David Eben put it well: “Volatility is not a risk we care about.” Our focus is to avoid permanent loss of capital. ” When we think about a company's risk, we always look at its use of debt. Because too much debt can lead to ruin. Points to keep in mind are: Insulet Co., Ltd. (NASDAQ:PODD) has debt on its balance sheet. But is this debt a concern for shareholders?

What risks does debt pose?

Generally, debt only becomes a real problem when a company cannot easily pay off the debt, either by raising capital or with its own cash flow. In the worst case scenario, a company may go bankrupt if it is unable to pay its creditors. But a more frequent (but still costly) occurrence is when a company must issue stock at a bargain price, permanently diluting shareholders, just to shore up its balance sheet. The advantage of debt, of course, is that it is often cheap capital, especially when it replaces dilution in a company that can be reinvested at a high rate of return. The first thing to do when considering how much debt a company uses is to look at its cash and debt together.

Check out our latest analysis for Insulet.

What is Insulet's net debt?

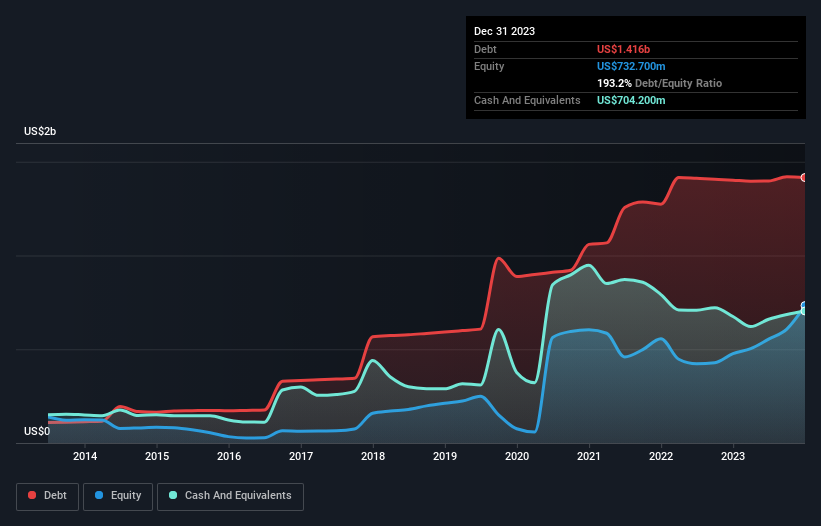

The graph below, which you can click on for greater detail, shows that Insulet had debt of US$1.42b in December 2023. Almost the same as last year. However, he also had US$704.2m in cash, so his net debt is US$711.6m.

How strong is Insulet's balance sheet?

Zooming in on the latest balance sheet data, we can see that Insulet had liabilities of US$451.2m due within 12 months, and liabilities of US$1.4b due beyond that. Offsetting this, it had cash of US$704.2m and his receivables of US$359.7m due within 12 months. So its liabilities outweigh the sum of its cash and (short-term) receivables by US$791.6m.

The listed Insulet shares have a total value of a very impressive US$11.6b, so this level of debt is unlikely to pose much of a threat. Having said that, it's clear that we need to continue to monitor the balance sheet to make sure it doesn't take a turn for the worse.

We look at net debt divided by earnings before interest, tax, depreciation and amortization (EBITDA) and calculate how easily a company's earnings before interest, tax, depreciation and amortization (EBITDA) cover its interest. Measure a company's debt load. Expenses (interest burden). Therefore, we consider debt relative to earnings, with or without depreciation.

Insulet's net debt to EBITDA ratio is around 2.3, suggesting a moderate use of debt. Additionally, EBIT is an overwhelming 31.0 times interest expense, meaning that the company's debt burden is as light as a peacock's feather. Pleasingly, Insulet has been growing its EBIT faster than former Australian Prime Minister Bob Hawke took down his garden glass, boasting a 147% increase in the last 12 months. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, Insulet's ability to strengthen its balance sheet over the long term will depend on the future profitability of its business. So if you want to see what the experts think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while tax preparers may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is converted into free cash flow. Over the past three years, Insulet has burnt through a significant amount of cash. While investors are no doubt hoping that this situation will eventually reverse, this clearly means that the use of debt is riskier.

our view

Insulet's interest charges suggest that Cristiano Ronaldo could manage his debts as easily as scoring goals against under-14 goalkeepers. However, we must admit that converting EBIT to free cash flow is counterproductive. It's also worth noting that companies in the medical devices industry, like Insulet, typically have no problem using debt. Taking all of the aforementioned factors together, we find that Insulet can handle its debt fairly comfortably. Of course, this leverage can improve return on equity, but it also brings more risk, so it's worth noting this. There's no question that we learn most about debt from the balance sheet. Ultimately, however, any company can contain risks that exist outside the balance sheet.Case in point: we discovered 1 warning sign for insulators you should know.

After all, it may be easier to focus on companies that don't even need to take on debt.Readers can access a list of growth stocks with zero net debt completely freeright now.

Valuation is complex, but we help make it simple.

Please check it out Insulet Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.