For decades, fossil fuel companies have been the epitome of blue-chip holdings with reliable profits, steady growth, and sound fundamentals. Institutional investors flocked to the market, eager for a low-risk way to meet their investment return goals. Billions of dollars of pensions, endowments and other funds have been invested in this industry as it has become a driver of global economic growth and established as a major driver of global stock markets. We are betting on its success.

However, as the 21st century progresses, this traditional investment theory is beginning to waver. Disruption and instability in fossil fuel commodity markets, competition from renewable energy, electrification of transportation, and increased investor awareness of the financial risks posed by climate change are leading some investors to reconsider the role of the energy sector in their portfolios. It is designed to be evaluated.

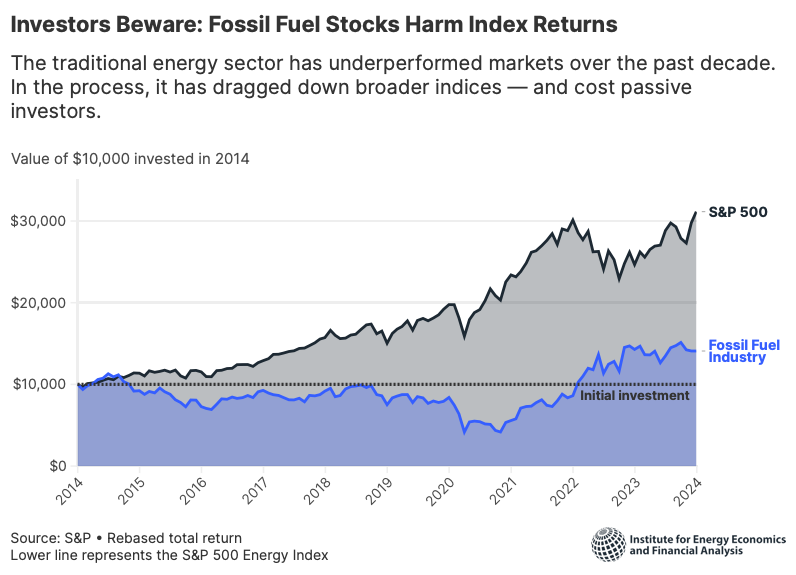

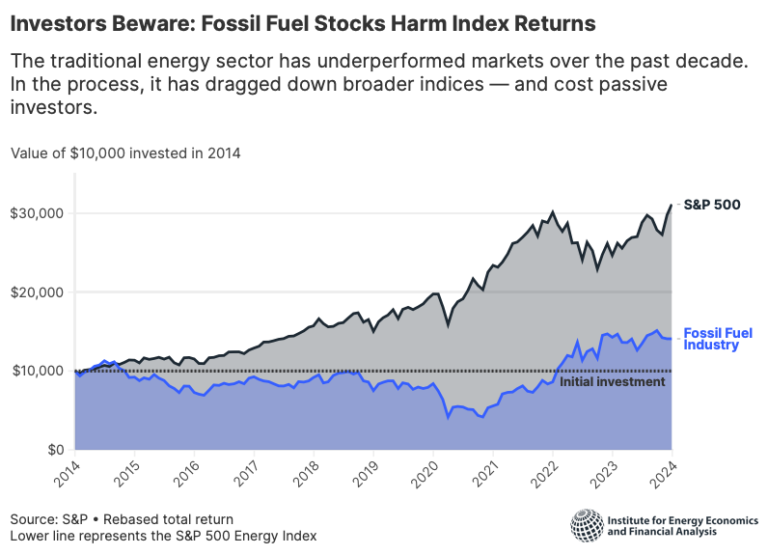

This report assesses the impact these changes have had on stock indexes across the market. The study takes as its starting point his decade-long pattern of underperformance in the energy sector compared to flagship stock indexes such as the Standard & Poor's 500 (S&P 500). The market trajectory is difficult. The energy sector underperformed the S&P 500 in eight of the 10 years from 2012 to 2021, finishing last in five of those years. Once a powerhouse of investment returns, the industry has found itself shrinking. At its peak in 1980, conventional energy accounted for nearly 30% of the S&P 500's market capitalization. By the late 2010s, this number had fallen to low single digits, making the fossil fuel sector significantly less valuable than other energy sectors. stock market.

This decline in the market presence of fossil fuels occurred in parallel with a marked change in equity investment. Passively managed investment funds that track market indexes began receiving large amounts of money after the Great Recession. And major index providers have begun launching new stock market indexes (referred to in this report as “ex-fossil” or “low-fossil” indices) that exclude or underweight fossil fuel companies. These indexes soon began to be tracked by index funds and attracted the attention of investors. As market demand grew, just a few representative indices became the basis for a variety of options, strategies, and weighting approaches.

The fossil fuel sector rebounded strongly in 2021 and 2022 after nearly a decade of decline. Among the key drivers were the world's emergence from the COVID-19 pandemic, which has strained international supply chains to breaking point, and Russia's invasion of Ukraine. It forced a major reconfiguration of the world's energy flows. Oil prices soared, the fossil fuel industry posted record profits, and commentators declared the sector's golden age had returned. In subsequent quarters, the bump disappeared. Despite leading the stock market in 2021 and 2022, the fossil fuel sector returned -4.8% in 2023. The sector's stock prices and market weight rose modestly from its all-time low in 2020 to 5.2% of the S&P 500 in December 2022, before reversing. In 2023 fossil fuels will fall to 3.9% at the end of the year.

What do these overlapping trends mean for the fossil fuel sector's place in stock portfolios? This report reveals that recent energy market turmoil has not overcome the long-term market decline in fossil fuels . We compare the risks and returns of some of the most systemically important indexes for institutional investors, including the S&P 500, Russell 3000, and MSCI All Country World Index (ACWI), to their legacy fossil indexes. We then extended our analysis across more than 60 additional indices and found that the same was still true. The profits made by fossil fuel companies during the pandemic and war were simply not enough to lift the industry out of a long pattern of underperformance. The sector has declined compared to its historical position and the market is taking notice.

We conclude that market evolution is at play.

- Excluding fossil fuels, the entire index family, region, and target market delivered slightly better returns in both absolute and risk-adjusted terms over the past decade.

- The low-carbon passive investment market has matured significantly. Indexes that reduce exposure to fossil fuels have proven to be investable and have passed reliability tests. The transaction costs for introducing a new index have been found to be affordable. And the number of investment products that use these as benchmarks is rapidly increasing.

- There is good reason to believe this is a permanent market trend. Fossil fuel companies once created shareholder value based on sound underlying fundamentals. Recently, its profitability has become dependent on uncontrollable variables. The traditional values underlying the fossil fuel industry, that the industry is closely linked to economic growth, are crumbling. Facing increased competition among fossil fuel producers and from cheaper alternative technologies, the industry is ill-prepared to manage shareholder value in the coming years.

These results have special implications for passive investing. Passive investment strategies rely on broad market exposure. As a result, the conventional wisdom is that any restrictions on diversification necessarily limit profits. In the specific example of fossil fuels, Real-world market results show that the opposite is true. Over the past decade, excluding the fossil fuel sector has limited risk and improved performance.. These results, coupled with the sector's negative long-term outlook, should be of great concern to institutional investors who allocate assets to passive equity strategies.

Increased availability of de-fossil or low-fossil variants of flagship indexes, emerging patterns of long-term outperformance of those variants, and negative long-term outlook for the fossil fuel sector to expand implementation of low-fossil indexes The preparations are now complete. -Fossil Passive Equity Strategy.