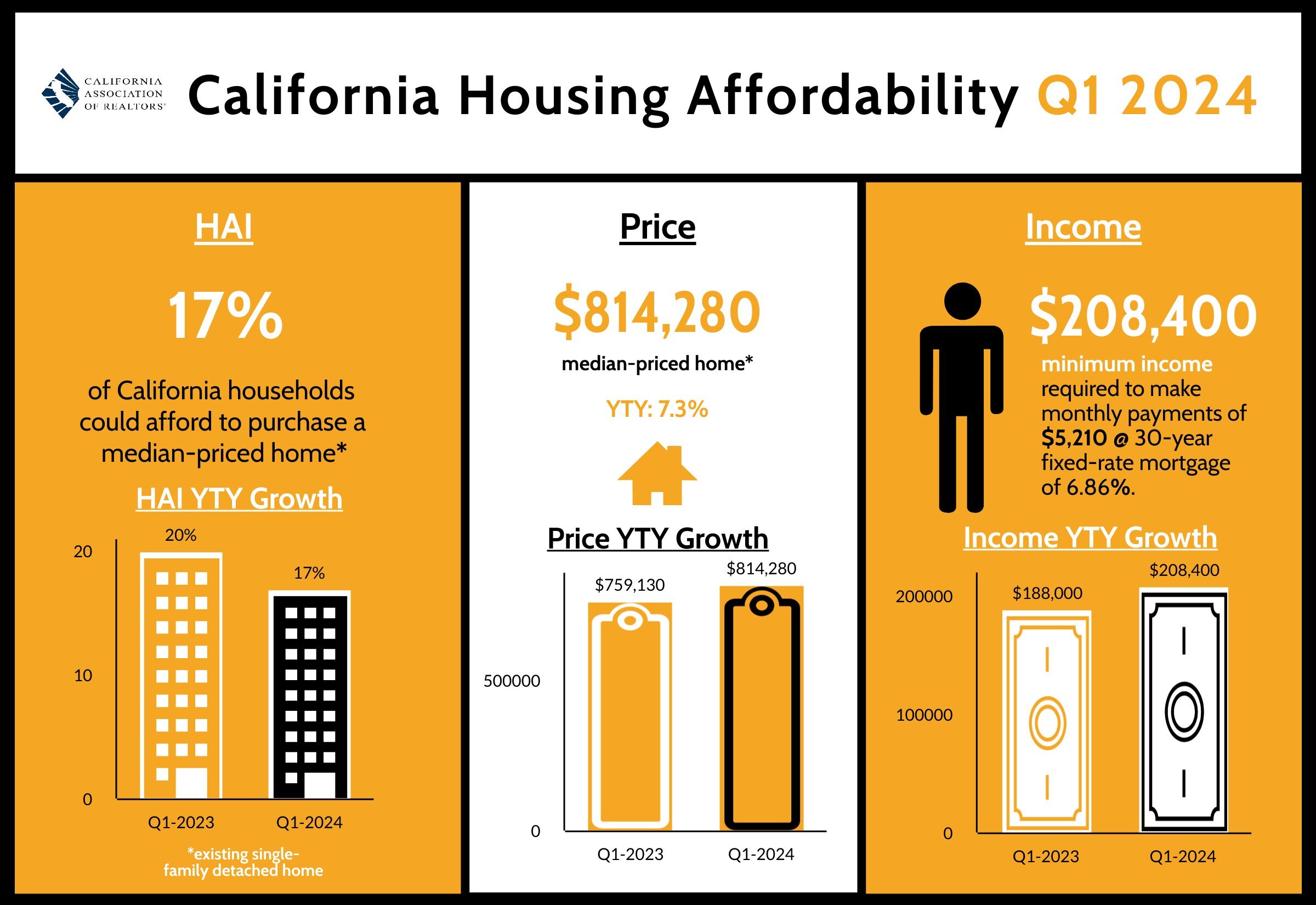

The California Association of Realtors reports that only 17 percent of the state's homebuyers will be able to purchase an existing single-family home at California's median price in the first quarter of 2024.

This is up from 15% in Q4 2023 and down from 20% in Q1 2023, according to CAR's Traditional Home Price Index (HAI). The Q1 2024 figure is less than a third of the Affordability Index's peak of 56% in Q1 2012. With the US economy performing better than expected, the Fed is unlikely to cut rates until at least 2024. The impact of the summer season could prevent significant price improvements in the coming months.

CAR's HAI measures the percentage of all households in California that can afford a median-priced single-family home. CAR also reports affordability indices for regions and some counties within the state. The index is considered the most fundamental measure of housing well-being for homebuyers in the state.

In the first quarter of 2024, a minimum annual income of $208,400 was required to purchase an existing single-family home with a statewide median price of $814,280. The monthly payment including taxes and insurance (PITI) for 30 years is $5,210 on a fixed rate loan assuming a 20 percent down payment and an effective compound interest rate of 6.86 percent.

The effective headline interest rate was 7.39% in the fourth quarter of 2023 and 6.48% in the first quarter of 2023. Recent economic reports have shown a lack of progress in fighting inflation in recent months, with the Federal Reserve's plans to cut interest rates this year further delayed and a downward adjustment to the federal funds rate expected by the end of summer. It may not be done until then.

The percentage of California households able to purchase a typical condo or townhome in the first quarter of 2024 rose to 24 percent, up from 22 percent in the previous quarter but down from 27 percent in the first quarter of 2023. decreased. In the first quarter of 2024, a monthly payment of $4,190 for a condo/townhome with a median price of $655,000 would have required $167,600.

Compared to California, nearly 4 in 10 U.S. households can afford a home with a median price of $389,400, and a minimum annual income of $99,600 is required to pay a monthly payment of $2,490. . Nationally, affordability is down from 40% a year ago.

Key takeaways from the Q1 2024 Home Affordability Report include:

- Compared to the previous quarter, home prices declined in four counties and remained unchanged in 10 counties. Thirty-nine counties showed quarter-over-quarter improvements in affordability due to lower interest rates and slower price declines compared to other counties during the same period. Compared to a year ago, six counties recorded price improvements, while 46 counties in the state saw year-over-year declines and only one remained unchanged.

- Lassen (51%) remained California's least expensive county. Tehama (39 percent) was followed by Plumas (37 percent), Shasta (37 percent) and Tuolumne (36 percent), the only five counties in California with an affordability index above 35 percent. Of all California counties, Lassen County continued to have the lowest minimum qualifying income ($66,000) to purchase a median-priced home in the first quarter of 2024.

- Mono (4%), San Luis Obispo (10%), and Orange, San Diego, Monterey, and Santa Barbara counties tied for 11%, making them the least expensive counties in California and the lowest in their respective counties. A limited living allowance was required. To buy a median-priced home in each county, you need an income of at least $222,000. The City of San Mateo will continue to require the highest minimum qualifying annual income ($511,600) to purchase a median-priced home in the first quarter of 2024 and will require a minimum qualifying annual income of more than $500,000 in the state. It was the only county. Santa Clara County came in second with a minimum income of $470,800, followed by Marin ($427,200).

- The largest year-over-year decline in housing affordability was in Siskiyou, down 9 percentage points from the previous quarter. Plumas and Mendocino recorded his second-biggest decline in affordability, falling five points below him from the same period last year. Despite rising household incomes, housing affordability remains near record lows in most counties due to rising home prices and rising mortgage rates.