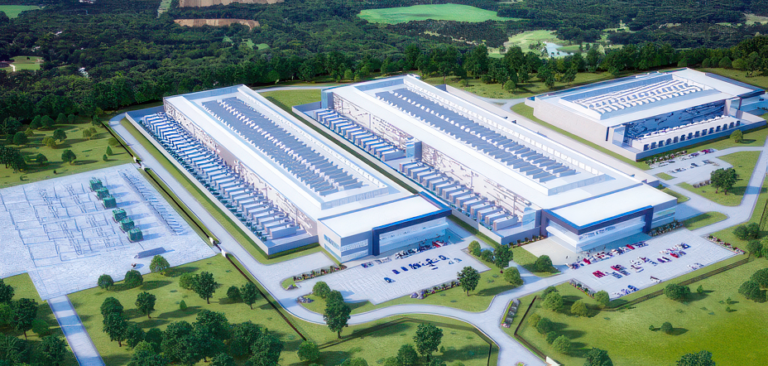

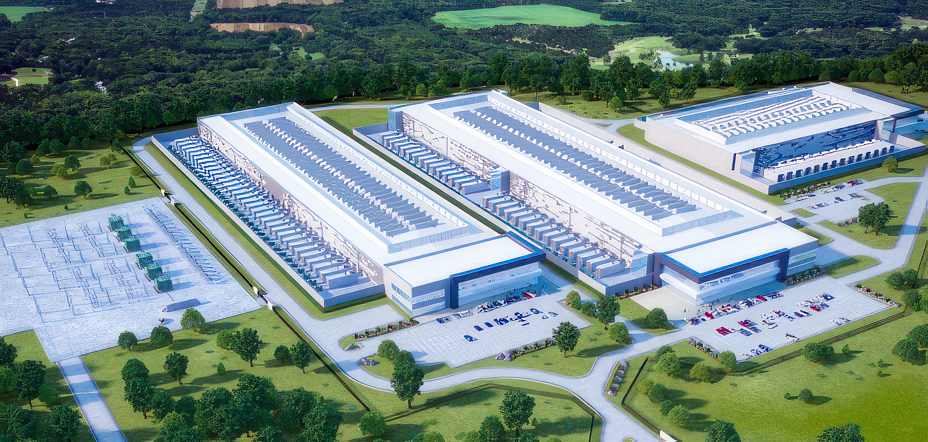

rendering. his PowerCampus Dallas at the Skybox data center in Lancaster; [Image: Skybox]

Dallas-based data center development company Skybox Datacenters, in partnership with development companies Bandera Ventures and Principal Asset Management, has begun construction on a new data center campus in Lancaster called PowerCampus Dallas.

The approximately 100-acre campus, located near Interstate 35 in southern Dallas County, will provide up to 300 megawatts (MW) of power, supported by an on-site private substation, and will cover up to 1 million sq. ft., according to the company. ft. of data center space.

“PowerCampus Dallas will raise the bar for the North Texas data center market and beyond,” Skybox Datacenters CEO Rob Morris said in a statement. “This partnership brings together expertise in multiple areas critical to delivering significant capacity in this dynamic data center market.”

North Texas is a hot market for data centers

According to Skybox, the campus is located in one of the fastest growing data center submarkets in the country and is surrounded by the most powerful infrastructure in the region, providing seamless interconnectivity and unparalleled expansion. It is said to provide functionality.

According to Baxtel, one of the largest data center information resources, the Dallas data center market includes 121 data center facilities with more than 13 million square feet of space and 1,128 megawatts.

A new multi-million square foot data center project is underway in DFW.

Google, for example, announced plans in August to build a more than $600 million data center in Red Oak, just south of Dallas.

And in July, Dallas-based Compass Datacenters and Schneider Electric, a global leader in the digital transformation of energy management and automation, partnered to build a state-of-the-art integrated facility in Red Oak and build prefabricated modular Demand for data centers is increasing.

PowerCampus Dallas is “tailored for hyperscale clients”

Skybox said the Dallas market is one of the nation's major peering and interconnection hubs, featuring excellent proximity to cloud providers and exchanges, and ample network availability to major cities. .

Skybox said Dallas has low energy costs and access to renewable power. Skybox said PowerCampus Dallas is designed to allow users to benefit from local and state tax incentives.

Texas offers state sales tax exemptions on eligible data center electrical or equipment to reduce the cost for data center customers to deploy large footprints in the state.

Skybox said PowerCampus is its latest product for large data center assets “tailored for hyperscale customers in major and emerging markets in the United States.” The company said PowerCampus Dallas will provide up to 300 MW of power and strategically address the emerging high-density computing needs of the Dallas region.

“Our partnership with Skybox and Bandera continues Principal's long-standing commitment to the data center space,” Ben Wobshall, managing director of real estate at Principal Asset Management, said in a statement. “Having invested more than $3 billion into the data center space over the past 17 years, we are able to witness first-hand the evolution of this space and leverage strategic partnerships like this to help our clients and businesses We are excited to help drive the continued success of our customers.”

With a customer-centric approach, Skybox provides mission-critical facilities specializing in speculative, campus, powered shell, turnkey, and build-to-suit project capabilities through active development and operations teams across the country. I said that there is.

supporters

Dallas-based Bandera Ventures is a real estate development and acquisition firm founded in 2003 by Charles Anderson, Pryor Blackwell, and Tom Leiser. The company was founded to responsibly develop, acquire, own and operate commercial real estate.

All three founders are former partners and senior executives at Trammell Crow Co. and have more than 100 years of combined commercial real estate experience. This partnership recently expanded with the addition of Matt Ashbaugh.

Bandera Ventures has developed and acquired 101 commercial projects since 2003 and provided investment capital to a wide variety of projects and businesses. The partner's track record covers more than 100 million square feet of development over his $10 billion.

Principal Asset Management's dedicated real estate investment team manages or sub-advises $95.5 billion in commercial real estate assets, with public and private market capabilities across all asset classes. Its real estate capabilities include both public and private equity, as well as fixed income investment alternatives.

![]()

Please put it on the list.

Dallas innovates every day.

Sign up to stay up-to-date on what's new and next in Dallas-Fort Worth, every day.