(Bloomberg) — Oil prices fell ahead of this week's U.S. inflation data from the Organization of the Petroleum Exporting Countries (OPEC) and the IEA, as well as reports that could provide clues about the outlook for demand.

Most Read Articles on Bloomberg

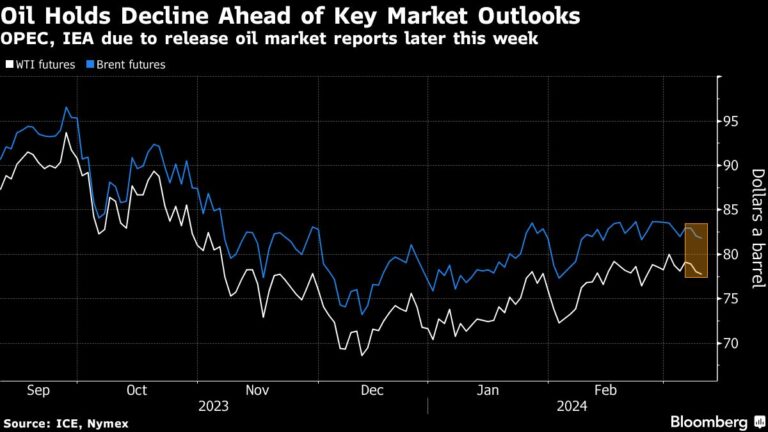

North Sea Brent futures fell below $82 per barrel after closing 1.1% lower on Friday, while West Texas Intermediate fell below $78. Prices remain within a narrow trading range. Investors are focused on the possibility of higher-than-expected U.S. inflation on Tuesday, which could disrupt the path of monetary policy.

Oil prices are emerging from their most volatile week since late 2021 as investors juggle competing bulls and bears. OPEC+ production cuts and tensions in the Middle East are being offset by rising supplies from outside the group and persistent concerns about the economic outlook for China, its biggest importer.

The Organization of the Petroleum Exporting Countries is scheduled to release its monthly market report on Tuesday, and the International Energy Agency is expected to release a corresponding outlook on Thursday. The U.S. Energy Information Administration is also scheduled to release its short-term energy outlook this week.

Meanwhile, Iran's oil exports have reached their highest level since 2018, when former US President Donald Trump abandoned Iran's nuclear deal with world powers and reimposed sanctions, the country's oil minister said.

Click here to receive Bloomberg's Energy Daily newsletter in your inbox.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP