Unlock Editor's Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

The amount of money US financial institutions have lent to shadow banks such as fintechs and private credit groups, as regulators warn that expanding ties between traditional and alternative financial institutions could pose systemic risks. exceeded $1 trillion.

The U.S. Federal Reserve reported Friday that U.S. banks' outstanding loans to non-deposit-taking financial companies exceeded the 13-digit threshold at the end of January. These hedge funds, private equity firms, direct lenders and others are using that money to invest and increase lending to a variety of high-risk borrowers that regulators prohibit banks from lending directly to.

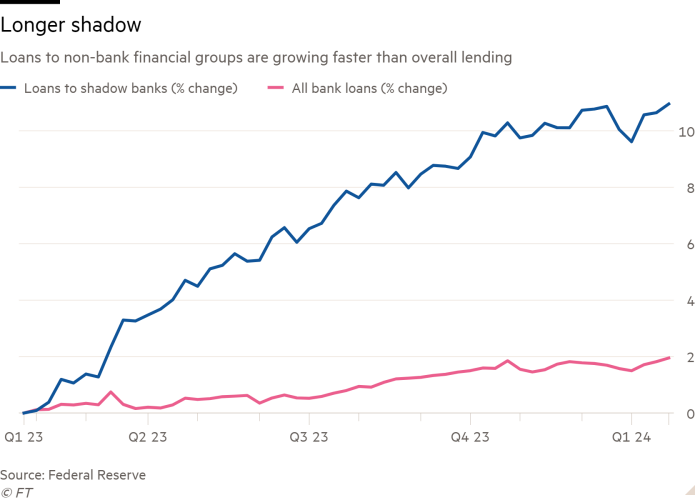

This amount has increased by 12% over the past year, making it one of the fastest growing businesses in the banking industry while overall loan growth is only 2%.

The surge in lending to shadow banks is worrying regulators. This is because there is little information or oversight about the risks shadow banks are taking. Last month, EU regulators announced they would take a deeper look into the relationship between traditional lenders and shadow banks.

One of the top U.S. banking regulators, Acting Commissioner of the Comptroller of the Currency Michael Hsu, recently told the Financial Times that he believes lightly regulated lenders are forcing banks to make lower-quality, higher-risk loans. Ta.

“We need to resolve the race to the bottom,” Su said. “And I think part of the way to solve this problem is to pay close attention to nonbanks.”

Recently, many banks have been seeking closer relationships with non-bank lenders. Last month, Citigroup announced it would partner with external alternative investment manager LuminArx to provide “innovative leverage solutions” for its $2 billion loan fund. Citi also led his $310 million loan to Sunbit, a buy now, pay later company that specializes in auto repair shops and dental clinics.

Wells Fargo last year put billions of dollars into a new credit fund run by Centerbridge, the $40 billion private equity firm that led the acquisitions of restaurant chain PF Chang's and business technology provider Computer Sciences Inc. Signed a loan agreement.

In 2010, the year banks were first required to terminate lending to nonbanks, lending totaled just over $50 billion across the banking sector. JPMorgan alone currently has twice as much nonbank lending.

For all banks, shadow banking loans now account for more than 6 percent of all loans, just over 5 percent of auto loans, and just 7 percent of credit cards, which exceeded $1 trillion for the first time last year. has fallen below. percent.

Late last year, the Federal Deposit Insurance Corporation proposed requiring banks to disclose more data about what types of shadow banks they lend to.

Banks may soon have to reveal how much they have lent to private equity firms, credit funds and other consumer lenders, rather than just reporting one category of non-deposit-taking financial groups. There is.

Comments on the proposal are expected to be submitted later this month. If enacted, banks could be required to start reporting more detailed information next quarter.

“We need more granularity,” said Gerald Cassidy, a bank analyst at RBC Capital Markets.

“There is a lot of leveraged lending in the financial markets, and this could be one area where there are hidden exposures that investors need to be aware of.”