-

Net income: The reported value was $308 million, significantly lower than the estimated $763.29 million.

-

Earnings per share (EPS): The result was $1.10, well below analysts' expectations of $2.95.

-

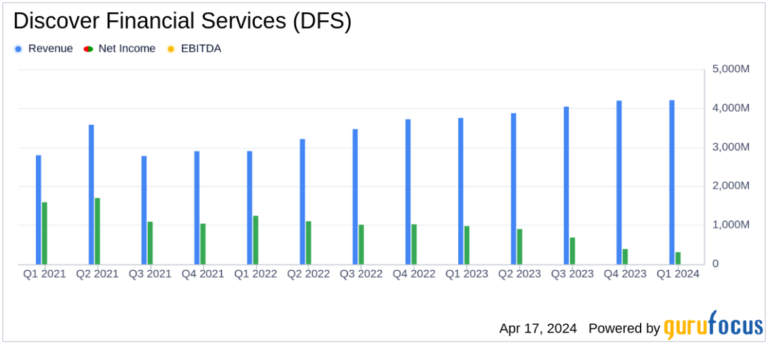

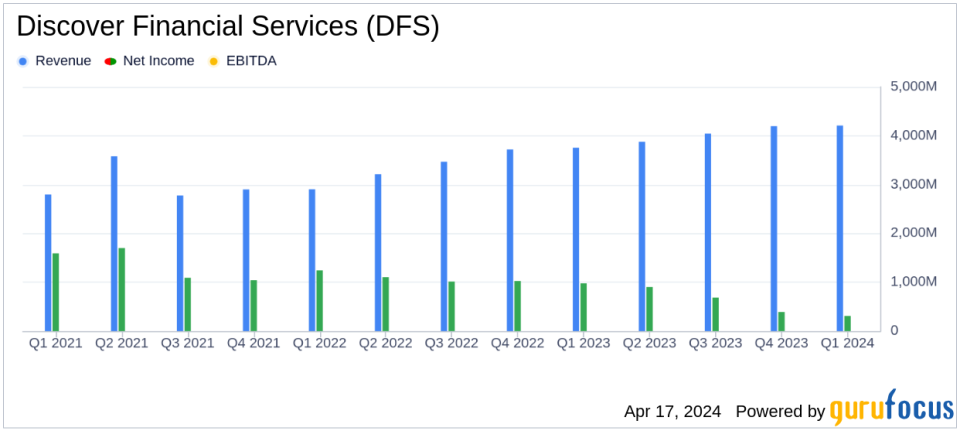

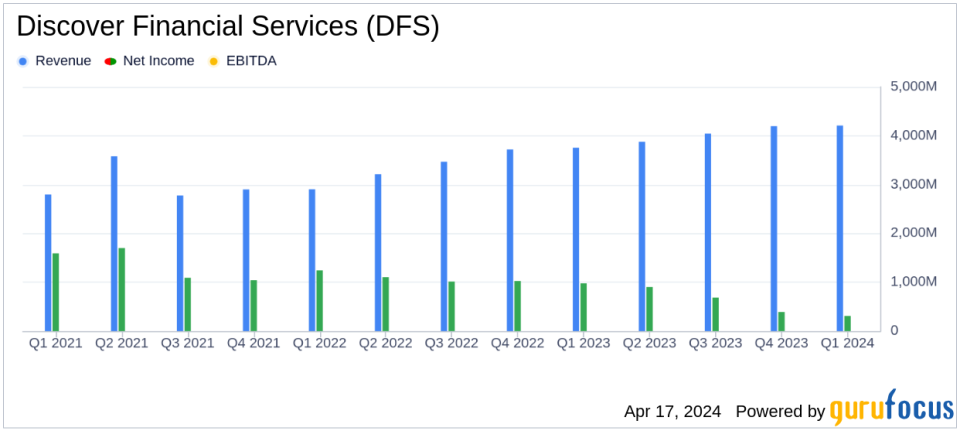

Revenue: The total amount was $4.21 billion, slightly higher than expectations of $4.07395 billion.

-

Total loan amount: Sales increased by 12% from the same period last year to $126.6 billion.

-

Net depreciation rate: It jumped to 4.92%, indicating an increase in credit losses.

On April 17, 2024, Discover Financial Services (NYSE:DFS) released its 8-K filing, revealing a difficult first quarter. The company, a prominent player in the U.S. financial services sector, reported net income of $308 million, or $1.10 per diluted share, compared with $968 million, or $3.55 per diluted share, in the same period last year. ) reported a significant decrease.

Discover Financial Services operates through two main segments: Direct Banking and Payment Services. The company issues credit and debit cards and offers other banking products such as personal and student loans, as well as managing the Discover, Pulse and Diners Club networks.

Analysis of first quarter performance

Total lending in the first quarter increased 12% to end at $126.6 billion. Despite this growth, the company faced a significant increase in total net charge-offs from 2.72% to 4.92% year over year, reflecting higher credit losses. This increase was particularly pronounced in the credit card sector, where net charge-offs soared to his 5.66%.

Revenue excluding interest expense rose 13% to $4.21 billion, slightly above analysts' expectations. But that was overshadowed by higher spending, including his massive $799 million increase in card misclassification correction reserves, which contributed to his 68% increase in total operating expenses.

Michael Shepherd, interim CEO of Discovers, commented on the quarter's results, citing the dual impact of strong loan growth and margin expansion against a backdrop of higher delinquencies and higher expenses. emphasized. Shepherd remains optimistic about the merger with Capital One, which is expected to strengthen the company's banking and payments platform.

“Our first quarter results showed loan growth, net interest margin expansion, and stabilization of delinquencies, while resolving card misclassification issues,” said Michael Shepherd, Discover's interim CEO and president. “Expenses have increased due to measures taken to advance this.”

The Payment Services segment reported an increase in pre-tax income of $82 million due to increased PULSE revenue and improved performance at Diners Club and Network Partners.

Despite its financial challenges, Discover maintains its commitment to shareholder returns and declared a quarterly dividend of $0.70 per share.

Detailed financial conditions and forward-looking statements will be further discussed at our next earnings call, scheduled for April 18, 2024. Interested parties can access the earnings call through Discover's Investor Relations website.

As Discover navigates through these turbulent times, especially with its impending merger with Capital One, investors and stakeholders are looking to reduce risk and capture growth opportunities in a competitive financial services environment. The company's strategic efforts to leverage this will be closely monitored.

For more information, please see Discover Financial Services' full 8-K earnings release here.

This article first appeared on GuruFocus.