A recent analysis of Dallas home prices found that no neighborhoods have experienced a decline in home prices over the past five years, creating affordability constraints for potential homebuyers earning the city’s median income of $58,200. The most common new homes being built in Dallas are single-family homes, with an average sales price of $1.4 million.

In a memo earlier this month, Dallas Deputy Mayor Majed Al-Ghafley revealed the results of a new market value analysis to help inform long-term planning for various city departments. The last such study was commissioned in 2018.

“The MVA is a tool for community revitalization and investment, guiding intervention not only where it is needed, but also where public investment can stimulate private market activity and leverage larger revitalization efforts,” Al Ghafri wrote.

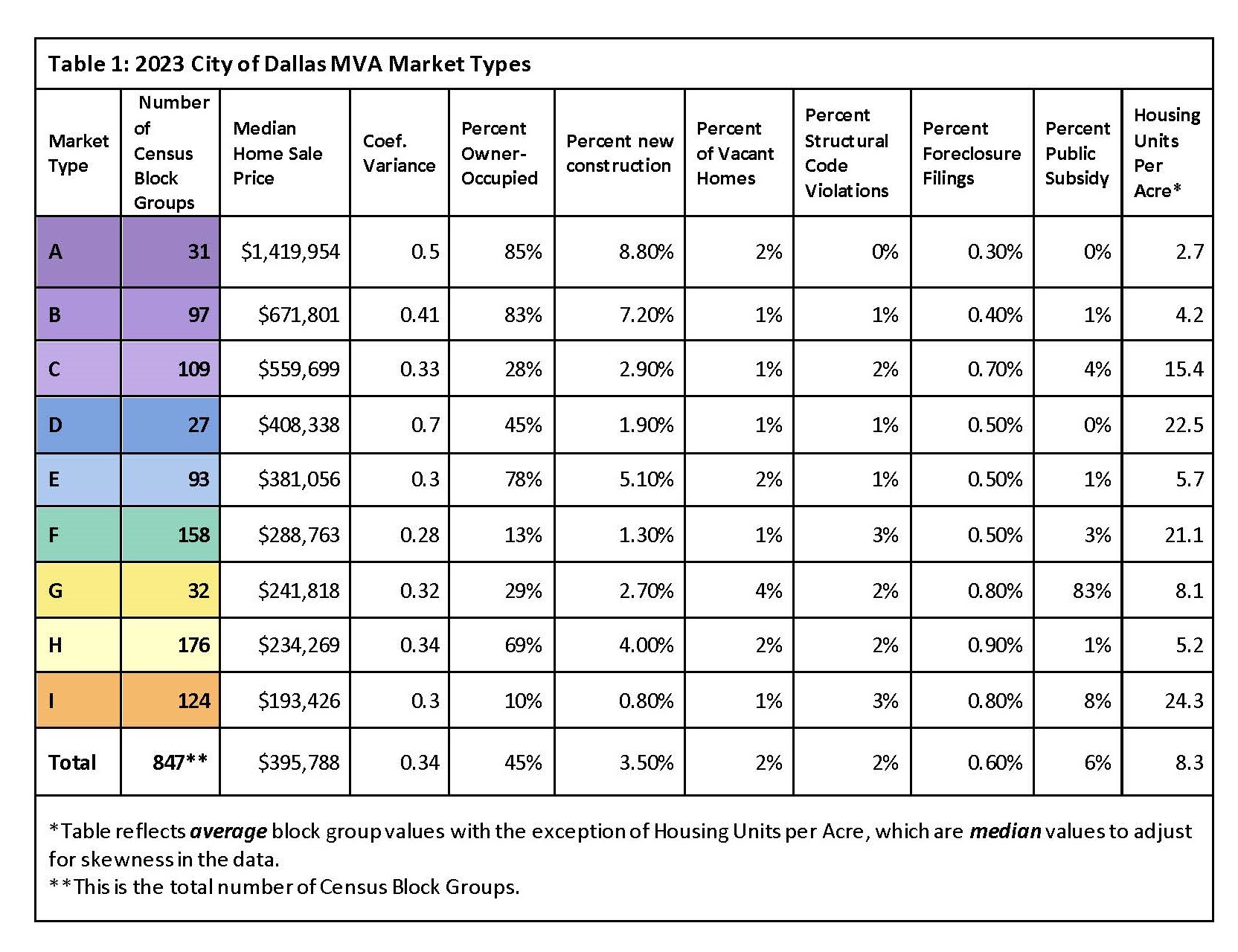

The new analysis divided the city into nine housing market types, with A being the most expensive and I being the least expensive. The criteria considered value, investment, financial stress, disrepair and vacancy rates in specific census block groups. Al-Ghafree said the composition of these market types has changed significantly since 2018. These changes mean the average Dallas homebuyer has fewer places to find a home within their budget.

“Low housing prices affect Dallas’ Hispanic and black households more than other racial and ethnic groups because of each group’s income,” he wrote.

These changes have led to large price increases in areas that were once more affordable, forcing more people out of their homes. Evictions are especially prevalent in West Dallas, South Dallas and Deep Ellum, according to the analysis. Median home prices in West Dallas and Cedar Crest in Oak Cliff have risen by one category since 2018. No neighborhoods in Dallas have seen prices decline, according to the report. The market types that saw the most significant increases in home sales prices were at the lower end of the spectrum, as demand for more affordable housing outpaced supply.

And it’s not just the city’s analysis that backs up the city’s big price gains: Industry analyst Construction Coverage looked at Zillow home price data to identify the cities with the fastest home price growth. Dallas came in third, with a 175 percent price increase over the past decade.

The new MVA map helps visualize this trend: Preston Hollow, Far North Dallas, East Dallas, and the areas around Uptown and Oak Cliff are at the high end of the market range. Northwest Dallas and extreme Southwest Dallas are in the middle of the range, while large swaths of South Dallas and extreme East Dallas are in the weakest market type.

Some takeaways from the analysis:

Market type with the most new construction It’s considered out of reach for residents with near-median incomes. This is market Type A, with a median home sale price of $1.4 million. About 9 percent of the homes in this range are new construction. In second place is Type B, with a median price of $671,801, of which 7.2 percent are new construction.

Market type with the most vacant homes Type G is the most expensive, with a median home sale price of $241,818. About 4 percent of the homes are vacant, and only 29 percent are owner-occupied. In the more expensive categories A and B, at least 80 percent are owner-occupied. (The last group, I, has the least owner-occupied homes, at 10 percent.)

More than 330 of the city’s 847 census tracts There are 237 homes that fall into the G, H, and I market type groups, and 237 homes that fall into the A, B, and C groups. Nearly 40 percent of the city’s housing stock falls into this lower market type, with about 30 percent falling into the middle range.

Affordability is further away than it has ever been. Even in Type I, the median home sale price is nearly $200,000, and most housing finance experts say that to purchase a home in that price range, a buyer would need to earn at least $62,000 a year, nearly $4,000 less than the median income in Dallas.

As affordable housing advocates and the city develop long-term plans to add more housing to Dallas, decisions about how to make homeownership affordable for more people will continue to depend not only on smart public policy but also heavily on market fluctuations.

author

Bethany Erickson

View Profile

Bethany Erickson: D MagazineThroughout her career, she has written about real estate, education policy, the stock market, and crime, sometimes all at the same time. She hates lima beans and 5 a.m., and takes practice SAT tests for fun.