(Bloomberg) — Investors are treading cautiously in early Asian trading as markets grow increasingly nervous following Iran's unprecedented attack on Israel over the weekend.

Most Read Articles on Bloomberg

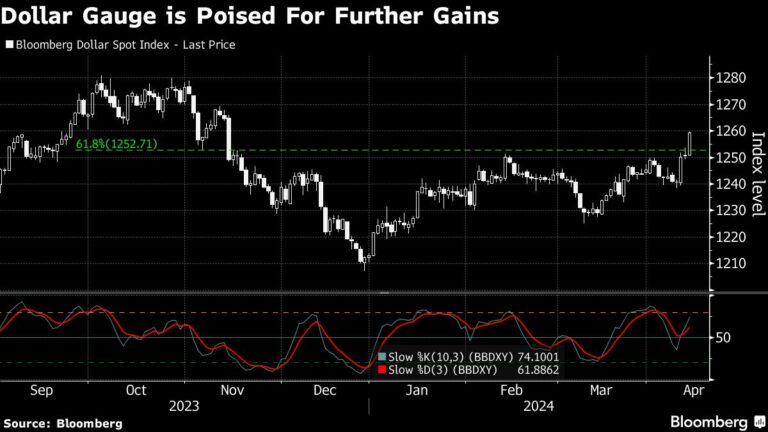

The dollar held steady against major developed markets, and U.S. stock futures edged higher after the S&P 500 index suffered its worst trade since January during Friday's flight to safety. Oil prices edged lower and gold rose, but Asian stock futures pointed to an early decline. Australian 10-year bond yields opened lower.

Investors are already spooked by persistently high inflation and the prospect of rising long-term interest rates, and an escalating crisis in the Middle East risks injecting fresh volatility into markets. As the conflict escalates, many say oil could soar above $100 a barrel, expecting a flight to U.S. Treasuries, gold and the dollar and further stock market losses.

Iran said “the issue is considered resolved,” but traders are now trying to determine whether the conflict will escalate into a wider regional war. Still, nerves may be eased following reports that President Joe Biden told Israeli Prime Minister Benjamin Netanyahu that the United States would not support Israel's counterattack against Iran.

“There could be an eventual fade out for the market as Iran and Israel pull back from the brink,” said Namik Immerbeck, chief strategist at Scandinaviska Enskilda Banken AB. “But in the short term, it will lead to trend-driven position reductions, especially following quantitative strategies,” he said, exacerbating the typical flight to safety.

Read more: Iran's attack on Israel intensifies race to avoid all-out war

Bitcoin fell nearly 9% following Saturday's attack, but has since rebounded to trade around $65,000. Stock markets in Saudi Arabia and Qatar recorded modest declines on Sunday amid thin trading volumes. The Israeli stock benchmark fluctuated between gains and losses at least nine times before closing with slight gains.

Oil will be closely watched as investors look to it for guidance on how to respond given the risk of a strike and counterattack cycle. Brent crude oil has already risen about 20% this year and was last trading around $90 a barrel.

In the bond market, investors will be weighing the risk of rising energy prices sparking inflation concerns. Treasuries tend to benefit during periods of uncertainty, but the threat that interest rates will remain high could limit their movement. U.S. Treasury futures opened lower.

The main movements in the market are:

stock

-

As of 7:45 a.m. Tokyo time, S&P 500 futures were up 0.3%.

-

Hang Seng futures fell 1.7%.

-

S&P/ASX 200 futures down 0.6%

-

Nikkei 225 futures fell 1.8%

currency

-

The euro was almost unchanged at $1.0648.

-

The Japanese yen remained almost unchanged at 153.26 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2660 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6471.

cryptocurrency

-

Bitcoin rises 2.2% to $65,257.71

-

Ether rose 2.6% to $3,148.13

bond

merchandise

-

West Texas Intermediate crude oil fell 0.4% to $85.35 a barrel.

-

Spot gold rose 0.7% to $2,360.77 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Michael G. Wilson.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP