investor sentiment. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

During the five-year period of share price growth, Summit Materials achieved compound earnings per share (EPS) growth of 41% per year. The EPS growth is more impressive than the 24% annual share price increase over the same period. Therefore, the market seems to have a relatively pessimistic view of the company.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

this free This interactive report on Summit Materials' earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

different perspective

We're pleased to report that Summit Materials shareholders received a total shareholder return of 56% over the year. The stock appears to have performed better of late, as the 1-year TSR is better than his 5-year TSR (the latter at 24% per annum). In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. It's always interesting to track stock performance over the long term. However, to better understand the summit materials, many other factors need to be considered. for that purpose, 3 warning signs We found in the summit materials (including one concern).

We would further like Summit Materials if we see some significant insider buying.While you wait, check this out free A list of growing companies with significant recent insider purchasing.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and the articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.