What trends should you look for to identify stocks that have the potential to increase in value over the long term? In an ideal world, companies would invest more capital in their businesses; It is hoped that the return on that capital will also increase. If you see this, it usually means the company has a good business model and plenty of opportunities for profitable reinvestment.With that in mind, the ROCE churchill china (LON:CHH) looks decent at the moment. So let's take a look at what the earnings trend can tell us.

About Return on Capital Employed (ROCE)

In case you aren't familiar, ROCE is a metric that measures how much pre-tax profit (as a percentage) a company earns on the capital invested in its business. This formula for Churchill China is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

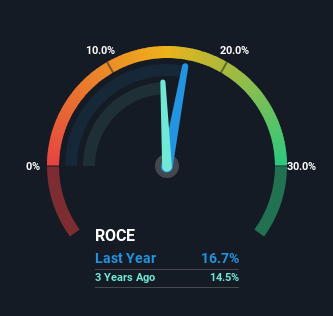

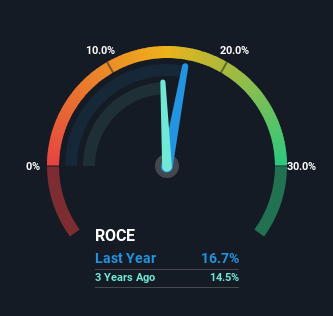

0.17 = 11 million British pounds ÷ (75 million British pounds – 12 million British pounds) (Based on the previous 12 months to June 2023).

therefore, Churchill China's ROCE is 17%. While this is a standard return in itself, it is much better than the 9.3% produced by the consumer durables industry.

Check out our latest analysis for Churchill China.

Above, we show how Churchill China's current ROCE compares to its previous return on equity, but history can only tell us so much. If you wish, check out what the analysts covering Churchill China are forecasting. free.

What are the return trends like?

Current return on capital is decent, but hasn't changed much. The company has invested 56% more capital in the past five years, and its return on capital has remained stable at 17%. 17% is a fairly standard return, and there's some comfort in knowing that Churchill China consistently earns this amount. Over the long term, such returns may not be as attractive, but if they are consistent, they can pay off in terms of stock returns.

What we can learn from Churchill China's ROCE

The main thing to remember is that Churchill China has demonstrated the ability to continually reinvest at a substantial rate of return. But the stock has fallen 24% over the past five years, so this decline could be a breakthrough. As such, we think this stock is worth further consideration given its attractive fundamentals.

In the end, we found that Churchill 3 warning signs for China Note (1 is a concern).

Churchill China may not be the most profitable company right now, but we've compiled a list of companies that are currently generating a return on equity of 25% or higher.check this out free I'll list them here.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.