On the heels of a bitter boardroom battle with American corporate firebrand Nelson Peltz, it's time to get a successor at Disney (DIS).

This is just some kind advice to Bob Iger from Hologic (HOLX) veteran CEO and Illumina (ILMN) chairman Stephen McMillan.

“We have to get serious about succession. To me, that's where the Disney board failed,” McMillan told me in an exclusive interview with Yahoo Finance.

McMillan, who has been CEO of medical device maker Hologic since December 2013, knows a thing or two about mixing it up with prominent activists.

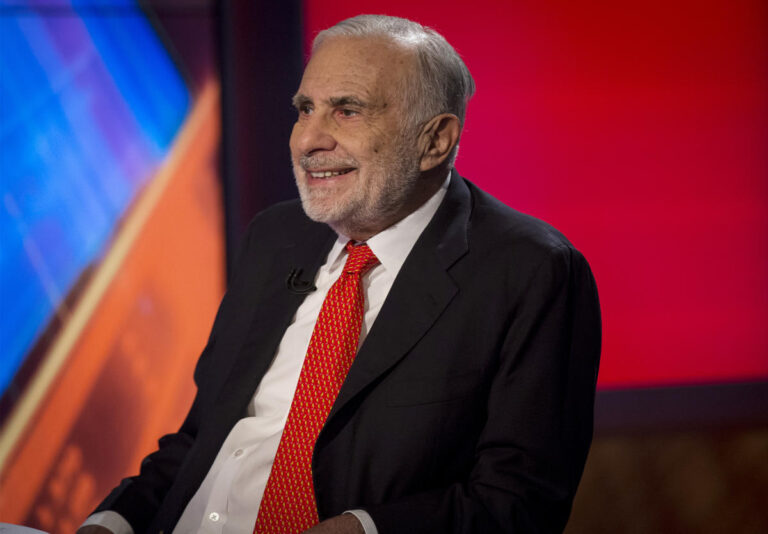

Billionaire activist investor Carl Icahn knocked on Hologic's door in November 2013, demanding a 12.63% stake and representation on the company's board. He also wanted to discuss ways to unlock shareholder value for the then-troubled company.

Hologic moved forward with enacting a poison pill, a common step in situations where there is the possibility of a hostile takeover.

By December 2013, the company had added two representatives of Mr. Icahn to its board of directors, and appointed Mr. McMillan, former CEO of medical device developer Stryker (SYK), as CEO.

Macmillan moved quickly to transform Hologic's culture, installing a new leadership team and improving the execution of the sales team. He also cut costs, much to the delight of Mr. Icahn, who wanted him back.

Mr. Icahn left his position at Hologic in May 2016 with an estimated profit of more than 40%.

“We have been very instrumental in driving value-enhancing changes at both Hologic and Illumina. As CEO of Hologic, I believe that: [MacMillan] He did a great job,” Icahn said in a phone interview.

Under McMillan's leadership as CEO, Hologic stock has risen an impressive 235%.

Furthermore, the high-stakes drama continues at biotech company Illumina.

Icahn disclosed his holdings in Illumina stock in 2023 and continues to hold a small position.

He initially launched a proxy fight in 2021 over a $7.1 billion deal with cancer test developer Grail, and was a vocal opponent of then-CEO Francis D'Souza, who later stepped down. Ta.

Mr. Icahn won a seat on Illumina's board of directors. Mr McMillan was appointed non-executive chairman in early June last year.

Illumina has announced that it will sell Grail by December 2023 to remove clouds over its stock price and perhaps calm Icahn's comments.

Still, Mr. Icahn is moving forward with a lawsuit he filed last year against Illumina's board. In his lawsuit, Icahn accused the board of breaching its fiduciary duty by completing the Grail acquisition despite regulatory concerns.

“Litigation is a long and messy issue,” McMillan said.

This is an edited and condensed version of our conversation.

Brian Sozzi: Do you consider yourself an activist whisperer?

Stephen McMillan: I don't consider myself an activist whisperer. What I tried to do is think like an activist. That's why we strive to be our own best activists, even on our boards.

You can say that we are listening to their voices. The biggest problem in corporate America, he says, is that we seem to have become like a political party that demonizes activism, instead of believing that there is usually a reason why activists participate. Thing.

I think the first reaction of many boards is to hire a lawyer. If you hire all the defense advisors, people will be pushed into a corner. My style, on the other hand, is to talk to them and hear where they're coming from.

How should I prepare to meet with an activist investor?

If you really listen…and I probably didn't do much preparation. Because I honestly think what a lot of people are doing is spending all their time being lawyers and defending banks. People are preparing and preparing answers instead of listening.

What I discovered is that activists' business theories aren't actually that good. But there's a reason they got involved, and it's underperformance in some way, whether it's capital allocation, stock price, bad acquisitions, or business mix.

How have you approached Carl Icahn?

It was important to always talk and listen. When I first joined Hologic, I went to his office many times to listen to his arguments and help him understand various things.

For example, at Hologic, we wanted to dissolve the company. And he wanted to cut costs. And what I ultimately shared with him was that the business was too small to really break up…and what we really need to do is accelerate sales, so the cost Reduction was not the goal.

The good thing is that he actually believes in and supports great CEOs and it's much more reasonable to say, “Okay, you know business.” If you think so, I'm going to hold you accountable, but I support you.

You are a leader trying to run a business. Have you ever taken the statements of activists like Karl personally?

No, I think the ego is too involved. I think you have to be objective. I think a lot of boards consider it personal. You need to depersonalize it and realize that you may not be as perfect as you think.

Many activists would argue that today's boards are dysfunctional. do you agree?

As with anything, I think it's extremely diverse. I think there are boards that work very well. I think the Hologic record is a great record. But we turned that around in a big way. I scaled it down.

So it's important to get Carl's guidance early on and get the right people in the roles.I think there are a lot of people on the board who are not qualified to help. [in] Who will be more naive in this situation?

Was Carl a good addition to Illumina?

At this stage, it is difficult to say that shareholders are benefiting. I believe he inspired the board to consider both leadership and holy grail decisions.

Will there be any solution?

Frankly, I'm very proud of him for not pursuing a proxy fight. I think one of the great things he did that didn't get a lot of coverage here is that he avoided a proxy fight this year, and I'm glad that's not the case. And we are moving in the right direction. Litigation is a protracted and messy issue.

I'm sure you've seen it. boardroom battle between Disney CEO Bob Iger and activist Nelson Peltz. Now that Bob Iger has stopped Peltz, what advice would you give him?

I have to think seriously about my successor. To me, that's where the Disney board failed. They've been kicking it down the road. They chose someone. I don't think that board was serious. I think he really needs to find someone to take over the company.

What's it like to meet Carl Icahn before he lets you go? Not many people get to do that.

Whenever I was with him, we always had very constructive discussions. In fact, I think it's better to meet in person than over the phone.

And I think he sometimes talks to you. He has a great anecdote. he has great experience. You just have to let him go on for a bit and share them.

I don't necessarily agree with everything he says. But we've entered a society where we feel, “You're either on my side or against me,” rather than, “What can I learn from someone with a different point of view?” Did. And if a good leader has a good plan, he is willing to evolve his position.

Brian Sozzi I'm the executive editor of Yahoo Finance. Follow Sozzi on Twitter/X @BrianSozziInstagram @BrianSozzi And even more linkedin. Have a tip about a deal, merger, activist situation, or more? Email brian.sozzi@yahoofinance.com. Are you a CEO and would you like to appear on Yahoo Finance Live? Email Brian Sozzi.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance