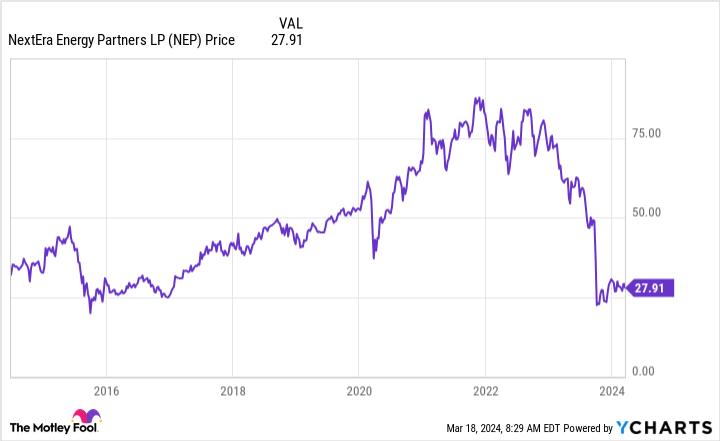

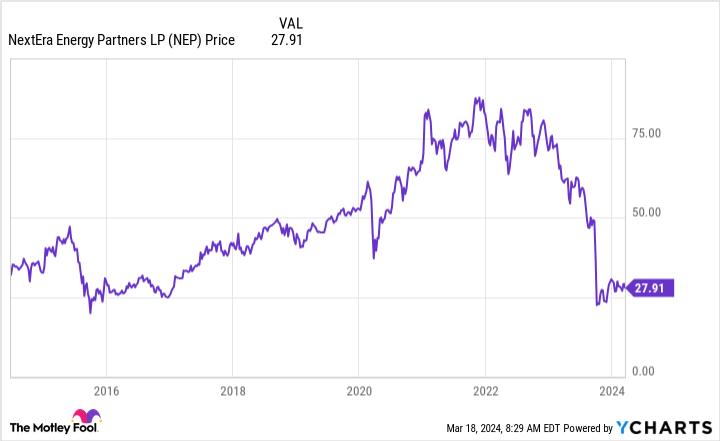

NextEra Energy Partner (NYSE:NEP) ” is currently hitting high-yield screens thanks to a huge distribution yield of over 12%. Noting that the yield at the end of 2022 was close to his 4%, this was not always the case. The sharp fall in unit prices that pushed up yields is worth considering, but so is the potential impact of that fall. To understand why the latter consideration is important, look at what's going on. equitrans midstream (NYSE:ETRN) today.

What went wrong with NextEra Energy?

NextEra Energy Partners was founded by: NextEra Energy (NYSE:Nee), one of the largest electric utilities in the United States. In addition to being a large regulated electric utility, NextEra Energy is also one of the world's largest producers of solar and wind power. To capitalize on Wall Street's once hot demand for everything related to clean energy, NextEra Energy has formed a master limited partnership (MLP) to own the clean energy assets.

NextEra Energy Partners is essentially a financing vehicle for our parent company, NextEra Energy. The parent company sells, or “drops down” in industry parlance, the clean energy assets to the MLP. MLPs purchase assets by issuing units and assuming debt. NextEra Energy will use cash from asset sales to fund future investments. NextEra Energy Partners will use the cash flow from the purchased assets to pay distributions to unitholders.

However, investors lost interest in the clean energy sector, leading to a notable decline in NextEra Energy Partners' price. This increases the cost of selling the unit. To make matters worse, rising interest rates have also increased the cost of debt capital. At this point, selling assets to NextEra Energy Partners is not very attractive for NextEra Energy. And, as you might have guessed, NextEra Energy has announced plans to retire the dropdown. That, in turn, will lead to slower growth for NextEra Energy Partners.

What does this have to do with Equitrans Midstream?

The big story of Equitrans Midstream is: EQT Co., Ltd. (NYSE:EQT), the company that created the MLP is buying it back. This is not the first time an MLP's parent company has bought back an MLP it created.The list includes utilities such as dominion energy and pipeline operators kinder morganamong others.

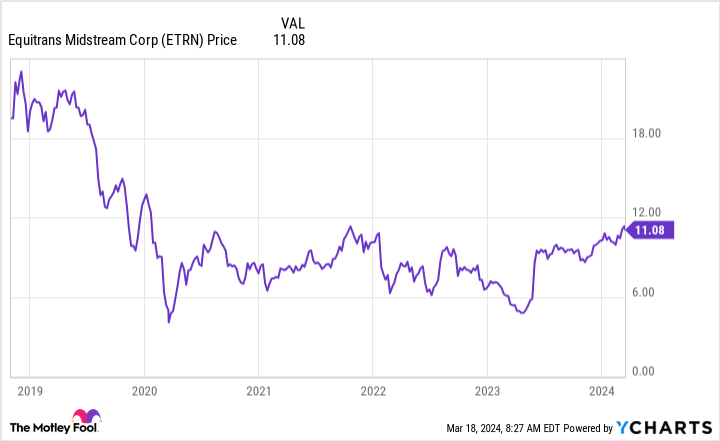

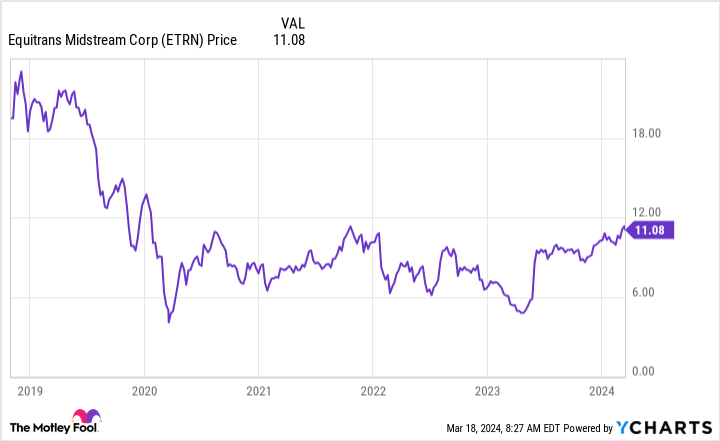

As you might expect, EQT is touting its acquisition of Equitrans Midstream as a positive. In fact, while the company calls the deal “transformative,” in many ways it simply restructures the company that Equitrans Midstream was before it was spun off. The real story is that Equitrans Midstream is being bought back for far less than the price at which it was spun off.

Remember NextEra Energy Partners here? His MLP's purpose is to be a financing vehicle for NextEra Energy, but in that regard it's not as valuable as it once was. There is a very real possibility that NextEra Energy simply buys back the MLPs cheaply, as the unit price is much lower than before.

To be fair, the path to growth in the clean energy sector is more attractive than the growth opportunity in the pipeline sector. This suggests that NextEra Energy may want to wait a little longer to see what happens with NextEra Energy Partners before making any rash moves. However, there are multiple examples of MLP spin-offs being bought back beyond their useful lives. If you own NextEra Energy Partners, you should keep the situation at Equitrans Midstream in mind.

Please buy with at least a little caution

But the real concern here should be for investors looking to add NextEra Energy Partners to their portfolios, given its high distribution yield of over 12%. While this yield is somewhat backed by a strong parent company, NextEra Energy could just as easily decide to acquire his MLP, effectively eliminating the attractive yield quickly. Equitrans Midstream in particular shows that this is indeed a very real possibility, and a risk that dividend investors should not ignore.

Should you invest $1,000 in NextEra Energy Partners now?

Before purchasing NextEra Energy Partners stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and NextEra Energy Partners wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Reuben Gregg Brewer has a position at Dominion Energy. The Motley Fool has positions in and recommends EQT, Kinder Morgan, and NextEra Energy. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

NextEra Energy Partners investors should monitor this acquisition closely. Here's why:Originally published by The Motley Fool