The easiest way to benefit from market rises is to buy index funds. But buying individual stocks can do better or worse than that. The downside risk was realized by Sempra (NYSE:SRE) shareholders have seen the share price drop 10% in the last year. This is significantly lower than the market return of about 25%. Long-term shareholders haven't been hit too hard, as the share price has fallen a relatively painless 0.6% over three years.

Shareholders are down over the long term, so let's take a look at the underlying fundamentals over that time period to see if that's in line with the returns.

Check out our latest analysis for Sempra.

In Buffett's words, “Ships will sail around the world, but a flat-Earth society will thrive.'' There will continue to be a wide discrepancy between prices and values in the marketplace. ..'' By comparing earnings per share (EPS) and share price changes over time, we can see how investor attitudes to a company have changed over time.

Although Sempra's stock price has declined over the year, EPS has actually improved. Of course, this situation could belie the previously overly optimistic outlook on growth.

It's surprising that the share price has fallen so much even though EPS has improved. Therefore, it is easy to justify considering other indicators.

In fact, Sempra's revenue is up 16% over the last year. There's no easy way to explain the share price movement based on these metrics, so it might be worth considering how market sentiment towards the stock has changed.

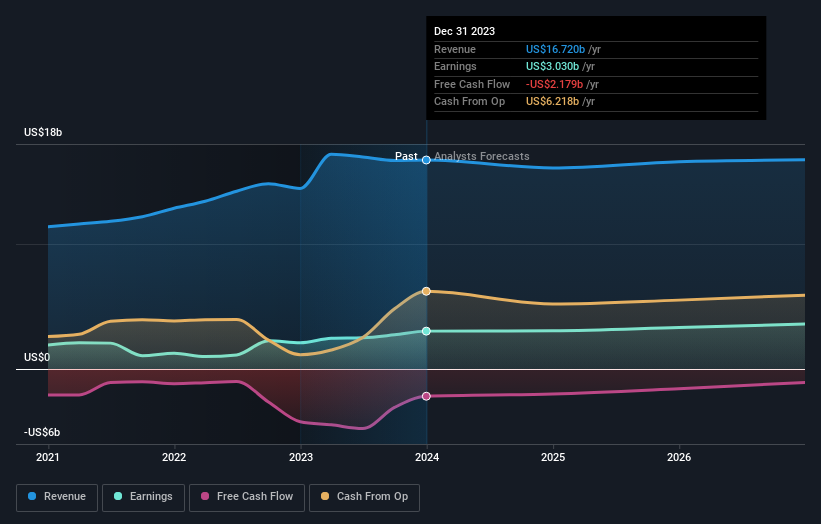

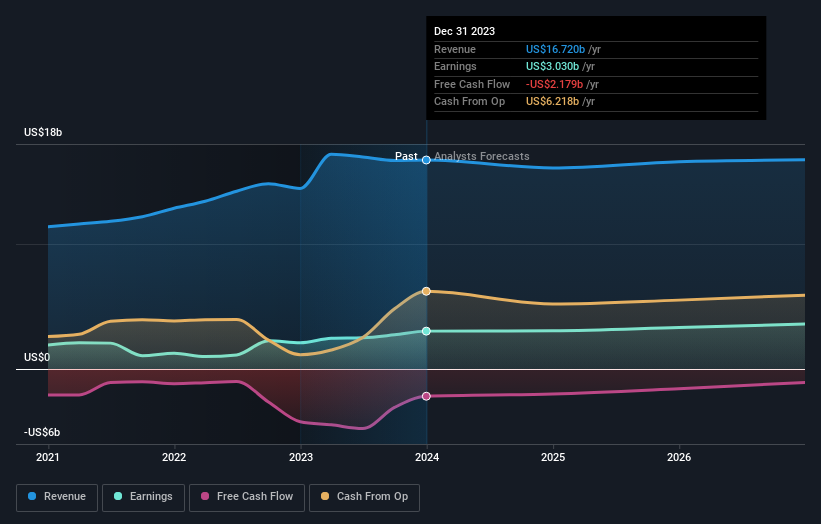

The company's earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

Sempra is a well-known stock, with many analysts covering it, suggesting some future growth is visible.I recommend checking this free Report showing consensus predictions

What will happen to the dividend?

It's important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. For Sempra, the TSR for the past year is -7.2%. This exceeds the stock return mentioned earlier. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

While the broader market rose about 25% last year, Sempra shareholders lost 7.2% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a return of 5% per year for over 50 years. If fundamental data continues to point to long-term sustainable growth, the current selloff could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important.For example, taking risks – Sempra is two warning signs I think you should know.

If you want to check out another company with potentially better financials, don't miss this free A list of companies that have proven they can grow their revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.