famous cruise companies carnival corporation (New York Stock Exchange: CCL) It has become a hot stock over the past year. The stock price has almost doubled. Investors were vindicated by the market when they bought stocks hoping for a post-pandemic rebound in consumer spending.

But now may be the time to lock in profits and say goodbye to Carnival stock.

Although the company has done an excellent job of restoring its pre-pandemic top-line performance, Carnival's profitability has suffered due to the pandemic's impact on its business.

Investors should avoid buying stocks for now. Those who own the stock may even consider locking in profits.

Here's why:

Stock prices alone don't tell the whole story

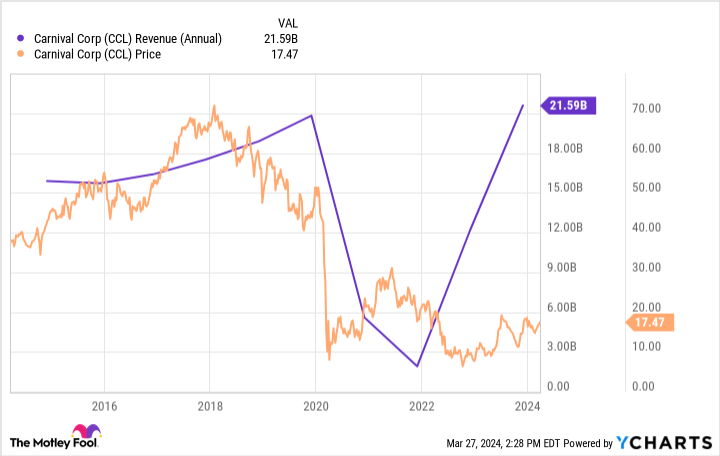

It took three painful years, but Carnival's business recovered. The company ended 2023 with revenue of $21.6 billion, about the same level as 2019, the year before the coronavirus pandemic upended its business performance.

At first glance, something seems off about the graph below. Despite a full recovery in revenue, the company's stock still trades at a fraction of its pre-pandemic price.

why is that? When the lockdown effectively reduced revenues to near zero, Carnival had to take drastic measures to stay in business. After all, companies have overhead costs even when their ships aren't sailing. Stock was issued and debt was incurred to raise the cash needed to keep Carnival afloat and complete its reconstruction.

Carnival's revenue is not what it used to be.

All of this is inflating stock valuations. Investors can view Carnival's valuation below. This is Carnival's market capitalization plus debt minus cash on hand. The company's enterprise value peaked at $60 billion, and its current $50 billion is much closer to that peak. If the stock reaches $70 again, Carnival will be a much bigger company than it has ever been.

You can also look at it from a revenue perspective. At its peak, Carnival was earning him more than $4 per share. Interest on debt reduces earnings, but holding more stock dilutes Carnival's profits and dilutes investors. Analysts expect Carnival to post earnings per share of $1.00 this year and $1.37 next year. While this is a significant increase in earnings year-over-year, it's coming from a much lower base number than before.

Carnival will need to grow to justify further stock price gains. However, remember that Carnival is a capital-intensive business. Building, staffing and maintaining new ships is costly, and Carnival's debt puts a cap on fleet expansion. Management announced that it would cut spending to pay down debt. Three new ships are scheduled to be delivered next year, but none will arrive in 2026, and only one will arrive in 2027.

The conclusion is:

Carnival, already considered an entry-level cruise company, is unlikely to raise prices to dramatically increase revenue. The likely outcome is that revenues will stagnate for several years while Carnival gets its financial footing. Little growth and a bloated balance sheet don't bode well for the stock.

Investors expecting profits should claim profits in case this stock starts to fall.

Should you invest $1,000 in Carnival Corp. right now?

Before buying Carnival Corp. stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Carnival Corp. wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 25, 2024

Justin Pope has no position in any stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Should investors still buy Carnival Cruise stock even if the stock price doubles? Originally published by The Motley Fool