key insights

-

UMB Financial will hold its annual general meeting on April 30th

-

CEO J. Kemper's total compensation includes a salary of US$1.04 million

-

Total compensation is in line with industry average

-

Over the past three years, UMB Financial's EPS increased by 6.5%, resulting in a total loss to shareholders of 8.4%.

The stock price for the past three years is UMB Financial Co., Ltd. (NASDAQ:UMBF) has struggled to generate growth for shareholders. Despite positive EPS growth over the past few years, the stock price has not tracked the company's fundamental performance. The company's general meeting, scheduled for April 30, could be an opportunity for shareholders to bring these concerns to the board's attention. They may also seek to influence management and firm direction by voting on resolutions such as executive compensation and other company issues. Here's our take on why we think shareholders are likely to be cautious about approving CEO pay raises at this point.

Check out our latest analysis for UMB Financial.

Compare UMB Financial Corporation's CEO compensation with its industry.

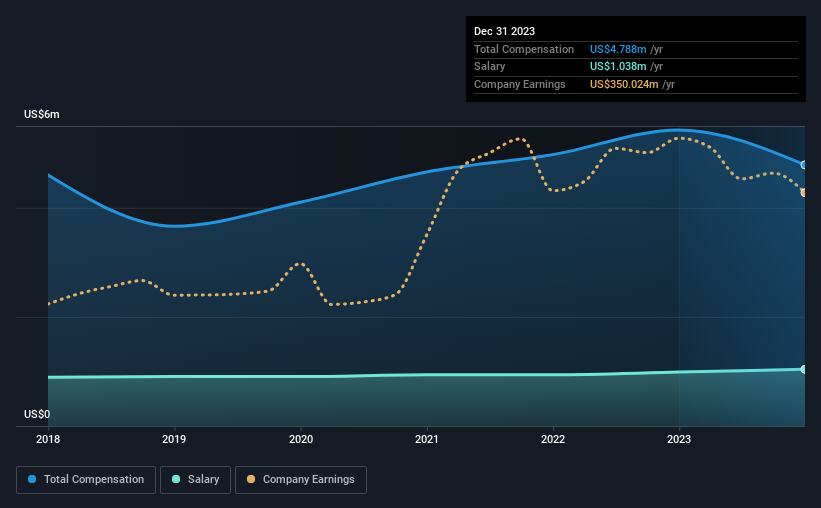

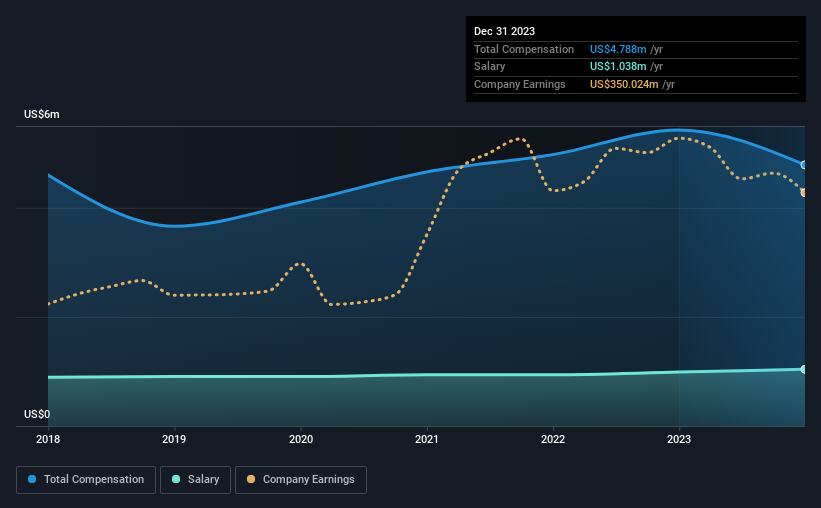

Our data shows that UMB Financial Corporation has a market capitalization of US$4.1b and paid its CEO total annual compensation of US$4.8m in the year to December 2023. We note that this is a 12% decrease compared to last year. We think total compensation is more important, but our data shows that CEO salaries are lower, at US$1.0m.

Comparing similar companies in the US banking industry with market capitalizations ranging from USD 2.0 billion to USD 6.4 billion, we found that the median total CEO compensation was USD 4.6 million. This suggests that UMB Financial is paying its CEO roughly in line with the industry average. Additionally, J. Kemper directly owns his US$170 million worth of shares in the company, suggesting that he is deeply invested in its success.

|

component |

2023 |

2022 |

Percentage (2023) |

|

salary |

1 million USD |

$988,000 |

twenty two% |

|

other |

3.7 million USD |

4.4 million USD |

78% |

|

Total compensation |

4.8 million USD |

5.4 million USD |

100% |

At an industry level, approximately 45% of total compensation is salary and 55% is other compensation. The percentage of compensation that UMB Financial retains as salary is small compared to the industry as a whole. It's important to note that the trend toward non-salary compensation suggests that total compensation is tied to company performance.

Growth of UMB Financial Corporation

UMB Financial Corporation has grown its earnings per share (EPS) at 6.5% per year over the last three years. Revenues for the subsequent 12 months were similar to the prior period.

It would be nice to see revenue growth, but it's good to see at least moderate EPS growth. In conclusion, we can't yet form a strong opinion on the business performance. But it's worth seeing. Past performance can sometimes be a good indicator of what's coming next, but if you'd like to take a peek into a company's future, this might interest you. free Visualize analyst forecasts.

Was UMB Financial Corporation a good investment?

With a total loss of 8.4% for shareholders over three years, UMB Financial Corporation definitely has some disgruntled shareholders. This suggests that it would be unwise for the company to pay its CEO too generously.

As conclusion…

Despite revenue growth, the share price decline over the past three years is certainly concerning. The fact that the stock price is not growing with earnings could indicate that other issues may be impacting the stock. Shareholders will want to know what's holding down the share price when profits are growing. At the next general meeting, shareholders will have the opportunity to discuss all issues with the board, including those related to CEO compensation, and assess whether the board's plans are likely to improve performance in the future.

While CEO compensation is an important aspect to focus on, investors should also keep an eye on other performance-related issues.That's why we did some research and determined 1 warning sign for UMB Financial What you need to know before investing.

The quality of the business is probably far more important than the CEO's compensation level.So check this out free List of interesting companies with high return on equity and low debt.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.