If you want to find stocks with long-term growth potential, what underlying trends should you look for? One common approach is to look for companies that: Return value Capital employed increasing with growth (ROCE) amount of capital employed. This shows that it is a compounding machine and the earnings can be continuously reinvested into the business to generate higher profits.But after a quick look at the numbers, we don't think so. Choose a water solution (NYSE:WTTR) has the potential to become a multibagger in the future, but let's take a look at why.

What is return on capital employed (ROCE)?

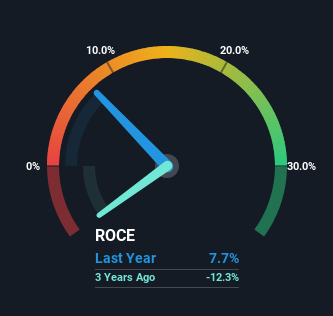

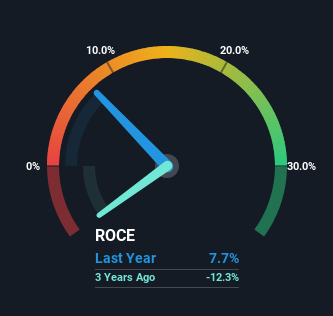

For those who aren't sure what ROCE is, it measures the amount of pre-tax profit a company can generate from the capital employed in its business. To calculate this metric for Select Water Solutions, use the following formula:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.077 = USD 77 million ÷ (USD 1.2 billion – USD 212 million) (Based on the previous 12 months to December 2023).

therefore, Select Water Solutions' ROCE is 7.7%. After all, this is a poor return, below the energy services industry average of 12%.

Check out our latest analysis for Select Water Solutions.

Above you can see how Select Water Solutions' current ROCE compares to its previous return on capital, but history can only tell us so much. If you're interested, take a look at our analyst forecasts. free Select Water Solutions Analyst Report.

So, how is Select Water Solutions' ROCE trending?

Over the past five years, Select Water Solutions's ROCE and capital employed have both been roughly flat. It's not uncommon to see this when you look at mature, stable companies that are likely past that stage of the business cycle and are not reinvesting their earnings. With that in mind, we don't expect Select Water Solutions to become a multibagger in the future unless investment accelerates again in the future.

The conclusion is…

In a nutshell, Select Water Solutions has been plodding along for the past five years, making the same return on the same amount of capital. And over the past five years, the stock has given up 16%, so the market doesn't expect these trends to strengthen any time soon. So, based on the analysis conducted in this article, we don't think Select Water Solutions has the makings of a multibagger.

On another note, we discovered that 3 warning signs for Select Water Solutions You probably want to know.

For those who like investing, solid company, check this out free List of companies with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.