This week's best investment news:

Behind the Memo: Easy Money by Howard Marks and Prime Minister Edward (pca.st)

Countdown to the Exchange: GMO's Jeremy Grantham (Nasdaq)

MiB: David Einhorn, Greenlight Capital (MiB)

Overcoming pessimism through perseverance with John Rogers (McKinsey)

Carl Icahn, Texas lawyer and bottle of vodka (FT)

Terry Smith – Fundsmith Equity Fund (Fundsmith)

Aswath Damodaran – Mag (Nificent) Seven: 7 stocks that saved the market in 2023! (Advertisement)

GMO Greatly Concentrated (GMO)

2024 Reader Survey (Verdad)

Leon Cooperman: There's a lot of value in certain sectors of the market, but we need to be cautious (CNBC)

Big Tech’s AI Hype Machine, Part Deux (Felder)

Lessons learned from the Ed Thorpe and Tim Ferriss interview (Moontower)

Stepping on the same pitchfork (Rudy Havenstein)

15 funds that destroyed the most wealth in the past 10 years (Morningstar)

Useful Idiot (Ep Theory)

The Definitive Guide to Berkshire Shareholder Meetings (Stephen Clapham)

Lot (Scott Galloway)

Measures to support China's stock market (CNBC)

Piecing together Berkshire Hathaway's 1986 Annual Meeting (Kingswell)

Meta Platform: Model Update (MBI)

Bonds remain too expensive (Morningstar)

MiB: Tom Hancock, GMO Focused Equity (MIB)

POD, PASSIVE FLOW, PANTER (AB)

Is Elon Musk right to worry about passive investing? (Sam)

Navigate the cycle using ratings (top-down)

Owning spin-off stocks: Selling them can cost you a lot of money (Forbes)

Ergodic economics (EE)

Pzena Investment Management: World Outlook 2024 Webinar (Pzena)

Greenhaven Road Capital Q4 2023 Letter (Greenhaven)

Jensen Quality Value Fund Update: Q4 2023 (Jensen)

This week's best value investing news:

Student Investment Management at Columbia Business School – Sven Karlsson) (Sven Karlsson)

At the Money: Stock Picking and Value Investing (MIB)

3rd European Value Investing Conference: George Athanasakos (Ivey)

Value investors talk about the potential of 'uninvestable' stocks (CNBC)

Risk: The ultimate definition of value investing (VIS)

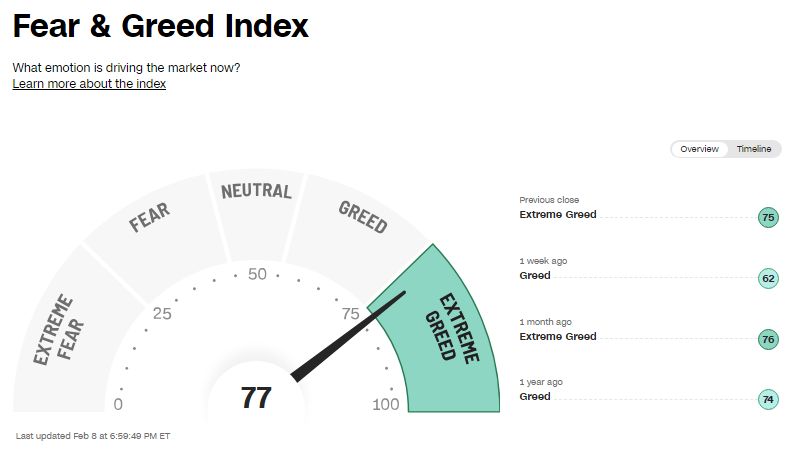

This week's Fear and Greed Index:

This week's best investing podcasts:

#2054 – Elon Musk (Joe Rogan)

TIP605: Uncovering the world's outperformers with Dede Eyesan (TIP)

Sem Kalsan's No Landing Scenario (Excess Returns)

Rohit Krishnan — Solving the Mysteries of AI (Infinite Loop)

Devin Martin – Finding Your Drive (Business Brew)

Arthur J. Gallagher: Insurance Broker (ILTB)

17 Average annual return of 26%, what’s next? – Mineral Resources | Summer Series (Equity Mates)

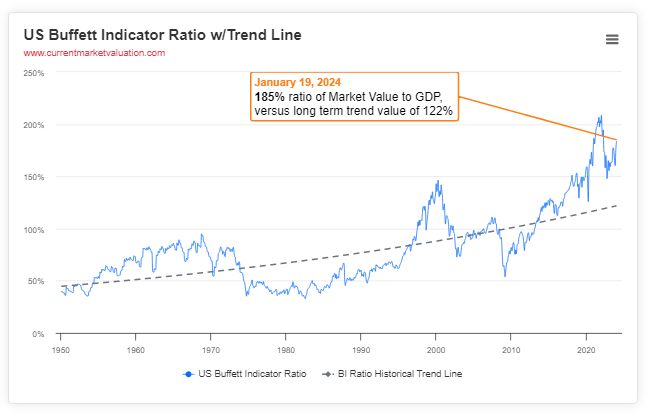

This week's Buffett indicators:

Overrated.

This week's best investment research:

Global Factor Performance: February 2024 (Alpha Architect)

How to profit from the rise in the dollar (ASC)

The market is like a big movie theater with small doors (PAL)

Will recent economic headwinds threaten US Timberland's comeback? (All About Alpha)

It’s not always about the economy: 5 questions to assess financial markets (CFA)

Best investment tweets of the week:

S&P 500 returns fell to 10.7% in the fourth quarter of 2023, the lowest level since the second quarter of 2020.

“The rate of profit is probably the most average-reversing series in finance, and if the rate of profit does not reverse its mean, there is something seriously wrong with capitalism.” – Jeremy・Grantham pic.twitter.com/32b26PKK8Y

— Charlie Billello (@charliebilello) February 8, 2024

This week's best investment graphics:

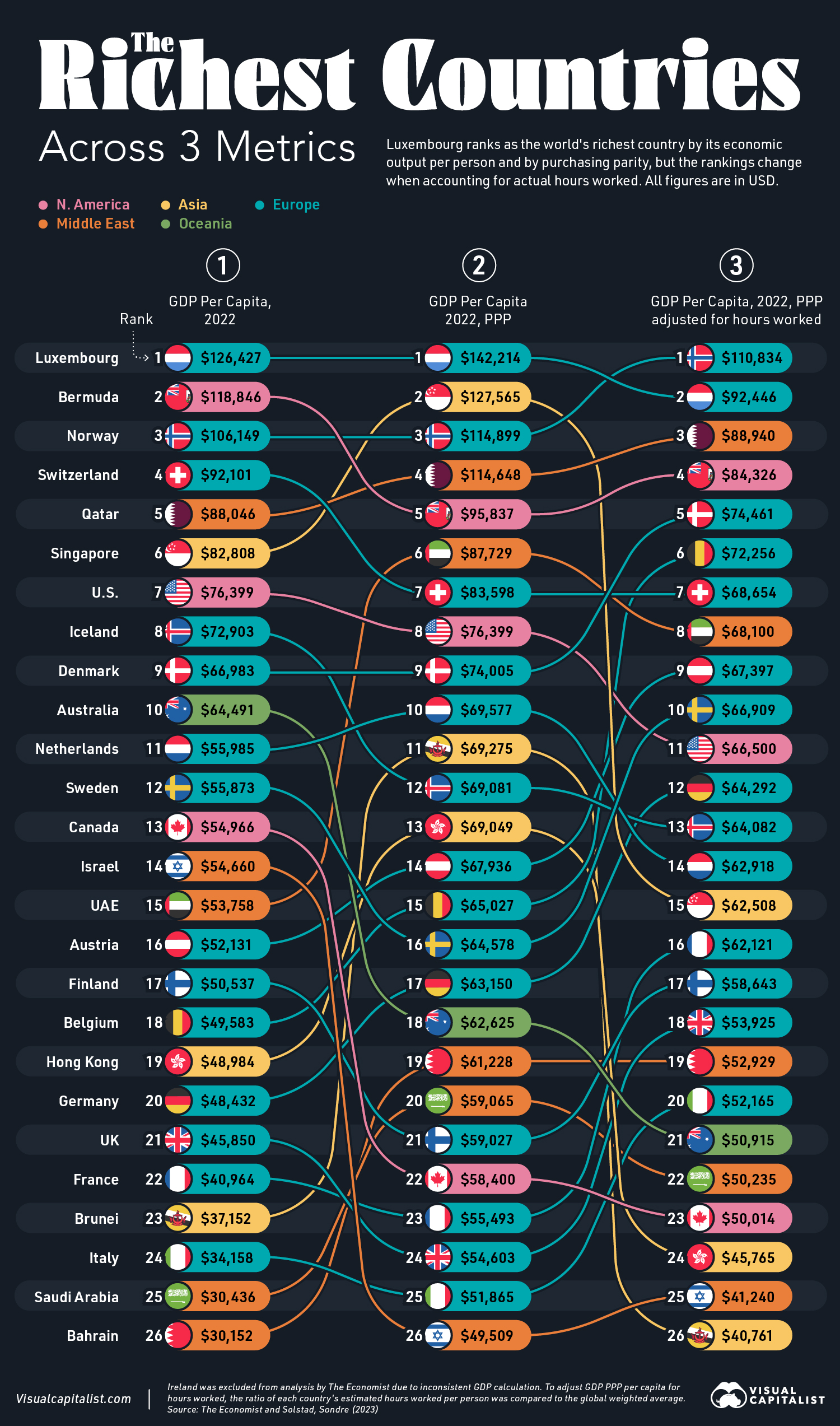

The world's richest countries according to three indicators (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

free inventory screener

Don’t forget to check out the free Large Cap 1000 – stock screener,here Acquirer multiple: