Investors are betting bullish on the asset ahead of the fourth Bitcoin halving on April 19, a quadrennial event in which the amount of new Bitcoin issued by the network falls by 50%. It's doubling. literally.

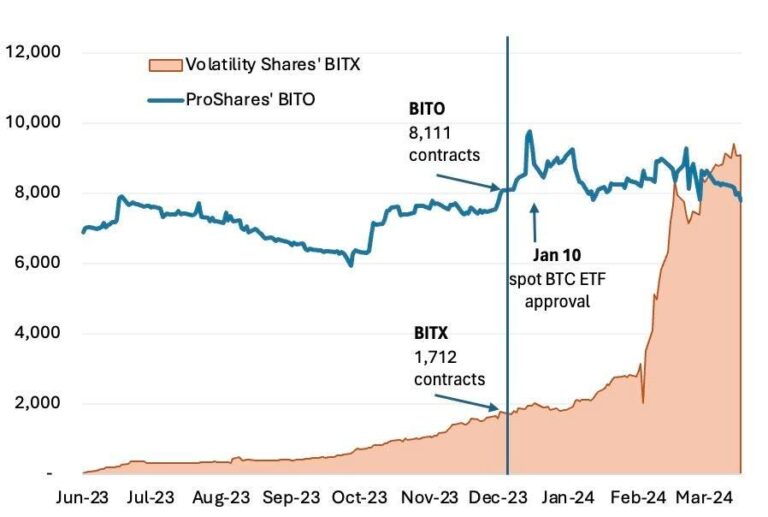

2X Bitcoin Strategy ETF (BITX), offered by Palm Beach Gardens, Florida-based Volatility Shares, is an exchange-traded fund (ETF) issue focused on leveraged and inverse ETFs founded in 2019. company, which has skyrocketed to its highest level in recent weeks. Holders of Bitcoin futures contracts on the Chicago Mercantile Exchange (CME). The firm surpassed this threshold for the first time on April 1st, and as of April 12th had 9,103 contracts worth $3.1 billion (although its reported assets under management were $1.5 billion due to additional leverage). nothing more than dollars). This leapfrogged long-time industry leader ProShares Bitcoin Strategy ETF (BITO), which has 7,536 contracts and $1.8 billion in total cash.

The BITX ETF has produced a 255% return since its inception in June 2023 through April 12th, and 135% in Q1 2024, on target, double the return of the Spot Bitcoin ETF over the same period. In terms of Bitcoin exposure, AUM ranks behind Grayscale (GBTC – $21 billion), BlackRock (IBIT – $18 billion), Fidelity (FBTC – $10.7 billion), and ArkInvest (ARKB – $3.1 billion). , the seventh largest U.S. Bitcoin ETF in existence. , Bitwise (BITB – $2.2 billion), ProShares (BITO – $1.8 billion).

Bitcoin Futures ETF Titans Holding BTC futures contracts

CME Bitcoin futures contracts held by ProShares’ BITO ETF and Volatility Shares’ BITX ETF

Source: Data from Forbes, Volatility Shares, ProShares

The growing popularity of this new ETF is due to the fact that, since February, it has used financial leverage to create long Bitcoin futures contracts held by asset managers and short Bitcoin futures contracts held by companies within a regulated futures exchange operated by CME. explains much of the 58% increase in Leveraged companies typically use the short side of futures contracts as a hedge for their other long positions. This surge in activity has once again made CME the world's largest crypto derivatives exchange. The total 19,000 Bitcoin futures contracts held are worth $6.8 billion.

Bitcoin Futures Growth, 2020-2024 Bitcoin futures contracts with open interest by type of market participant

Bitcoin futures contracts held in open interest by a group of market participants.

Source: Forbes, data from CFTC

How do products like BITX and BITO operate compared to spot ETFs offered by BlackRock (IBIT) and Fidelity (FBTC), which have collectively generated more than $28 billion in revenue since their launch on January 11, 2024? are different. The latter products, on the other hand, are purchased directly. BITX and BITO have bundled cash-settled futures contracts on CME, backing their stock prices with Bitcoin in the spot market. BITO is designed to mimic the spot price of Bitcoin, while leveraged products like BITX use debt to make even bigger bets on the price of Bitcoin, resulting in double his profits on Bitcoin. will be achieved. Returns can be impressive during bull periods, as evidenced by his 135% growth in BITX in the first quarter.

The opposite is also true when reversing. Losses can double, and short-term market corrections can quickly destroy market positions. Therefore, these high-risk products are aimed at sophisticated investors who plan to monitor their holdings on a daily basis. On April 12th, a flash crash of multiple crypto assets caused the price of Bitcoin to drop by 9% in a few hours. This decline equates to a loss of almost 20% for BITX holders.

forbes reported on the rise of these new crypto ETFs in a February 2024 article that examined the need for futures ETFs that track the spot price of Bitcoin. Prior to the launch of spot ETFs, BITO was the clear market leader. It brought in more than $1 billion on the first day of trading in October 2021, setting a record for the entire ETF industry. In the run-up to Bitcoin's halving, its assets under management soared to over $2 billion. But in a world of low-cost spot ETFs, higher expense ratios and the hidden costs of repeatedly purchasing more expensive monthly commitments can be harder to swallow.

The report concluded with the belief that while BITO could retain 75-80% of its then-current assets under management, it would face difficulties raising new funding for the product. . It also notes how ProShares is preparing to launch a series of leveraged and inverse ETFs to attract investors with higher risk tolerances, one of which will be launched this month. The ProShares Ultra Bitcoin ETF was launched and has a total of $73 million in assets under management.

That's exactly the wave that allowed BITX to ride the futures ETF pole position.

There is reason to expect this trend to continue for the most part after the halving, even if volatile assets continue to experience sudden and wild swings in both directions. First of all, halvings have historically been very bullish for the price of Bitcoin. Bitcoin skyrocketed from around $650 during the 2016 halving to around $20,000 by the end of 2017. Similarly, the asset traded at around $8,800 before the 2020 halving before reaching a then-high price of nearly $69,000 in November 2021.

Although past performance is no guarantee of future results, the surge in demand for spot Bitcoin ETFs, which is nearly three times the total amount produced by the network each day, shows no signs of slowing down either. This ratio will be even higher if Bitcoin issuance decreases from 900 units to 450 units. In such cases, revenues from these products could be even greater than the first quarter results in the coming years.

This may not mean that AUM for BITX and similar products will continue to grow at the same pace. Investors should exercise extreme caution as these products have very high risk characteristics.