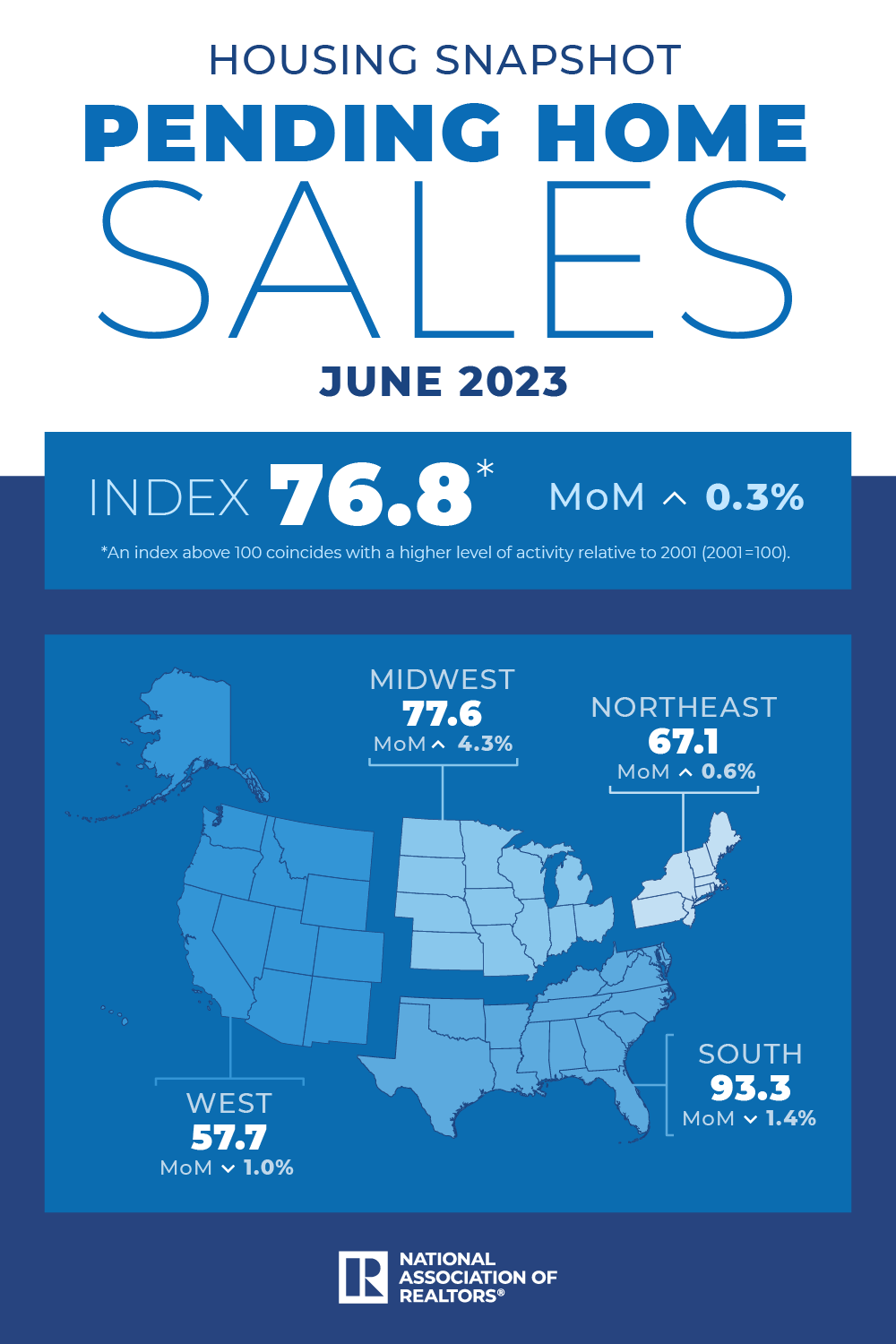

The number of pending home sales increased slightly in June, the latest indicators that the housing market is on the mend. The median existing home sales price rose to the second highest in 20 years in June, with more buyers once again facing multiple offer situations, according to the latest report from the National Association of Realtors® Became. NAR's Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, rose 0.3% in June, the first increase in four months.

“While the recovery is still far from over, the housing recession is over,” said Lawrence Yun, NAR's chief economist. “The existence of multiple offers means that demand for housing is not being met due to a lack of supply. Home builders are expanding production and hiring workers.”

Housing inventory remains at historic lows, down 13.6% from even last year's lows. “There is simply not enough homes for sale,” Yun said in a recent report. According to NAR data, 76% of existing homes sold in June were on the market for less than a month.

Homebuyers have limited options and face rising home prices and rising mortgage rates. But there may be some relief soon. Mortgage rate hikes may be almost over, which should bode well for home purchases, Yun said.

“The consumer price inflation rate has settled down close to the Federal Reserve's desired conditions, and mortgage interest rates appear to have peaked,” Yun said. “Given continued employment growth, a significant drop in mortgage rates could lead to a flood of buyers at the end of the year and into next year.”

NAR projects that 30-year fixed-rate mortgages could reach 6.4% by the end of the year and 6% in 2024. Mortgage rates have been nearing 7% in recent weeks, a far cry from the ultra-low 2%. A little more than a year ago, the average was 3%.

Home sales outlook

NAR has released its latest forecasts for what it believes will be the market's trajectory over the coming months.

- Used home sales: NAR projects existing home sales will decline 12.9% in 2023 compared to 2022, but increase 15.5% in 2024.

- price: The national median existing home price is expected to remain roughly flat, likely ending this year down just 0.4% from 2022, reaching $384,900 in 2023. After that, NAR predicts home prices will rise 2.6% to $395,000 in 2024. The West, the most expensive region of the country, is likely to see further price reductions, while more affordable regions such as the Midwest are expected to see modest price increases, the NAR report said.

- New home sales: New home sales are expected to be a bright spot for home sales as more buyers seek more inventory options. NAR forecasts that new home sales are expected to increase by 12.3% in 2023 and further increase by 13.9% in 2024. The national median new home price is expected to fall 1.9% to $449,100 this year, but rise 4.2% to $468,000 next year.

- Housing construction: Economists are calling for the new housing market to make up for the lack of supply in the real estate market. However, NAR projects that housing starts in 2023 will be 5.2% lower than in 2022 (1.47 million units). However, the number of housing starts is expected to increase by 5.4% to 1.55 million in 2024.

“It is important to expand supply as much as possible to expand access to homebuying for more Americans,” Yun said. “Housing prices are affected by how much inventory enters the market. Increased home construction suppresses price increases, but when construction is restricted, home price increases outpace income growth.” It will happen.”

Regional breakdown of contracts concluded

Meanwhile, the latest housing market conditions show the market has slowed significantly compared to last year's brisk pace due to the pandemic. Overall, pending home sales in June were down 15.6% from a year earlier, according to NAR data. However, market performance varied by region. Month-over-month, contract signings increased in the Northeast and Midwest, but decreased in the South and West. Despite this, transaction value in all four major U.S. regions declined in June compared to the same month last year.