(Bloomberg) — U.S. Treasuries resumed selling early Monday as Federal Reserve Chair Jerome Powell warned of a potential interest rate cut in March, further exacerbating the impact of Friday's strong jobs report. I let it happen.

Most Read Articles on Bloomberg

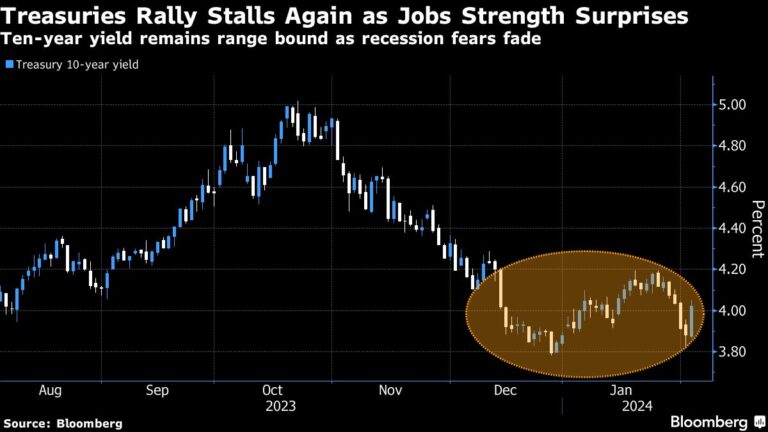

The 10-year Treasury yield rose about 6 basis points in early Asian trading as Powell spoke on CBS's 60 Minutes program, fueling a heavy selloff on Friday that pushed yields up about 14 basis points.

Mr Powell's appearance, which aired in the US on Sunday, was taped ahead of Friday's jobs report, which showed US companies increased salaries in January by the most in a year.

Friday's heavy sell-off in U.S. Treasuries spread across bond markets in Asia, weighing on Australian and New Zealand government bonds on Monday. Australian and New Zealand 10-year bond yields rose about 10 basis points in early trading. The dollar strengthened against major currencies early Monday.

Investor bets on the Fed cutting interest rates in March fell from nearly 40% on Thursday to around 20% on Friday, as the economy's resilience reduces the likelihood of imminent policy easing.

Ed Yardeni, president of Yardeni Research, said in a note that even though the outlook for a March rate cut has weakened, “the market still expects five rate cuts this year.” “Fed officials will continue to push back against the idea of significantly lower interest rates,” he said.

Australian and South Korean benchmarks both fell more than 1% on Monday, while Japanese stocks edged higher. U.S. stock futures contracts fell in Asian trading after the S&P 500 rose 1.1% to a new record high on Friday. Benchmarks' strong performance continues as February, historically one of the most turbulent months of the year for U.S. stocks, comes to an end.

Oil prices rose following US and UK attacks on Houthi targets over the weekend. The Iranian-backed Houthis have vowed to comply. West Texas Intermediate prices edged higher in early trading Monday after falling 7.4% last week, the biggest one-week decline since October.

China's oath

Investors will focus on China's stock market, which fell on Friday and suffered an extended slump. Following the heavy selling, the China Securities Regulatory Commission said Sunday it would direct more medium- and long-term funds into the market and vowed to prevent abnormal fluctuations.

On Friday, a measure of Chinese companies listed in the United States fell more than 1% in New York, mirroring a similar decline in mainland China benchmarks.

Elsewhere, former US President Donald Trump also threatened to impose tariffs of more than 60% on Chinese goods if elected, in another hawkish statement aimed at the US's largest supplier of goods. suggested.

This week's main events:

-

China Caixin Composite PMI, Monday

-

Eurozone S&P Global Services PMI, PPI, Monday

-

Australian interest rate decision Tuesday

-

Eurozone retail sales Tuesday

-

Order from German factory, Tuesday

-

Polish interest rate decision Wednesday

-

Thailand interest rate decision Wednesday

-

Cleveland Fed President Loretta Mester and Philadelphia Fed President Patrick Harker meet on Tuesday

-

Fed President Adriana Kugler and Richmond Fed President Tom Barkin speak on Wednesday

-

Bank of England Deputy Governor Sarah Breeden speaks on Wednesday

-

Thursday's CPI data for Brazil, China, Chile, Mexico and Russia

-

U.S. new unemployment claims, Thursday

-

U.S. Treasury Secretary Janet Yellen speaks at a Senate Banking Committee hearing Thursday

-

pakistan general election thursday

-

ECB Chief Economist Philippe Lane and ECB Governing Council Member Pierre Wunche speak on Thursday

-

European Central Bank releases economic update on Thursday

-

Canadian unemployment rate Friday

-

China's comprehensive lending, money supply, new yuan lending, Friday

-

German Consumer Price Index, Friday

-

Reserve Bank of Australia Governor Michelle Bullock will testify to Parliament on Friday.

The main movements in the market are:

stock

-

S&P 500 futures were down 0.2% as of 9:32 a.m. Tokyo time.

-

Hang Seng futures fell 0.9%.

-

Japan's TOPIX rose 0.3%

-

Australia's S&P/ASX 200 falls 1.2%

currency

-

Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.2% to $1.0770.

-

The Japanese yen fell 0.3% to 148.76 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2219 yuan to the dollar.

-

The Australian dollar fell 0.3% to $0.6490.

cryptocurrency

-

Bitcoin fell 0.6% to $42,517.13.

-

Ether fell 0.6% to $2,286.32.

bond

-

The 10-year Treasury yield rose 6 basis points to 4.08%.

-

Japan's 10-year bond yield rose 5.5 basis points to 0.715%.

-

The Australian 10-year bond yield rose 10 basis points to 4.08%.

merchandise

-

West Texas Intermediate crude rose 0.3% to $72.50 per barrel.

-

Spot gold fell 0.2% to $2,034.80 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Garfield Reynolds.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP