RelaxFoto.de/E+ via Getty Images

Here in Texas, as Summer approaches and overpowers the fragile, fleeting Spring season, the rapid changes in pressure and temperature often render powerful storms.

Giant, commanding clouds that look like the anvils of the gods roll across the vast sky until all wisps of blue have been blotted out. The darkness and opacity of an overcast sky on the verge of a storm can be menacing.

But sometimes the dark clouds gather and the storm never comes. Sometimes there’s only a brief, light rain, and then the clouds crack open and give way to glorious beams of sunlight stretching down from the heavens.

I think this image is a decent illustration of today’s economy.

In November 2023, I wrote an article titled “Recession Is Imminent: Position Your Portfolio For Monster Dividend Growth” arguing that due to tight financial conditions, weakening consumer spending power, and poor business conditions, a recession is likely on the way.

Since then, employment has held up more than expected and stock market indices have soared to new all-time highs.

Storm clouds gathered, but the rain never came.

Is this one of those rare “soft landings” that the market seems to be pricing in?

It could be, but I still believe a storm (i.e., recession) is still very much a possibility this year.

Below, I’ll explain why. But first, we need to address recent positive developments that have extended the business cycle and confounded the macroeconomic picture. I’ll end with a brief discussion of my favorite investment for a weakening growth/disinflation/falling interest rates environment.

Sunbeams

There have been a number of striking sunbeams (i.e., pieces of good economic news) that have to be acknowledged, even by the dark cloud watchers like me.

Artificial Intelligence Could Jumpstart A New Era of Productivity Growth

Since AI is capturing so much attention today, it only makes sense that we should start there.

So far, generative AI seems to have only resulted in incremental productivity enhancements here and there. But lots of companies, both major corporations and VC-backed startups, are working on AI-based technologies. Some of these investments are highly likely to render significant technological advancements that become widely adopted.

Over the last year or so (roughly corresponding with the release of ChatGPT in November 2022), there has been a marked uptick in labor productivity.

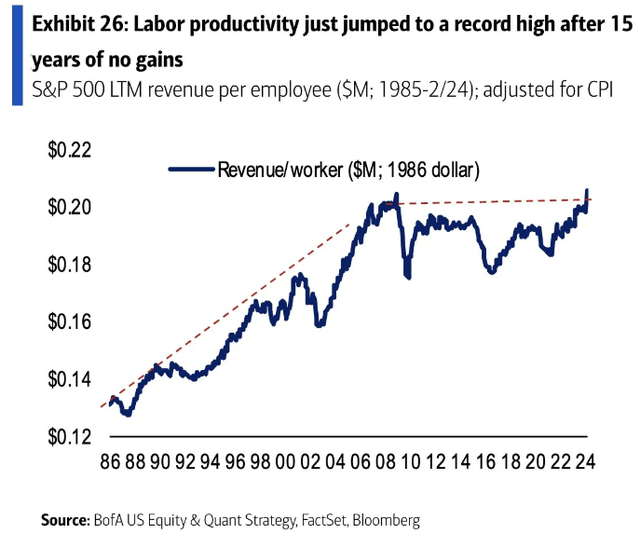

Normally, labor productivity is defined as GDP divided by labor hours. Productivity has risen based on this usual measurement but also based on another notable metric: S&P 500 (SPY) revenue per employee, adjusted for inflation.

Bank of America

From 1985 to 2008, there was a strong uptrend in S&P 500 company revenue per employee, but that metric stayed rangebound for a decade after the Great Financial Crisis.

Recently, this metric broke out to a new high, the first since 2008.

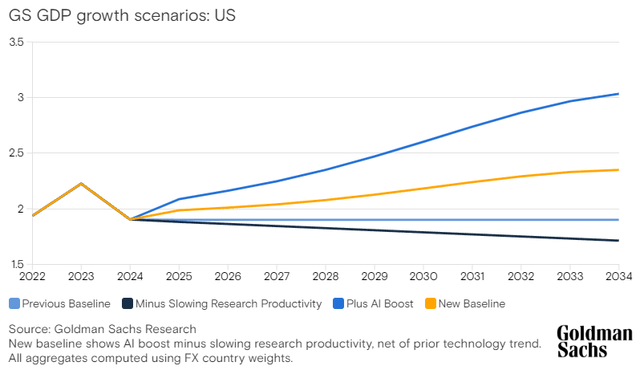

Higher productivity tends to support higher GDP growth. Goldman Sachs, for one, believes that AI should gradually boost real GDP growth in the next decade — by only a small amount at first, growing to somewhere between 40 and 110 basis points by 2034.

Goldman Sachs

Of course, real GDP almost certainly won’t be a smooth, straight line up and to the right. It will be a bumpier ride than that.

But if Goldman Sachs is right that AI does boost real GDP growth in the years ahead, all else being equal, that is good news.

Rare-Earth Treasure Trove Discovered In Wyoming

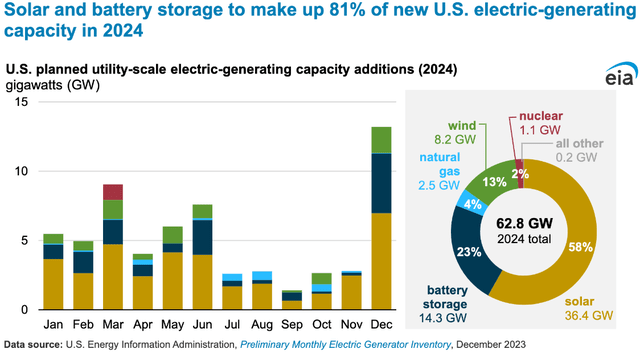

Renewable energy is expanding rapidly. In 2024, planned electricity generation capacity additions are made up almost entirely of renewable energy sources, mainly solar, battery storage, and wind.

EIA

But though the US is rich in natural gas, we have traditionally been reliant on other countries, especially China, for the rare-earth metals that go into photovoltaic panels and utility-scale batteries. Historically, most of the world’s mining output of these minerals has come from China, which has made the US highly reliant on a country with whom we increasingly have an adversarial relationship.

That’s why it is great news that the Australia-based mining company, American Rare Earths, recently announced one of the largest discoveries of rare-earth minerals ever: 2.34 billion metric tons in Southeast Wyoming, a particularly mining-friendly state that would probably love to create replacement jobs for coal miners as the coal-mining industry shrinks.

I would certainly consider this as unalloyed (pardon the metallurgical pun) good news.

Employment: Everyone Who Wants To Work Is Working

For over two years straight, 4% or less of Americans who want jobs don’t have jobs. That means that 96%+ of Americans who want work are working.

Only a few times in modern history has the US unemployment rate been below 4% for this long.

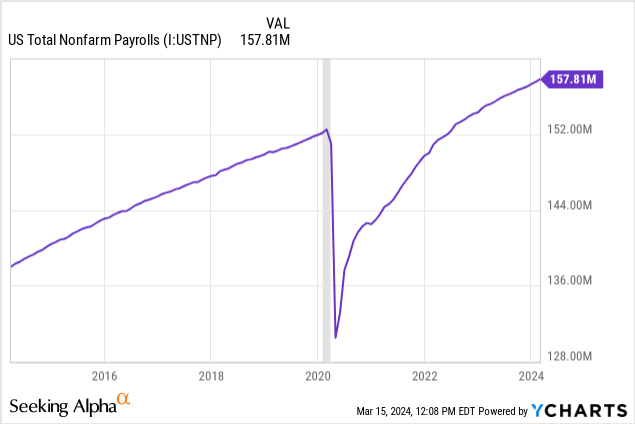

Total nonfarm payrolls growth seems to have mostly rebounded back to its pre-COVID trend.

To be clear, there is still a 4 million job gap between the pre-COVID trend and today’s actual number of jobs. But the jobs rebound has been admirable, nevertheless.

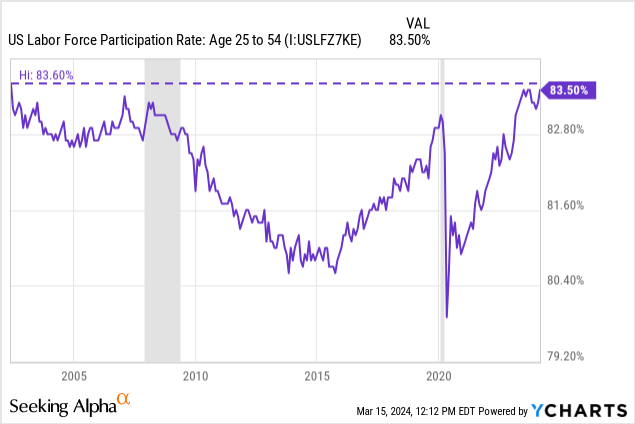

Particularly good news is the fact that a very high share of prime-aged (25 to 54) adults are participating in the labor force.

You’d have to go back to mid-2002 to find a higher prime-aged LFPR than today’s.

Now, to be clear, the rate of job gains has slowed, which is to be expected as the unemployment rate sits at a very low level.

There have been 229k average monthly nonfarm job gains over the last year, compared to 333k from March 2022 to March 2023 and 602k from March 2021 to March 2022.

Still, jobs are the most basic and important source of income and therefore spending power for consumers. Lots of people working seems like unalloyed good news to me.

Legal Immigration Growing

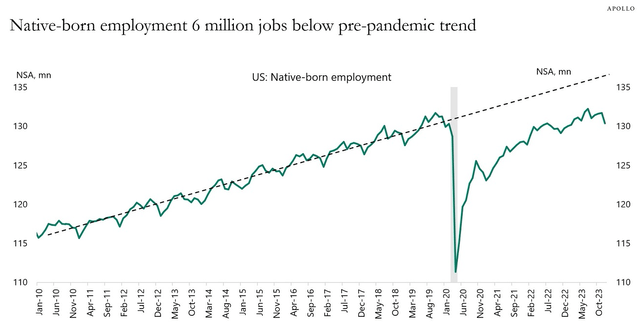

Returning to the 4 million job gap between, it’s interesting to note that the number of native-born workers in the US labor force is down about 2.4 million from the pre-COVID peak of 131.7 million in October 2019 to today’s 129.3 million.

The Daily Spark

And as you can see from the pre-COVID trend growth line shown above, native-born employment is down about 7 million from where it would be if the pre-COVID trend had held.

What gives? Where did those workers go?

Well, unfortunately, about 1.2 million Americans have died of COVID-19 (at least as a comorbidity) since the pandemic began. That unfortunately took some Americans out of the labor force.

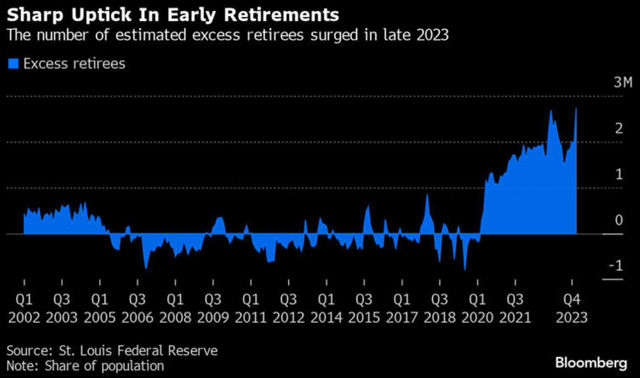

But an even larger cause of the drop in native-born American workers is early retirement.

Bloomberg

The stock market is booming, 401K balances are up, and older workers are clocking out early. Why continue to work when annual stock returns are in the double digits?

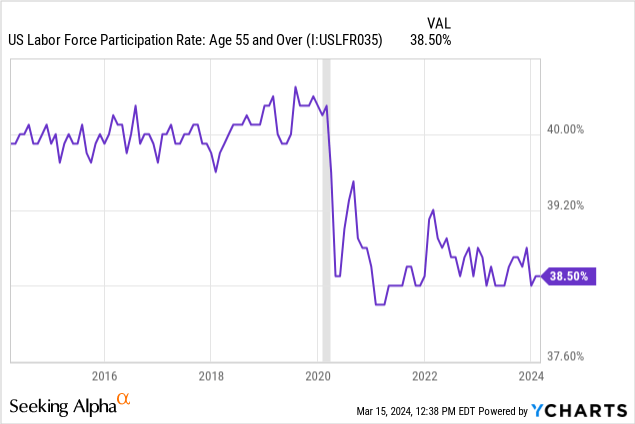

Hence the step-down in LFPR among 55+ aged workers since COVID-19 began.

On an individual basis, this is great. Retiring early is the dream of a great many investors.

On an economy-wide basis, this is not so good, for multiple reasons.

First, unsurprisingly, since retirees make less money once they retire, they also spend less money. Recent research confirms the obvious: people’s spending declines steadily after age 65. And for retirees of any age, spending tends to decline by 0.75% to 0.8% per year on average. An aging population increasingly made up of retirees will almost inevitably weigh on aggregate demand/consumption, which will in turn suppress GDP growth.

Second, seeing older and more experienced workers leave the labor force can also be negative for the economy. Sometimes, there literally aren’t enough younger workers to fully fill the shoes of retiring workers. Other times, younger workers simply aren’t as experienced to be as productive as their retiring coworkers.

That’s where immigration comes in.

While the birth rate is falling precipitously in the US as well as most of the world, which means that our births-minus-deaths number will eventually turn negative, we are blessed to remain an attractive destination for immigrants from across the globe.

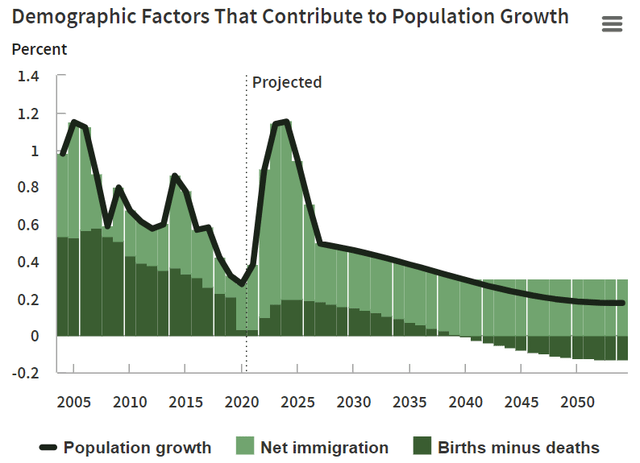

Congressional Budget Office

This should keep our population growing for the foreseeable future, which puts the US in a far stronger position than any of our major global peers.

Japan’s population is already in decline. Germany’s population soon will be in decline as well, along with Europe more broadly. And, as we discussed in “A Warning To U.S. Investors In Chinese Stocks,” the Chinese population has now begun to decline as well, a process that is expected to continue indefinitely and only increase going forward.

Strong net immigration separates the United States (and our North American neighbor, Canada) from the rest of the developed world.

If not for immigration, the US population would be in decline within a decade, much like the rest of the world.

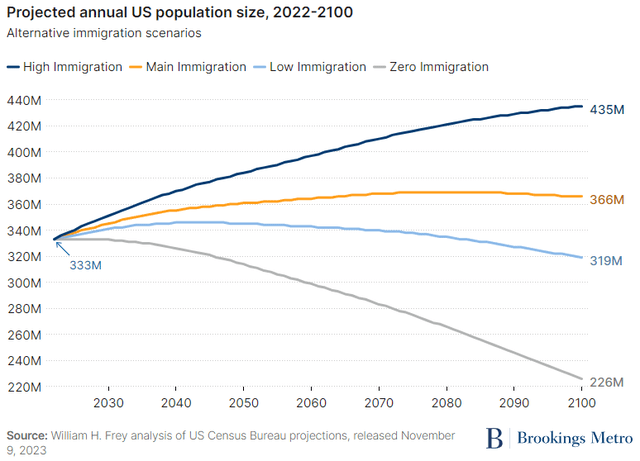

Brookings Institution

But if immigration holds steady, then the US population shouldn’t peak until the 2070s.

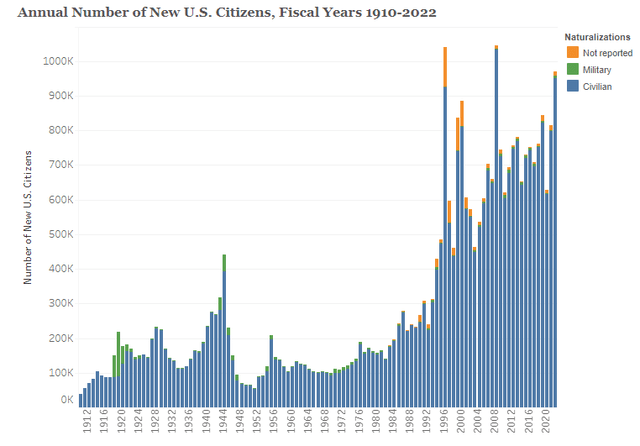

According to US Citizenship And Immigration Services, in fiscal 2023, the US naturalized about 875,000 new citizens. Over the last decade, 7.7 million people were naturalized in the US.

Migration Policy Institute

Economic research has demonstrated that when immigrants are naturalized, they tend to both earn more and spend more money, thereby boosting economic activity.

Thus, the surge in naturalizations over the last 30 years or so seems like an overwhelmingly good thing for the US economy.

Immigrants are America’s secret (economic) weapon. Not only do they increase aggregate demand/consumption, but they are also disproportionately likely to work and fill job openings.

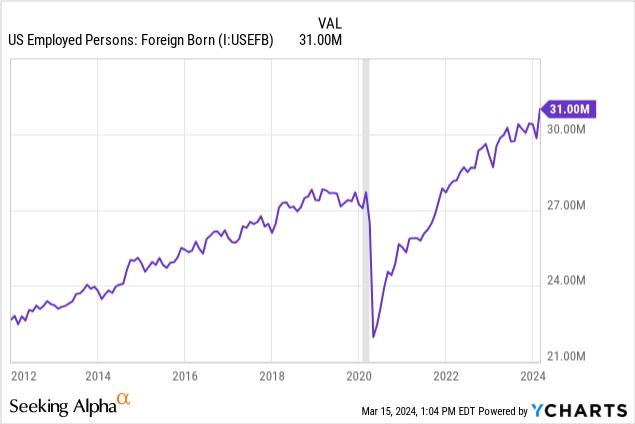

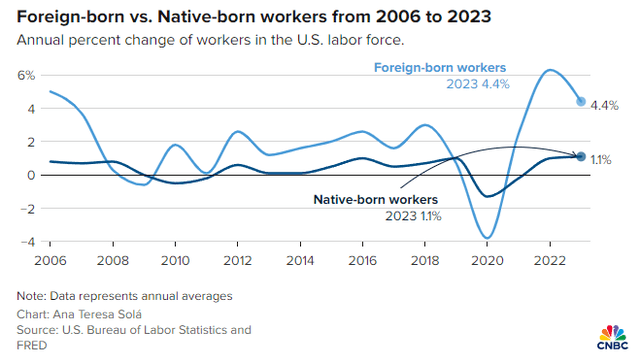

While native-born American employment has stagnated since COVID-19 began, foreign-born employment has surged right back to its pre-COVID trend growth.

This faster growth in the foreign-born worker population than the native-born worker population is not new, but it has certainly been more pronounced over the last few years.

CNBC

And this chart above doesn’t show what has been happening in the early months of 2024. Over the last three months, about 1 million native-born workers have left the labor force on net, probably as a result of early retirements facilitated by the stock market rally.

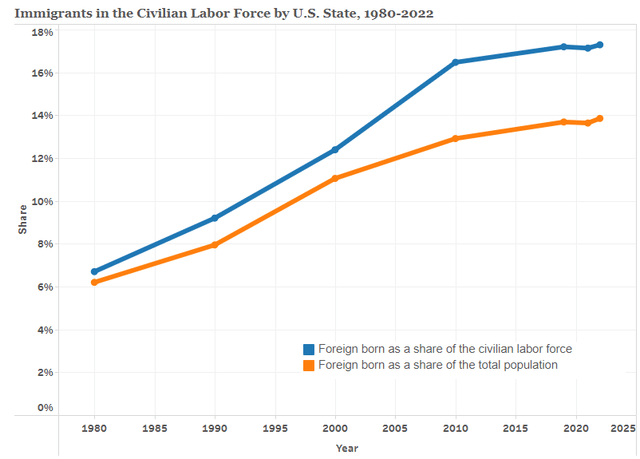

In 2022, while immigrants made up only 14% of the total population, they accounted for over 17% of the labor force.

Migration Policy Institute

In 2023, immigrants made up an even larger 18.6% of the US labor force. In 2024, so far at least, we are on track to see foreign-born workers make up an even larger share of the labor force.

I realize that bringing up immigration in an election year may be controversial, but I do not wish to make any political statements here.

Instead, the statement I’m trying to make is that there is significant evidence that immigration has been a net positive for the US economy, has made the labor market stronger than it otherwise be, and has probably played a role in keeping the US out of recession even while several other developed nations are slipping into or teetering on the edge of recessions.

From an economic perspective, the recent surge in immigration certainly appears to be an underappreciated piece of good news.

Storm Clouds

With all of the above said, there are still storm clouds in the sky. Some of them have only gotten larger and darker.

Labor Market Weakening

Over the last year or so, the US unemployment rate has gradually drifted higher by about 50 basis points.

If unemployment continues to drift higher, an extremely reliable recession indicator called the Sahm Rule will be triggered sometime this year. The Sahm Rule signals the imminent beginning of recession when the 3-month average unemployment rate reaches 50 basis points higher than the lowest 3-month average unemployment rate from the last 12-month period.

It’s true that the labor market is strong — right now. But there are also signs of weakening.

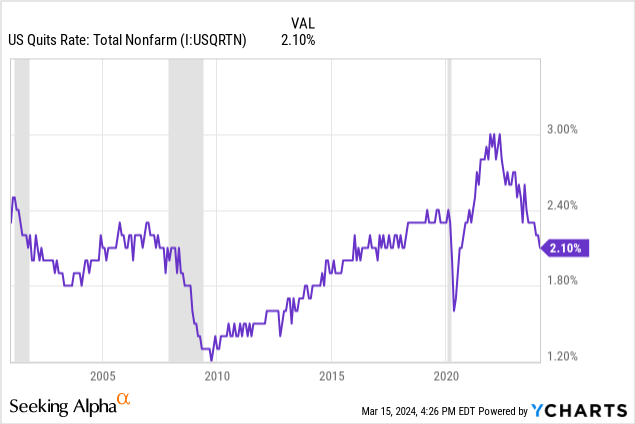

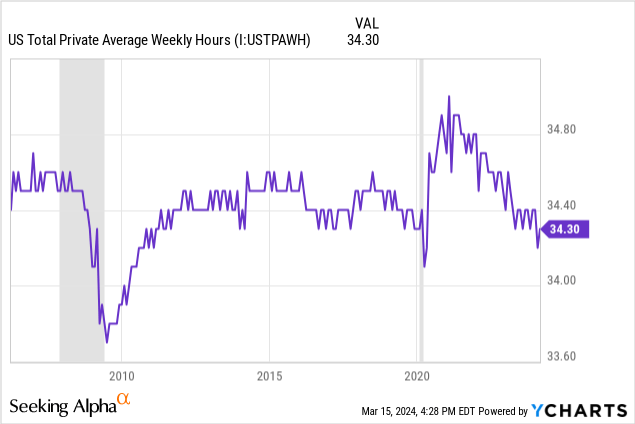

For example, the quit rate is falling rapidly, signaling that workers are losing confidence in their ability to quickly find a better-paying job.

Weekly hours worked have also continued their steady decline since peaking in 2021:

Do more workers mean each worker can put in slightly fewer hours of work per week? Or does it mean that businesses are seeing weakening orders and cutting back workers’ hours rather than engaging in layoffs? Are people just working slightly fewer hours than they used to?

Candidly, I don’t know.

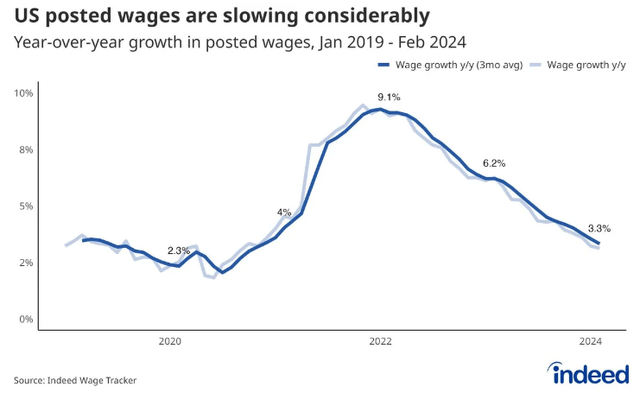

Here’s another sign of not only the labor market loosening but also that the recent spike in inflation has not caused a wage-price spiral to take off:

Indeed

Contrary to the government’s average hourly earnings metric that still shows wage growth over 4% YoY, Indeed’s wage tracker (based on their trove of data) shows that wage growth has now roughly fallen back to 2019 levels.

Combined with slightly fewer hours worked per week, falling wage growth is even more meaningful.

I don’t mean to suggest the labor market is sending alarm signals right now, but if trends hold, they will later this year.

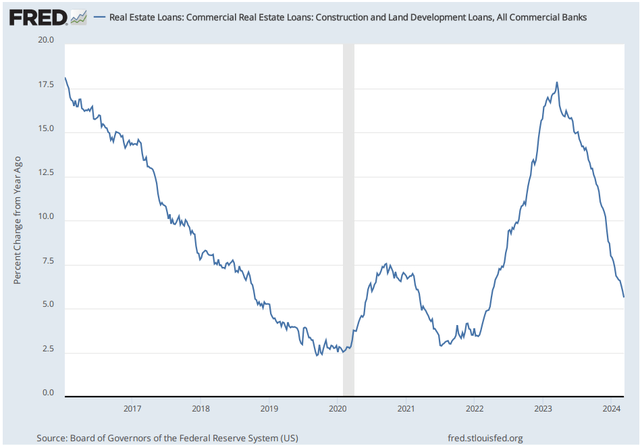

That will be especially true if layoffs pick up, perhaps led by the construction sector as banks rein in construction lending.

Commercial Bank Lending For CRE Construction & Land Development YoY:

St. Louis Fed

The last time growth in nominal bank lending for commercial construction was this low was in early 2022, there were half a million fewer construction jobs.

Most Consumers Still Weakening

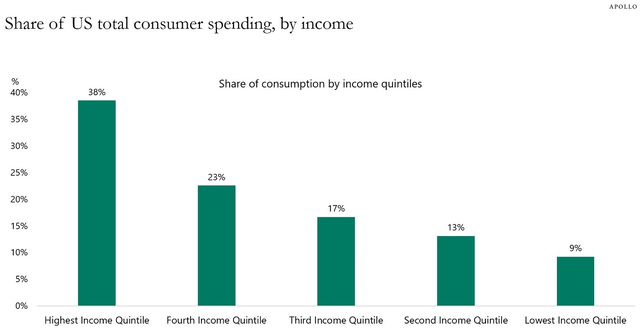

I’ve written in the recent past that consumers are weakening. But that is too broad a statement. Really, most consumers are weakening.

There isn’t just one, monolithic “average American consumer.” The tyranny of averages is at play here, as there is a wide divergence of consumer spending power between the affluent consumer and the paycheck-to-paycheck consumer.

The highest 40% of income earners account for slightly over 60% of total consumer spending, while the bottom 60% of earners (generally the paycheck-to-paycheck crowd) do slightly less than 40% of consumer spending.

The Daily Spark

The affluent consumer has remained very strong and flush with cash in recent times.

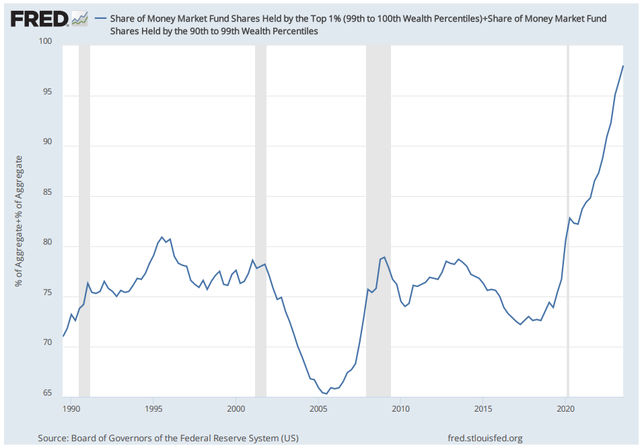

Consider this: The top 10% of households by wealth currently own an incredible 98% of all money market fund shares.

St. Louis Fed

As of this writing, there is about $6.1 trillion in MMF assets under management, which means that the richest 10% of households currently enjoy a risk-free cash interest income stream of almost $300 billion annualized — or about $25 billion monthly for as long as the Fed holds the policy rate above 5%.

High interest rates are providing fuel (on top of their other income streams) for the richest households to continue spending.

How about the paycheck-to-paycheck households? Their experience with high interest rates is very different.

Although the bottom 60% of earners have only slightly over half of total credit card debt (source), credit card debt to median annual income is higher for the lowest-income households and lower for the highest-income households.

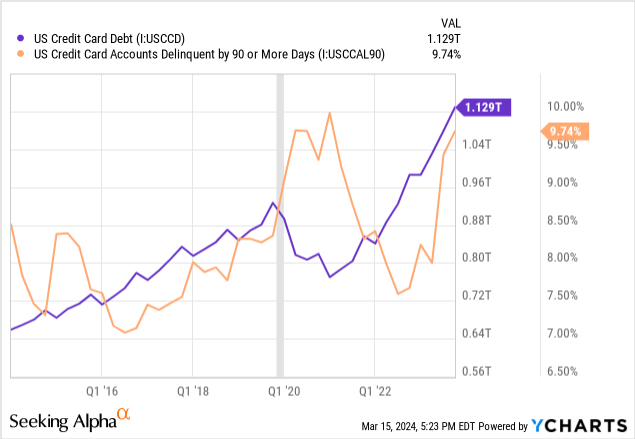

Credit card debt has absolutely soared over the last several years — three times faster than disposable income — and serious delinquency rates (90+ days late) have surged to pandemic-era levels amid 20%+ interest rates.

Unsurprisingly, low-income households account for the majority of delinquencies, according to the New York Fed. That’s true also for auto loans and apartment rents.

As we have seen with small-cap stocks and small businesses, high interest rates are absolutely crushing every part of the economy exposed to floating interest rates.

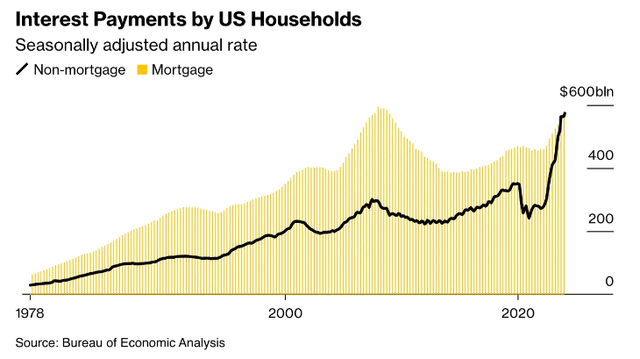

Consider this: For the first time in generations, perhaps ever, households’ non-mortgage interest payments — from credit card, auto, student, buy-now-pay-later — have risen higher than total household mortgage interest payments.

Bloomberg

Most big bank economists and portfolio managers do not see a rising tide of weakness in the economy because they are in the affluent group. They and people like them have plenty of spending power.

But weakness is rising from the bottom up, not the top down or the middle out.

Unless you grasp this, you won’t be able to understand why, for example, parent company Dollar Tree (DLTR) is closing almost 1,000 Family Dollar stores over the next few years.

Family Dollar serves a very low-income, urban customer base that is largely dependent on food stamps and other government support for spending power. While retail theft has cooled for retailers like Target (TGT) serving middle-income customers, it has only gotten worse for Family Dollar.

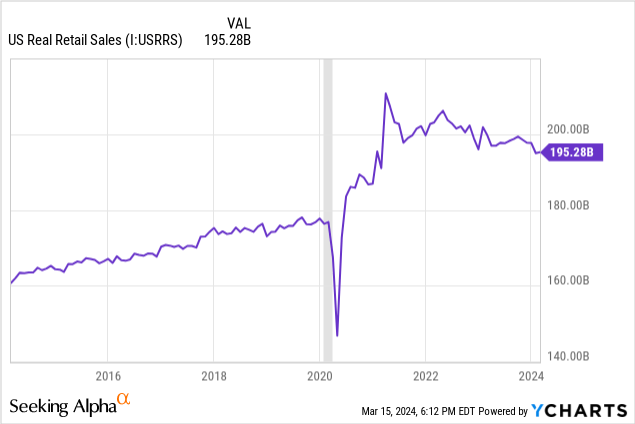

Zooming out to real (inflation-adjusted) retail sales across the whole economy, we find that there has been a downward trend since the end of government stimulus checks in early 2021.

Putting aside the spike in consumption in early 2021 driven by the last “stimmy check,” real retail sales are down 5.3% over the last two years.

On the whole, retailers are not selling more units of stuff like they were for most of the 2010s. They’re selling fewer items at higher prices!

This is not a sign of strength, in my opinion.

Rather, it’s a sign that the US really has two economies: one for the affluent, and another for folks living paycheck-to-paycheck. The paycheck-to-paycheck economy is struggling.

My Favorite Type of Investment For This Environment

How does one put all of the above pieces together?

Clearly, it’s not all good news or bad news, bullish or bearish, for the US economy.

Labor productivity is rising, unemployment remains low, immigration is boosting payrolls and GDP, and the mother lode of rare-earth minerals in Wyoming could wean the US off reliance on China for renewable energy materials.

Good news!

But, at the same time, employment is not as strong as it first appears, wage growth is cooling, and consumer spending power is weakening for the paycheck-to-paycheck segment of the economy.

My view remains that this is the formula for moderating GDP growth, further disinflation, and (eventually) falling interest rates — at least over the next year or so.

If I’m right, then the Fed should definitely have enough confirming data to start cutting their policy rate by this Summer.

Whether or not we’ll get a recession, candidly, I’m less sure than I was in November 2023. But if I had to venture a guess, my guess would be that we will get into a recession sometime this year.

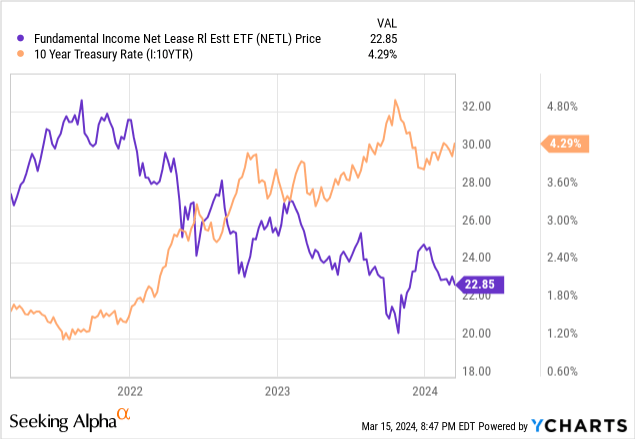

Weakening economic growth, disinflation, and falling interest rates are the perfect environment for net lease REITs, which the market treats like bond proxies.

If you compare the Fundamental Income Net Lease Real Estate ETF (NETL) to the 10-year Treasury rate, you’ll find that its price movements are the mirror opposite of the 10-year Treasury rate.

When the 10-year yield is up, net lease REITs are down.

When the 10-year yield is down, net lease REITs are up.

Most net lease REITs are highly correlated, although some perform slightly better than others.

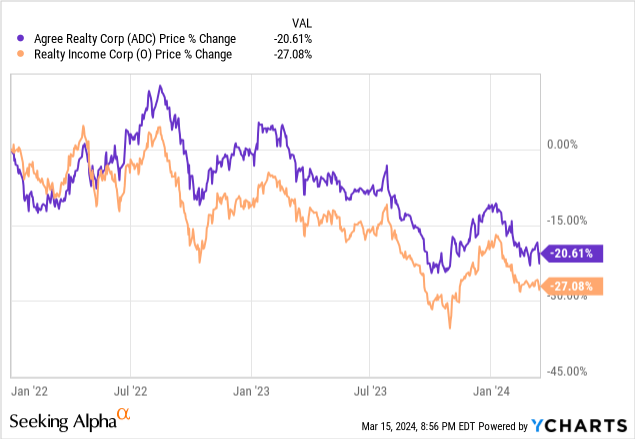

Agree Realty (ADC) and Realty Income (O) ostensibly have the same investment strategy: issue capital and invest in net lease properties at a higher return than the cost of its capital.

But in the last few years, ADC’s portfolio has only increased in quality with investment grade tenancy rising from around 66% to nearly 70%. Meanwhile, O’s portfolio has diversified so widely (casinos, data centers, vertical farming, etc.) that risks are becoming harder for the average investor to identify.

Hence we find that ADC has slightly outperformed as the market has favored it in recent years, awarding it with a relatively higher valuation while demoting O to a relatively lower valuation.

Plus, ADC’s balance sheet is leaner and cleaner than that of O with net debt to EBITDA of 4.7x compared to O’s 5.5x. While O has meaningful debt maturities every year over the next few years, ADC has almost no debt maturing until 2028.

Both net lease REITs have been punished by the market because of the bond proxy nature of their net lease assets, which have organic rent growth prospects of only ~1% per year.

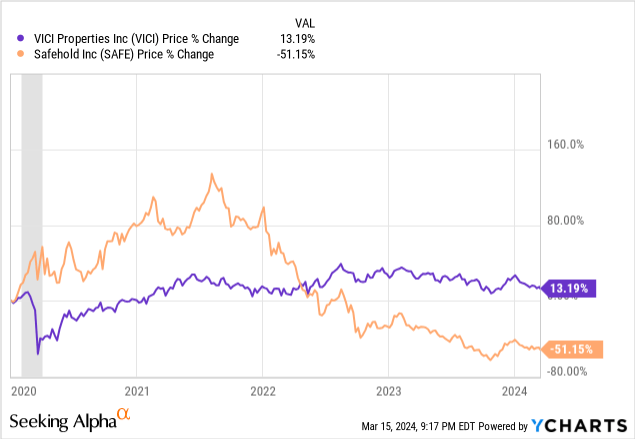

For those who believe inflation will average 2-3%, it is notable that VICI Properties (VICI) has been the most resilient non-industrial net lease REIT during the post-COVID inflationary era. On the other hand, those who believe inflation and interest rates are going a lot lower from here should instead check out Safehold (SAFE), which soared when rates fell to ultra-low levels but has collapsed as rates have spiked higher since then.

VICI primarily owns casino properties with strong annual rent escalators, some of which are based on CPI. Plus, gambling tends to be an industry that is highly resistant to inflation.

Meanwhile, SAFE owns multi-decade-duration ground leases with rent escalators that only kick in after 5- or 10-year increments. It is highly sensitive to interest rates, both to the upside and downside.

Choose your flavor. Each of these four net lease REITs, not to mention NETL, should perform very well for the balance of 2024 if my thesis about moderating growth, disinflation, and falling interest rates bears out.