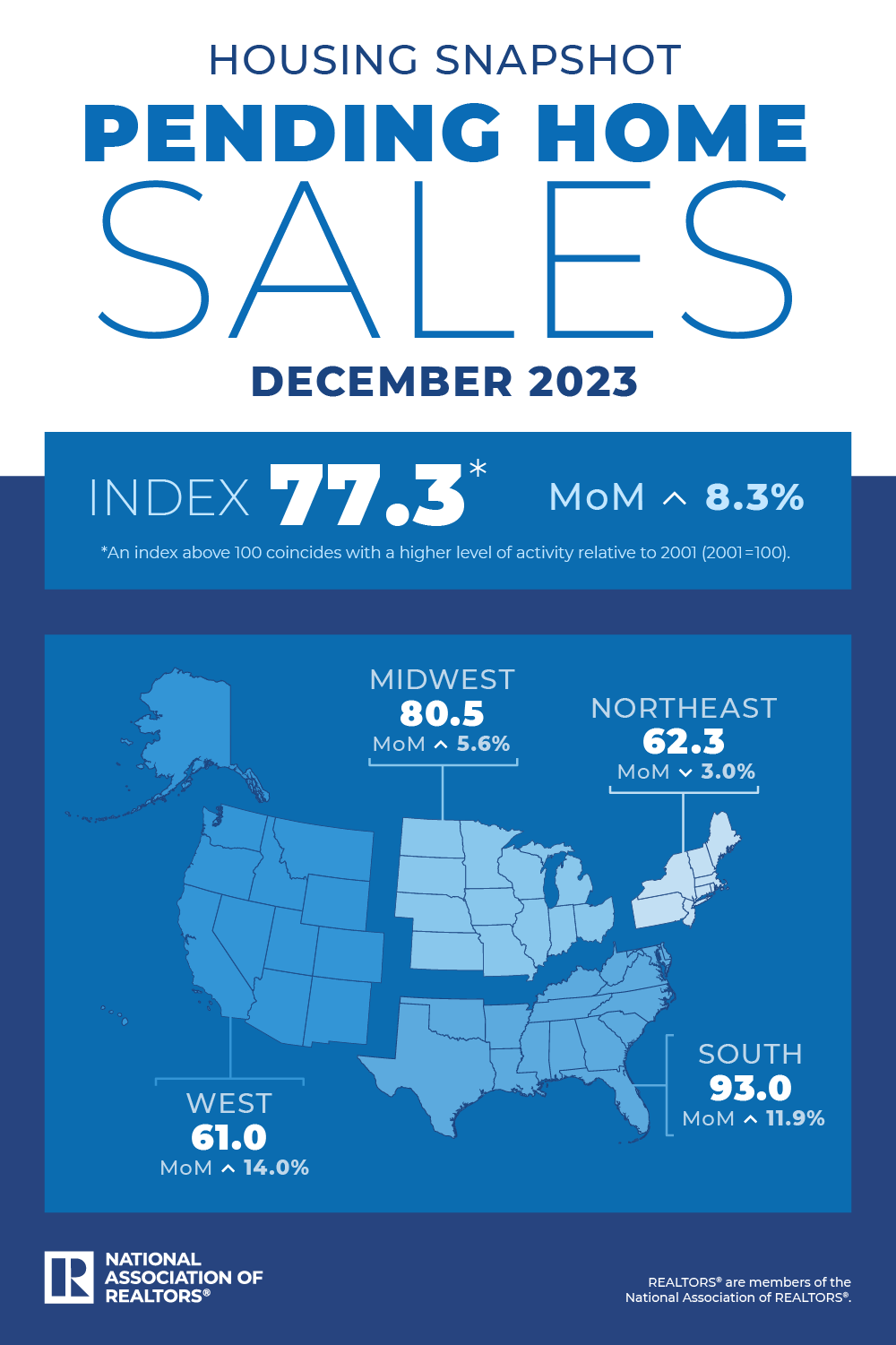

Citing the Pending Home Sales Index, the National Association of REALTORS® announced that pending home sales increased 8.3% from November to December as mortgage rates continued to decline.

Citing the Pending Home Sales Index, the National Association of REALTORS® announced that pending home sales increased 8.3% from November to December as mortgage rates continued to decline.

Pending sales, where contracts have been signed but the transaction has not closed, are considered a leading indicator and generally precede existing home sales by one to two months. Compared to the same period last year, sales increased by he 1.3%.

“The housing market is off to a strong start this year as consumers benefit from lower mortgage rates and stable home prices,” NAR Chief Economist Lawrence Yun said in a press release. . “Increased employment and rising incomes will further increase housing affordability, but increased supply is essential to meet all potential demand.”

Odeta Cusi, chief deputy economist at First American, said in a release that the monthly increase was the largest since 2020 and significantly exceeded the consensus estimate of a 2% increase.

“When you factor in mortgage application status, another leading indicator of sales activity, the consensus forecast always looks on the low side,” Cusi added. “The average number of mortgage applications in December was up nearly 8% month over month, and January is up about 10% compared to December so far. A simple relationship-based analysis shows that existing home sales should accelerate.”

The better-than-expected increase comes after new home sales in December also beat expectations, rising 8% to 664,000 units, compared to consensus expectations of 649,000 units.

By region, pending sales increased in the West, South, and Midwest, with large increases month-over-month in the West and South, but sales decreased in the Northeast.

“The numbers on pending home sales show that many U.S. consumers have recovered from the pandemic with strong credit scores and continue to purchase homes,” Thelma Hepp, chief economist at CoreLogic, told Agent Publishing. “We can see that we are in a favorable position.” “However, they also recognize that market fundamentals make buying a little more difficult. Prices remain strong and that will not change, but recent mortgage rate cuts have helped drive buying appetite. There is.”

Looking ahead, NAR expects existing home sales to increase 13% year over year in 2024 and another 15.8% in 2025. The association also expects the median home price to rise 1.4% to $395,100 in 2024, and then 2.6% to $395,100 in 2024. Finally, NAR expects the Fed to cut rates four times this year, leaving the 30-year fixed rate in the 6% to 7% range for most of the year.