For those caught up in the still-expanding “Magnificent Seven” tech stock bubble, there are 493 other potential stocks in the S&P 500 (^GSPC). It's an initiative worth remembering.

Fields such as industry and healthcare can be selected.

And beyond the S&P 500, there may be great investment opportunities in private equity, U.S. Treasuries, and even classic cars if you're interested.

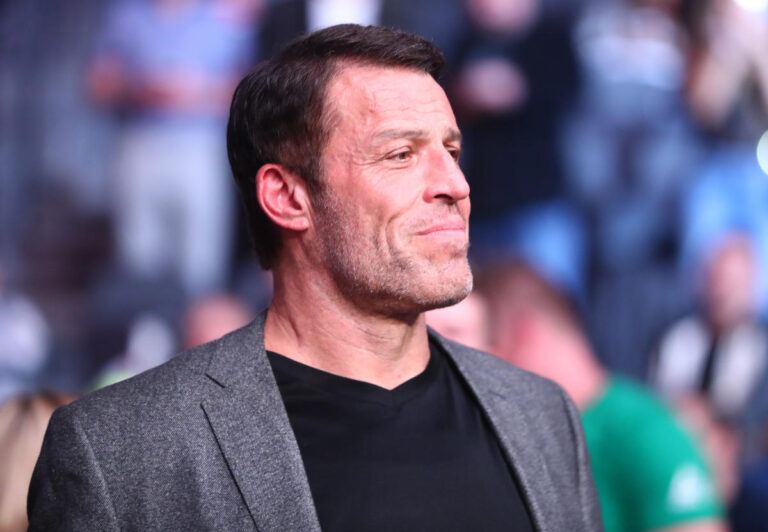

Putting it all together, this is what is known as diversification — Touted by life and business strategist Tony Robbins as a proven wealth-building approach tested by millionaires and billionaires alike.

“All I would say is stay diversified. We've all heard that word a million times,” Robbins told Yahoo Finance at his New York headquarters (see video above) .

The 6-foot-6 author, who recently published “The Holy Grail of Investing,'' said it was a reminder from his longtime friend and prominent investor, hedge fund billionaire Ray Dalio. Diversification allows investors to better reduce correlation between investments and lower potential risk.

Robbins, who is known for his super-energy seminars and has a reported net worth of more than $600 million, warned against the AI hype bubble.

“I'm concerned about that, too,” Robbins said of investors' enthusiasm for Magnificent Seven names like Nvidia (NVDA) and Microsoft (MSFT).

The call to diversify couldn't have come at a better time, as the Magnificent Seven's trades are highly correlated and mostly move in a singular direction: upwards and to the right.

The Magnificent Seven now accounts for about 30% of the S&P 500's market capitalization, thanks in part to the enthusiastic reaction to AI chip maker Nvidia's earnings report a week ago. The market reaction has caused Wall Street analysts to stumble as they try to inch up their profit forecasts, effectively giving the group's share price further upward momentum.

Over the past three months, Magnificent Seven's earnings estimates have been revised upward by a whopping 7%, and margins have risen by 86 basis points, according to Goldman Sachs strategists.

The Magnificent Seven's average share price is up 14% this year, according to Yahoo Finance calculations. Nvidia led the way with a 60% gain, while Tesla (TSLA) fell 23%.

Over the past year, two of the Magnificent Seven have grown by triple-digit percentages. Nvidia is at 239% and Meta (META) is at 184%. During this time, the S&P 500 rose a respectable 29%.

While some people are finally starting to call for a timeout on the Magnificent Seven, there are reasonable explanations that any rational investor should consider.

“The bar is high for the Magnificent 7 due to heightened expectations and concentrated positioning,” strategists at JPMorgan Asset Management argued in a new client note. “AI is a long-term investment, and its beneficiaries will include many companies beyond chipmakers.”

They added that the economy's soft landing and lower interest rates in the second half of this year “bode well for a bounce back” for sectors and companies left behind in last year's bull market.

An argument could be made that not all members of the Magnificent Seven posted impressive fourth quarters and outlooks to justify near-all-time valuations for their stocks.

Apple's (AAPL) performance in China was weak. Guidance for the March quarter was weak. iPhone sales were not surprising.

For Alphabet (GOOG, GOOGL), advertising revenue, which is the core of its business, fell short of expectations. Tesla's quarter and Elon Musk-led earnings call were littered with red flags.

Microsoft's quarter punctured any short-term belief that any of the company's AI efforts would lead to a major reassessment of revenue forecasts by the street. Other than the company's first-ever dividend announcement, Meta had a good quarter. However, capital investment in 2024 will also increase significantly, potentially putting pressure on profit margins and cash flow.

Amazon (AMZN) and Nvidia's quarters are widely watched.

“I've done everything in my life to say that success leaves a mark. Find the best in the world. Find out exactly what they're doing and do the same.” If you do that, your chances of success increase 100 times,” Robbins said.

The best investors in this game stay diversified, not buy seven high-tech companies competing for the same customers.

please think about it.

Brian Sozzi I'm the executive editor of Yahoo Finance. Follow Sozzi on Twitter/X @BrianSozzi And even more linkedin. Have a tip about a deal, merger, activist situation, or more? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news impacting the stock market.

Read the latest financial and business news from Yahoo Finance