February is Black History Month, a time to celebrate the accomplishments and honor the struggles of Black Americans in this country. Homeownership is one area where Black people are making progress, but they still grapple with things like valuation bias and exclusionary housing practices. The 2023 State of America's Black Housing Report, released by the National Association of Real Estate Brokers (NAREB), highlights these and other factors that impact Black homeownership. Here are the highlights.

Black homeownership rates face challenges due to income and wealth.

Inventory shortages, high home prices and mortgage rates have plagued the housing market for the past two years, with most Americans needing an income of $115,000 to buy a median-priced home. The median household income for Black households is $52,860, which will put homebuying out of reach for many. Black households also have a lower median net worth at $24,520, one-tenth that of white households. The combination of these factors resulted in little improvement in the homeownership rate, which stood at 45.9% in Q4 2023, an increase of only 2.7% over the past decade.

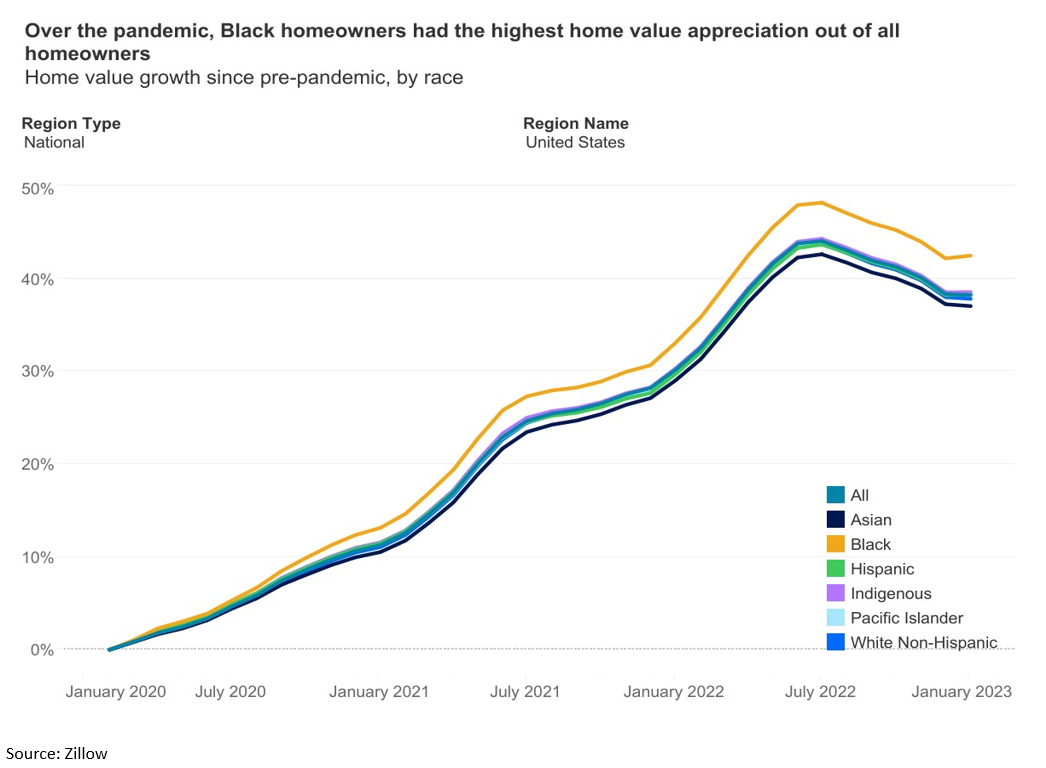

Although home values have increased, inequality remains.

From January 2020 to 2023, Black home values rose 42.5%, the fastest growth of all races and ethnicities. While it's encouraging to see that 66% of Black households' median net worth comes from home equity, there are still significant disparities when it comes to Black neighborhoods. The report found that homes in majority-black neighborhoods had appraised values 21 to 23 percent lower than homes in non-black neighborhoods. These homes are also 1.9 times more likely to be appraised at contract price than homes in majority-white neighborhoods.

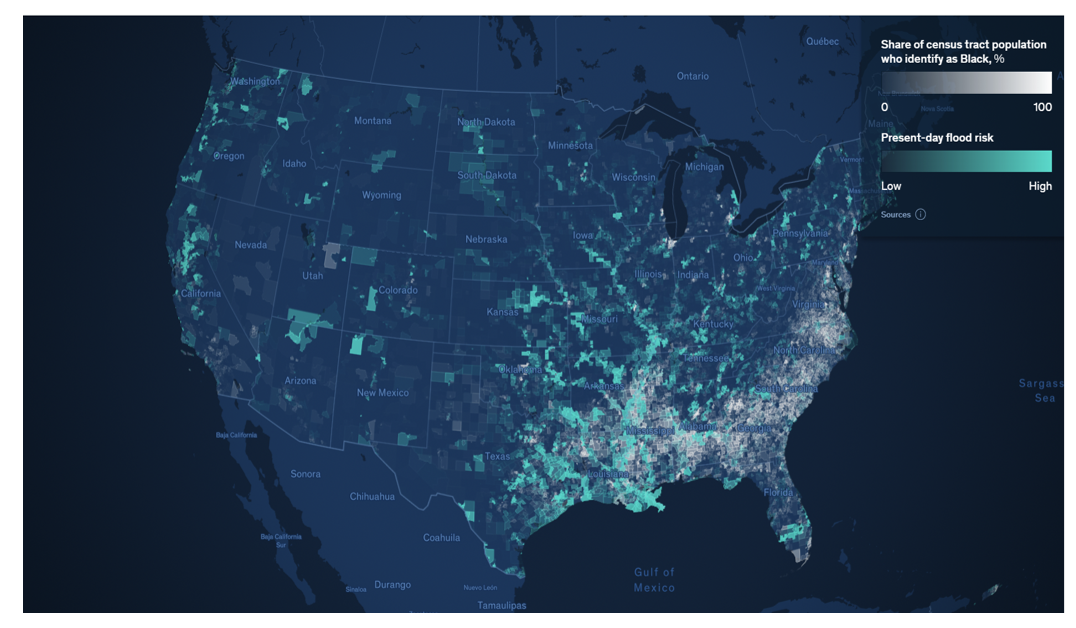

Climate change will have a major impact on black neighborhoods.

Extreme weather events have a huge impact on the world, and communities of color are disproportionately affected. According to the report, 19% of the Black population lives in areas at high risk of hurricanes and flooding, and 33% live in areas exposed to heat waves. Prejudicial practices such as redlining and racial discrimination contribute to black families living in areas with little vegetation or in older homes unequipped to deal with damage from natural disasters. Climate-induced factors such as property damage, health risks, and higher insurance premiums will only exacerbate the racial inequities these communities already experience.

Source: McKinsey Institute for Black Economic Mobility

They have high credit scores and limited access to conventional financing.

The median credit score for Black borrowers in 2022 was 695, which is still 56 points lower than the credit score for white borrowers. Limited access to credit, a lack of intergenerational wealth, and a long history of discriminatory lending practices have contributed to low credit scores, or lack of credit history, known as credit invisibility . As a result, his 40% of black consumers now have access to subprime loans, which tend to have higher interest rates than prime loans. Despite having a checking or savings account, black households are 25% more likely to use alternative services such as payday loans, making them underbanked.

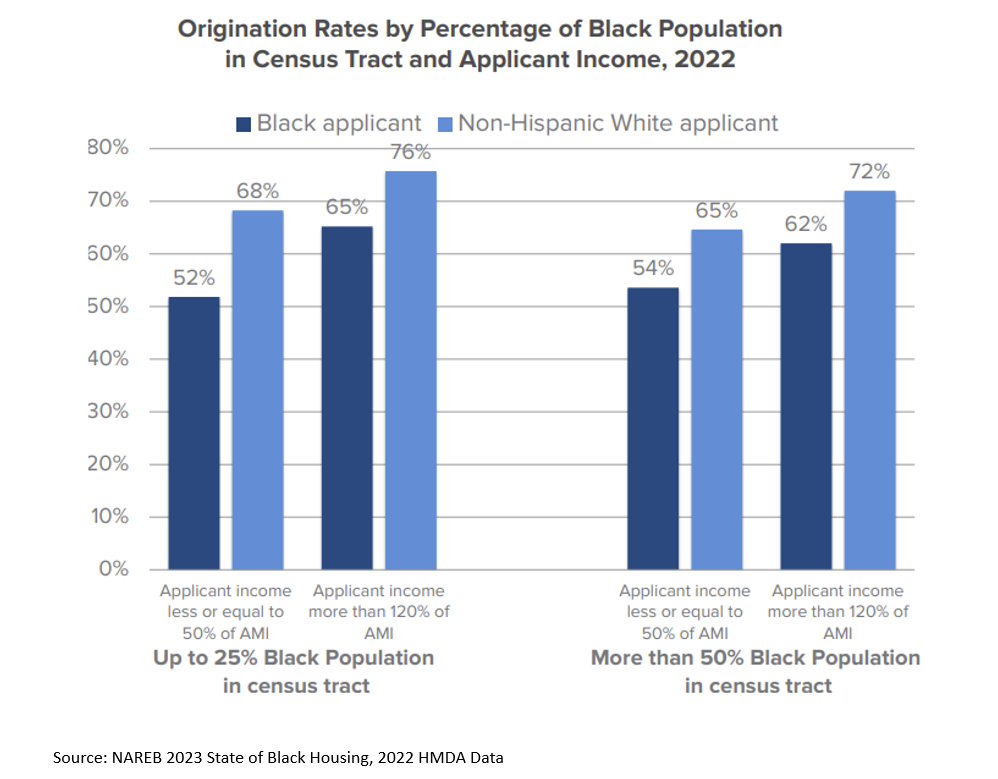

As denials increase, messages in black neighborhoods increase.

The rejection rate for Black applicants in 2022 was 17%, more than double the 7% rejection rate for white applicants. Debt-to-income ratio was the primary reason Black borrowers' applications were denied at 39%, up from 34% in 2021. The number of home loan acquisitions in majority-minority areas is a point from 2021, when black borrowers accounted for 54% and increased by 11%. Low-income black applicants had higher loan originations in predominantly black areas, whereas higher-income black applicants had higher loan originations in areas with smaller black populations.

For more information on housing, demographics and economic trends in Virginia, be sure to check out Virginia REALTORS®' other economic insight blogs and data pages.